US stocks have started 2023 on a tear, with the benchmark S&P 500 up 14% year-to-date. But China’s slowing growth poses threats to the rally, given American companies’ huge business exposure to the Asian economy. US-listed companies’ profits could fall if the world’s second-largest economy keeps floundering. Loading Something is loading. Thanks for signing up!… Continue reading Why China’s faltering economy could soon become a top-of-mind concern for the US stock market

‘Time to get greedy’: A 35-year market veteran shares 5 little-known stocks that could soar up to 800% once investors realize that there won’t be a repeat of 2008

US Markets Loading… H M S Premium Kevin Rendino, the CEO of 180 Degree Capital, bets on mismanaged micro-cap stocks. Kevin Rendino, 180 Degree Capital This story is available exclusively to Insider subscribers. Become an Insider and start reading now. Veteran investor Kevin Rendino believes micro-cap stocks are set for a huge turnaround. Although stocks… Continue reading ‘Time to get greedy’: A 35-year market veteran shares 5 little-known stocks that could soar up to 800% once investors realize that there won’t be a repeat of 2008

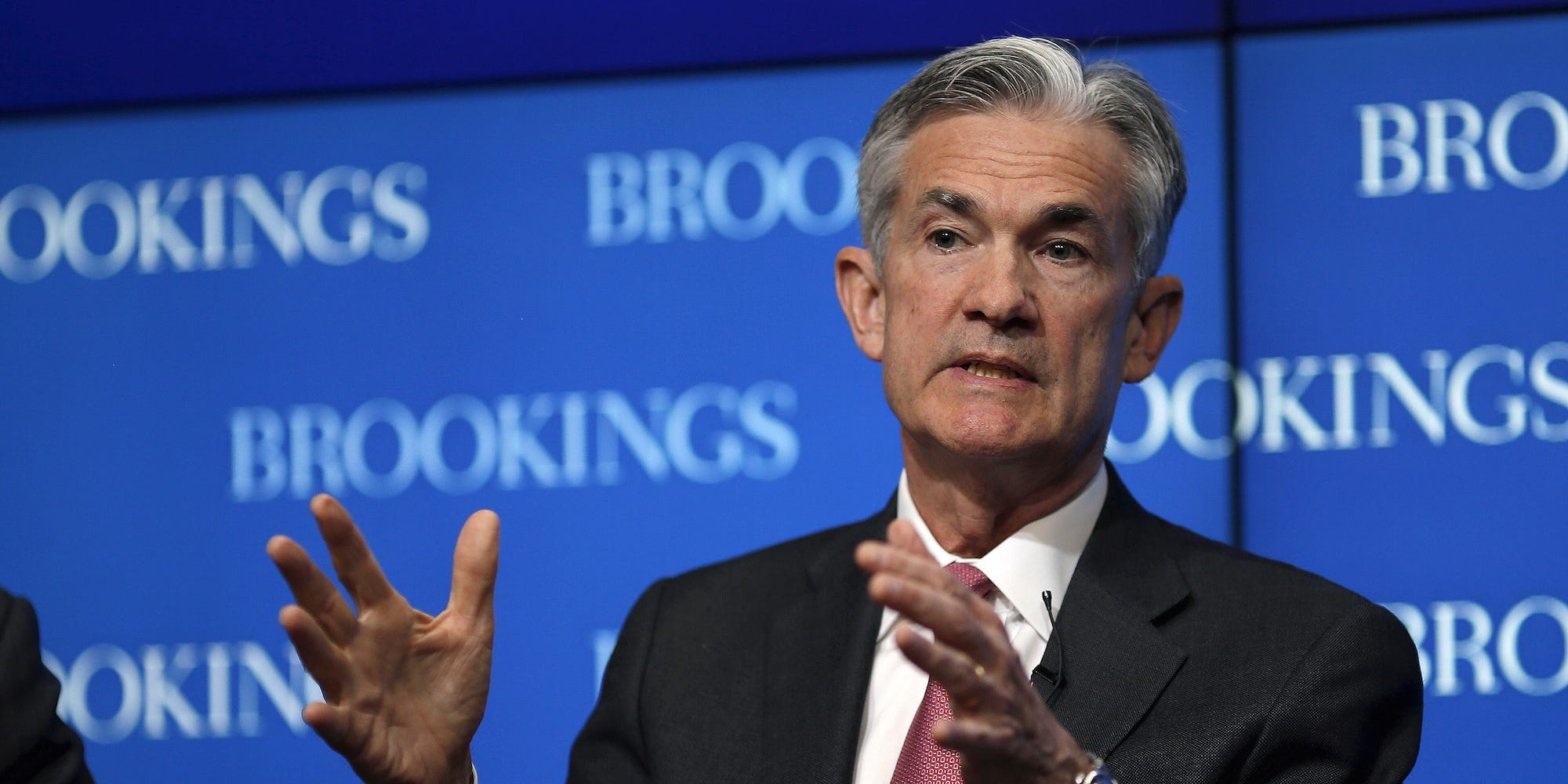

Stock Market Today: Stocks Close Mixed as Central Banks Raise Rates

Stocks closed mixed after a second day of hawkish testimony before Congress by Federal Reserve Chair Jerome Powell and a series of rate hikes by global central banks. Economic data also pressured equities for much of the trading day. Powell wrapped up his two-day semi-annual report to Congress by reiterating the Fed’s view that interest… Continue reading Stock Market Today: Stocks Close Mixed as Central Banks Raise Rates

Why Necessity-Based CRE is Poised to Outperform in Today’s Market

During his two decades investing in real estate, Mike Hazinski, chief investment officer of First National Realty Partners (FNRP), has made a career of anticipating and analyzing economic ups and downs in commercial real estate (CRE) investing – through booms, busts and a pandemic. By leaning into these experiences, he’s considered a go-to expert who… Continue reading Why Necessity-Based CRE is Poised to Outperform in Today’s Market

Emerging-market stocks will make up a bigger share of the global landscape than the US by next decade, Goldman says

Emerging-market stocks will catch up to US stocks in global market share by 2030, Goldman Sachs estimated. That’s due to faster growth in EM markets, which is largely led by China, economists said in a note. China could replace the US as the world’s largest economy by 2035, the bank added. Loading Something is loading.… Continue reading Emerging-market stocks will make up a bigger share of the global landscape than the US by next decade, Goldman says

Don’t count on an interest-rate cut boosting stocks until next year, former Dallas Fed boss says

Don’t expect the Federal Reserve to cut interest rates anytime soon, Richard Fisher says. The US central bank is unlikely to lower rates until 2024, the former Dallas Fed president said. Inflation has started to cool in recent months but remains well above the Fed’s 2% target. Loading Something is loading. Thanks for signing up!… Continue reading Don’t count on an interest-rate cut boosting stocks until next year, former Dallas Fed boss says

Shares of famous artwork are going public for the first time with a top painting’s IPO expected to draw $55 million

Shares of a Francis Bacon painting are set to become publicly traded, The Wall Street Journal reported. It will allow retail investors to join the high-value art market, purchasing fractional ownership. The IPO is led by Artex, with shares only available on a specially made art stock exchange. Loading Something is loading. Thanks for signing… Continue reading Shares of famous artwork are going public for the first time with a top painting’s IPO expected to draw $55 million

AI fever will carry the bull market higher even as the US tips into recession, veteran trader says

AI fever will carry the bull market even higher, according to Virtus’ Joe Terranova. Terranova pointed to the strong success of AI stocks this year, which have carried the S&P 500. The power of generative AI won’t be wiped away, even if the US tips into a downturn, he said. Loading Something is loading. Thanks… Continue reading AI fever will carry the bull market higher even as the US tips into recession, veteran trader says