A group of Evergrande bond investors sounded the alarm on the troubled Chinese developer, the WSJ reported. Last month, Evergrande cancelled a $19 billion debt restructuring, leading bondholders to warn of wider turmoil. “This will likely lead to the uncontrolled collapse of the group,” the investors wrote. Loading Something is loading.

Thanks for signing up!

Access your favorite topics in a personalized feed while you’re on the go.

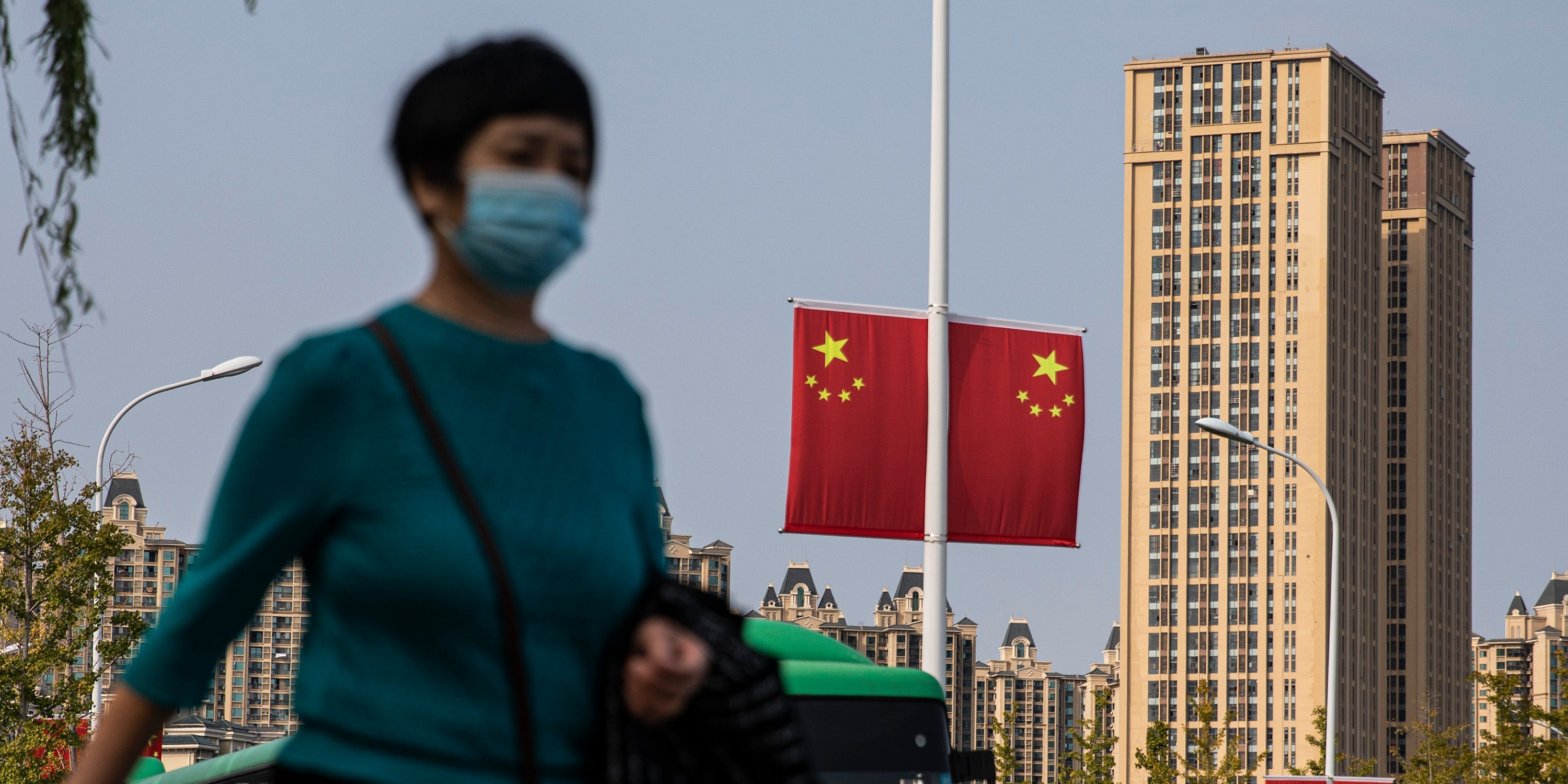

A group of investors who hold more than $6 billion of bonds issued by ailing Chinese property giant Evergrande said the developer could soon face big trouble that could spill out into the rest of the country’s real estate market.

The Wall Street Journal and Reuters reported Monday that a statement from bond investors raised doubts about the company’s efforts to win over regulators amid its business turmoil and mounting debts.

Last month, Evergrande cancelled a $19 billion debt restructuring that had been in the works for years at the last minute, citing regulatory hurdles. In their letter, the investors said the deal must get done or else consequences could be dire.

“This will likely lead to the uncontrolled collapse of the group,” the bond holders said of Evergrande’s inability to get the restructuring done. Evergrande defaulted in 2021 and remains China’s most indebted property developer. By June, it held roughly $332 billion in liabilities, which included thousands of unfinished homes it still had to deliver.

The group of investors said that the company’s failure to go ahead with the debt deal could ripple through the rest of the property sector with a “catastrophic effect” on competitors already facing their own issues. They said the firm must seek a deal with regulators and get the restructuring done.

“This is the only way the cloud of uncertainty surrounding the regulatory issues can be resolved,” the investors said. “Until then, the base case is that China Evergrande Group will be liquidated at the next winding up hearing on October 30, 2023.”

In August, Evergrande filed for Chapter 15 bankruptcy protection.

Should regulators fail to approve the deal, investors said it would make “any offshore restructuring of Chinese real estate companies a mission impossible.”

Meanwhile, Country Garden, the biggest developer in China, has been able to narrowly skirt a default, but it was late on bond payments in August. And another developer, Sunac China Holdings, is now targeting a roughly $11 billion restructuring of dollar debt, per the Journal.

Evergrande said in March that if it can’t secure a restructuring deal and a liquidation becomes necessary, bond investors would see returns likely around two to nine cents on the dollar.