JPMorgan Asset Management CIO says markets are headed for a “feel good period” before an economic slowdown. Investors should not lean into the fleeting rally next quarter amid a looming recession, JPMorgan’s Bob Michele says. “If we’ve been taught anything this past month, you may see it coming or you may not.” Loading Something is… Continue reading Markets are headed for a rally right before a recession ‘pounds away at the economy,’ JPMorgan Asset Management CIO says

There’s a simple reason why it’s very likely that the stock market bottomed in October

The stock market’s October low likely represented the bottom of the bear market, according to Fundstrat.That’s because 50% of bear markets since 1950 have bottomed in the month of October.”Is it really far-fetched to think markets bottomed [on] October 12? History would suggest it makes sense,” Fundstrat said. Loading Something is loading. Thanks for signing… Continue reading There’s a simple reason why it’s very likely that the stock market bottomed in October

Block gave a ‘robust’ response to brutal short-seller report, and shares of the CashApp parent are looking at 40% upside, Bank of America says

Shares of Block could rise 40% from recent levels, Bank of America said Friday. Block gave a “robust” response to Hindenburg Research’s report raising fraud concerns at the Cash App parent. BofA has a $96 price target on Block and backed its buy rating. Loading Something is loading. Thanks for signing up! Access your favorite… Continue reading Block gave a ‘robust’ response to brutal short-seller report, and shares of the CashApp parent are looking at 40% upside, Bank of America says

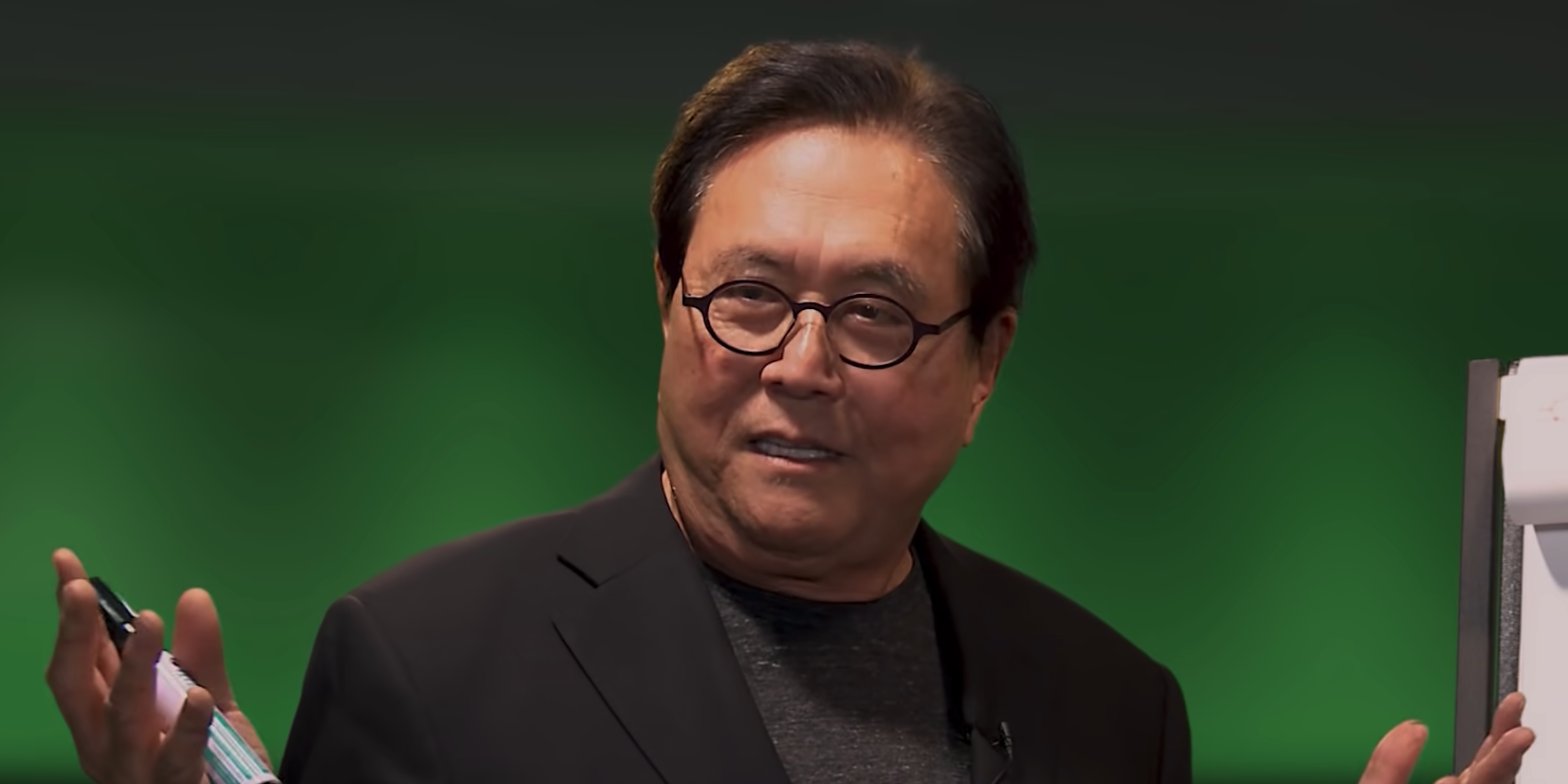

‘Rich Dad Poor Dad’ author Robert Kiyosaki warns the next chapter of the bank crisis will impact on one of the world’s key central banks

The next chapter of the banking crisis will involve the Bank of Japan, according to Robert Kiyosaki. The “Rich Dad Poor Dad” author said the bank’s exposure to derivatives markets is a large risk. Kiyosaki has been bearish for years, predicting the market to crash under the weight of high inflation. Loading Something is loading.… Continue reading ‘Rich Dad Poor Dad’ author Robert Kiyosaki warns the next chapter of the bank crisis will impact on one of the world’s key central banks

Couple’s move to Ontario put millions in play in high-stakes divorce case

Sometimes a formal agreement isn’t enough to satisfy the family law courts Published Mar 30, 2023 • Last updated 14 hours ago • 4 minute read Couples should consider the impact a move to a new jurisdiction may have on an existing marriage contract. Photo by Getty Images/iStockphoto Wealthy families are no strangers to marriage contracts.… Continue reading Couple’s move to Ontario put millions in play in high-stakes divorce case

Budget’s changes to 3 registered savings plans could affect how you invest this year and beyond

Jamie Golombek: Here’s what you need to know about budget changes that may affect your investment strategies Published Mar 30, 2023 • Last updated 21 hours ago • 5 minute read The federal budget made changes to three registered savings plans. Photo by Getty Images/iStockphoto The big news for high-income earners in this past week’s federal… Continue reading Budget’s changes to 3 registered savings plans could affect how you invest this year and beyond

Stock Market Today: Stocks Rise Ahead of Next Inflation Update

Stocks started the day in positive territory Thursday as banking industry concerns eased and expectations grew that the Fed could pause rate hikes at its May meeting. And while optimism waned throughout the day, the three major benchmarks still closed higher for a second straight day. The absence of jarring financial sector headlines created a… Continue reading Stock Market Today: Stocks Rise Ahead of Next Inflation Update

Time to Consider Foreign Bonds

I normally dismiss foreign bonds and bond funds, whether denominated in U.S. dollars or in native currencies. Looking back five years through March 3, which allows for events besides the COVID lockdowns and war in Ukraine, the broad Standard & Poor’s international aggregate investment-grade index (covering developed markets) lost an annualized 2.2%, in U.S. dollars.… Continue reading Time to Consider Foreign Bonds