stocks to buy

If you’ve got some money socked away for a truly speculative, high-upside swing, here are 30 of Wall Street’s most bullish calls. Aggressive investors scouting out the best stocks to buy right now would do well to keep an eye on the research community.

That might sound like pretty commonsensical advice, but it’s not typically the case. You see, while Wall Street’s analysts are an optimistic bunch, they’re not exactly an exuberant bunch.

On the one hand, Sell calls by the Street are indeed quite rare – so much so that even stocks that are heavy in mere Hold calls should get a wary eye.

But analysts aren’t exactly known for making bombastic calls, either. Investors looking to make a truly speculative high-risk, high-reward bet are much more likely to find predictions of doublers from Reddit and Twitter than respected research firms.

Consider this: Among analysts surveyed by S&P Global Market Intelligence, the average 12-month upside for an S&P 500 stock is a mere 11.9% – just a couple of points better than the average 9%-10% you can expect out of the index in an average year.

Admittedly, the S&P 500’s best stocks to buy right now have quite a bit more upside in them – a pair, Enphase Energy (ENPH) and Penn National Gaming (PENN), are predicted to scoot about 70% higher over the next 12 months or so. But if you’re willing to venture a little farther afield, you can find a few stocks that Wall Street is so collectively bullish on, the average upside expectation for this time next year sits at least 100% higher than current levels.

The 30 Best Stocks to Buy Right Now for Speculative InvestorsWe screened the Russell 3000 for stocks that Wall Street analysts are exceedingly bullish on. Here’s what we were looking for:

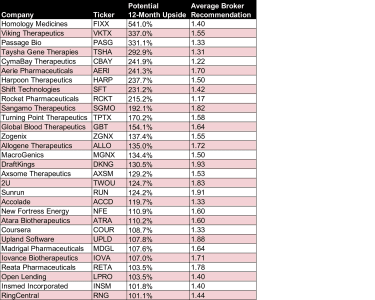

Stocks covered by at least 10 analysts. The presence of just one or two covering analysts can make for some pretty easily skewed results. However, a crowd of at least 10 Wall Street pros ensures that even a wildly optimistic prediction won’t throw off the average by too much.Stocks with solid Buy ratings. S&P scores analysts’ stock calls on a five-point scale, where 1.0 equals a Strong Buy and 5.0 is a Strong Sell. Anything below 2.5 translates into a Buy call, and anything below 1.5 is a Strong Buy call. We looked for companies with scores of 2.0 or below, meaning they’re either high-conviction Buy calls or Strong Buy calls.Stocks with implied upside of at least 100%. To sniff out Wall Street’s most optimistic calls, the average 12-month price target must translate into a minimum of 100% upside for shares.The result? A cool 30 stocks that the pros think will jump anywhere between 101% to a whopping 541% in just the next year alone.

Be forewarned, however, that higher implied rewards also imply higher risk. The stocks listed here tend to carry greater levels of volatility, and therefore greater potential for loss.

The full table is below, but first, we’ll point out one trait that shouldn’t surprise anyone: a heaping helping of biotech stocks. About two-thirds of these stocks – including nine of the top 10 – come from the biotechnology space, where a single positive drug-trial result can vastly change a company’s trajectory and generate quick, massive returns.

Homology Medicines (FIXX, $3.49), for instance, is “an emerging contender in the field of Adeno-associated virus-based gene therapy,” say Oppenheimer analysts, who rate the stock at Outperform (equivalent of Buy) and believe it can hit $22 per share – more than six times current prices – over the next 12 months. And Raymond James has an Outperform rating and $13 price target on Viking Therapeutics (VKTX, $4.20), calling its VK2809 “potentially the best oral [non-alcoholic Steatohepatitis] drug in development.”

If you’re looking for more traditional picks, consider Kiplinger’s 22 best stocks to buy for 2022. But if you want to swing for the fences, here are Wall Street’s 30 best moonshots:

S&P Global Market Intelligence

Your Guide to Roth Conversions

Special Report

Tax Breaks

Your Guide to Roth ConversionsA Kiplinger Special Report

February 25, 2021

Early Retirement: How To Protect Your Hidden Retirement Asset

retirement

Early Retirement: How To Protect Your Hidden Retirement AssetCongratulations, you’re ready to leave the grind for early retirement. But even if your savings are rock solid, an early exit from your career puts on…

December 23, 2021

25 Top Stock Picks That Billionaires Love

stocks

25 Top Stock Picks That Billionaires LoveBillionaire investors were busy during the third quarter of 2021. Here are 25 companies, of various shapes and sizes, that were some of their most rec…

December 23, 2021

The 12 Best Consumer Discretionary Stocks to Buy for 2022

stocks to buy

The 12 Best Consumer Discretionary Stocks to Buy for 2022Consumer discretionary stocks may be among 2022’s most challenging places to invest in. But these picks could overcome several sector headwinds.

January 4, 2022

The Pros’ Picks: 22 Top Stocks to Invest In for 2022

stocks to buy

The Pros’ Picks: 22 Top Stocks to Invest In for 2022Wall Street’s best ideas for the new year are all over the map. Read on to discover the pros’ top stocks to invest in across 2022.

December 29, 2021

The 12 Best Industrial Stocks to Buy for 2022

stocks to buy

The 12 Best Industrial Stocks to Buy for 2022The pros love several value-oriented sectors for 2022, including industrials. Read on as we highlight 12 top industrial stocks for the year to come.

December 28, 2021

The 2022 Stock-Market Outlook with Anne Smith and James K. Glassman

Markets

The 2022 Stock-Market Outlook with Anne Smith and James K. GlassmanSure, measuring stock markets by calendar years is a bit artificial, but it’s still a good way to give your portfolio a checkup. We forecast what stoc…

December 28, 2021