Tech stocks could be the next domino to fall as the market factors in looming economic risks, according to Morgan Stanley’s Chris Toomey. “I don’t think the technology industry is immune from the overall economy,” Toomey told CNBC. The tech sector has enjoyed a sizzling rally so far this year, thanks in part to the… Continue reading Tech stocks aren’t immune to economic pain – and could be the next domino to fall, Morgan Stanley advisor says

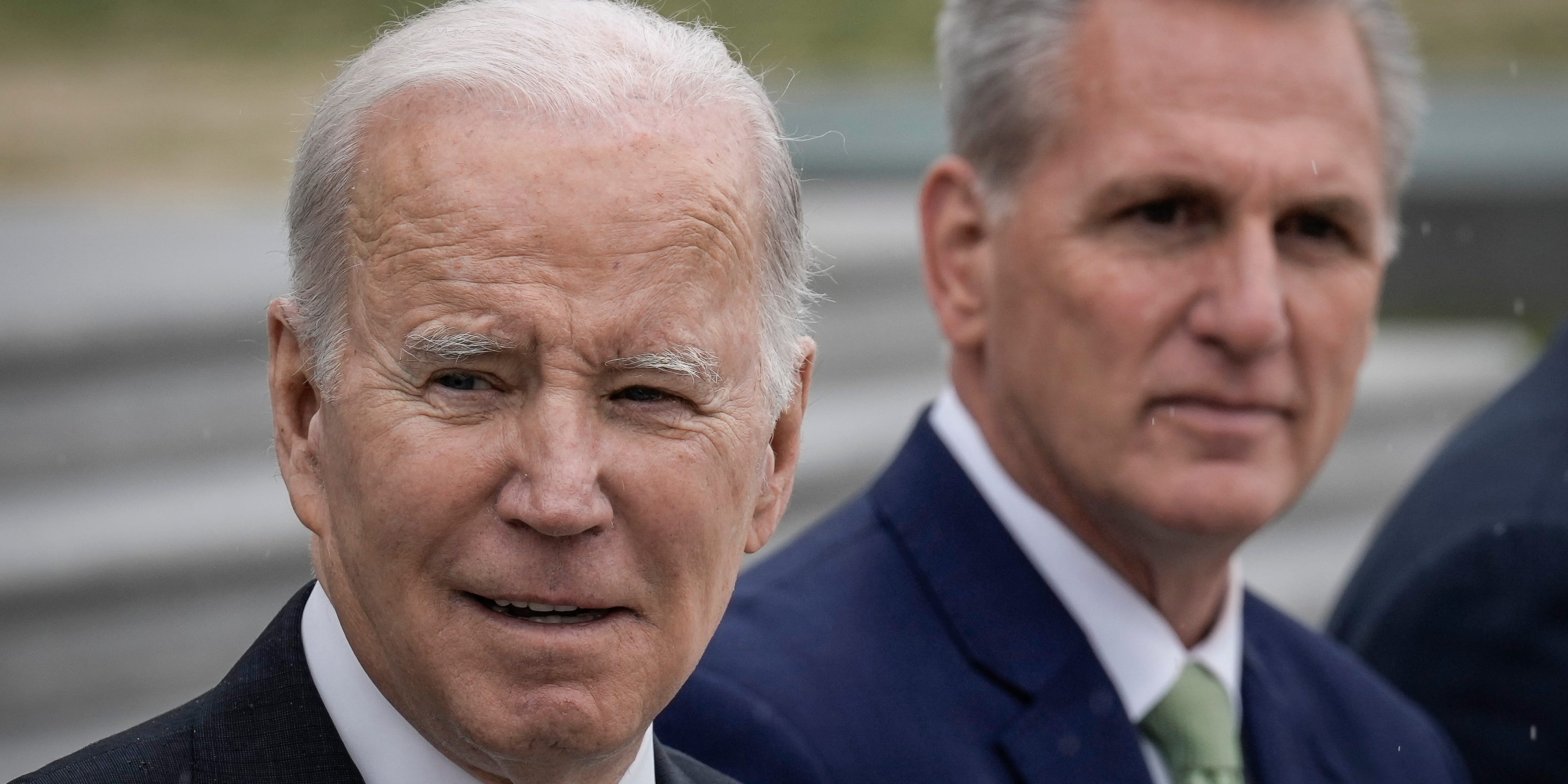

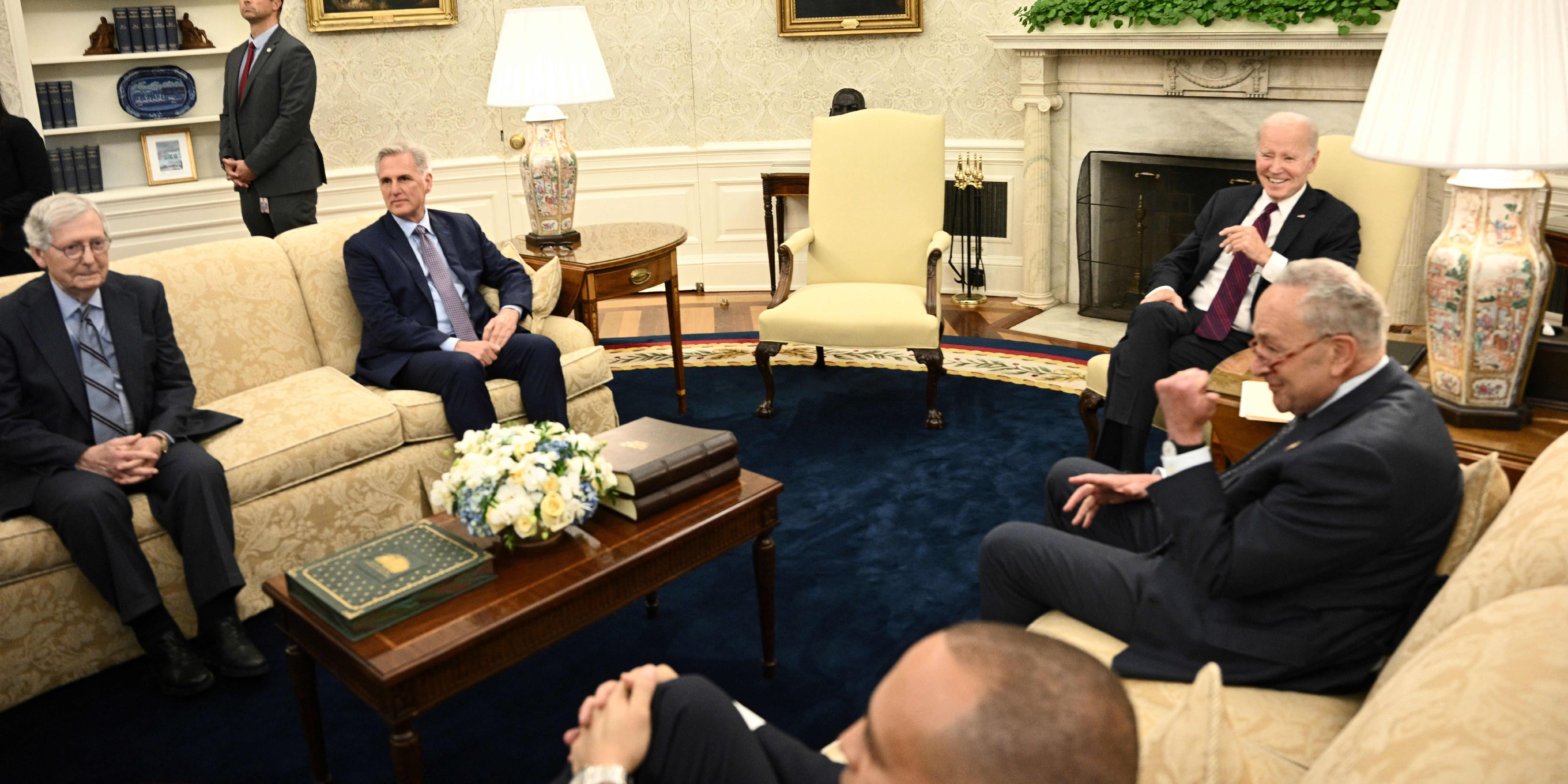

US lawmakers are running out of time to end the debt-limit standoff – so dump stocks and buy bonds, JPMorgan strategist says

Investors should buy Treasurys with debt-ceiling negotiations set to go down to the wire, according to a JPMorgan strategist. The Biden administration and the House of Representatives held talks about resolving the stand-off at the weekend. “They are running out of time… there’s just not that many days left to negotiate,” Alex Wolf told Bloomberg… Continue reading US lawmakers are running out of time to end the debt-limit standoff – so dump stocks and buy bonds, JPMorgan strategist says

Taylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Taylor Swift showed her financial savvy by escaping a deal with FTX, the bankrupt crypto exchange. The pop superstar invests in a specific type of mutual fund, Boaz Weinstein revealed. “For many reasons, it’s hard not to be a Swifty,” the hedge fund manager tweeted after a concert. Loading Something is loading. Thanks for signing… Continue reading Taylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Billionaire investor George Soros’ fund dumped its entire Tesla stake in the first quarter – cashing out on the EV’s maker’s 2023 rebound

Billionaire investor George Soros’ family office dumped its entire stake in Tesla during the first quarter of 2023. Soros Fund Management likely enjoyed gains from the EV stock’s 68% surge in the January-March period. The fund also reduced its exposure to First Horizon Bank amid the banking turbulence. Loading Something is loading. Thanks for signing… Continue reading Billionaire investor George Soros’ fund dumped its entire Tesla stake in the first quarter – cashing out on the EV’s maker’s 2023 rebound

Why You Should Teach Your Kids Investing

When you send your child off to school, they’re exposed to a wide, wonderful spectrum of knowledge: the arts, sciences, history, language … and if they’re lucky, matball. A fortunate number might also learn a thing or two about investing as part of a personal finance course. But the odds are still heavily against it… Continue reading Why You Should Teach Your Kids Investing

These 7 charts show that the stock market’s secular bull rally is still alive and well

The secular bull rally in the stock market is still alive and well, according to Ned Davis Research.From positive GDP growth to an incredibly low unemployment rate, investors should prepare for more gains in stock prices.These are the seven charts that suggest the secular bull rally in stocks still has room to run, according to… Continue reading These 7 charts show that the stock market’s secular bull rally is still alive and well

Gold could rally to a new record high if the US defaults and investors flee to safety

A default could push gold to a new record high as investors would seek safe haven assets. In a default, a weaker dollar and falling Treasury yields could also bring gold up. Even if a last-second deal was reached, gold could see a near-term rise, RBC Capital Markets said. Loading Something is loading. Thanks for… Continue reading Gold could rally to a new record high if the US defaults and investors flee to safety

Fears of a US debt default are mounting as the deadline to lift the borrowing limit looms. Here’s what Elon Musk, Paul Krugman and Jamie Dimon have warned.

Fears of a US debt default are mounting as a deadline to raise the government’s borrowing limit draws near. Treasury Secretary Janet Yellen has warned of worrying consequences if Congress doesn’t make a decision soon. Here’s what 6 top voices have said so far about the ongoing debt-ceiling deadlock. Loading Something is loading. Thanks for… Continue reading Fears of a US debt default are mounting as the deadline to lift the borrowing limit looms. Here’s what Elon Musk, Paul Krugman and Jamie Dimon have warned.