Roubini partners with Goldman Sachs to launch alternative safe haven products in a big market crash Author of the article: Bloomberg News Tracy Alloway Published Mar 14, 2023 • 3 minute read Nouriel Roubini, chief executive officer of Roubini Macro Associates Inc., during a panel session at the Qatar Economic Forum (QEF) in Doha, Qatar,… Continue reading Roubini launches alternative haven trade for the era of endless inflation

Ontario Teachers’ posts 4% return in ‘difficult’ investment environment

Funds posts 4% return in ‘difficult’ investment environment in 2022 as net assets grew to $247.2 billion. Published Mar 14, 2023 • Last updated 9 hours ago • 2 minute read Ontario Teachers’ Pension Plan net assets grew to $247.2 billion, approaching the pension’s goal of $300 billion by 2030. Photo by Cole Burston /THE CANADIAN… Continue reading Ontario Teachers’ posts 4% return in ‘difficult’ investment environment

Stock Market Today: Markets Rise as Bank Stocks Bounce

Tuesday started off strong for stocks, but the major benchmarks finished off their session highs on reports that a Russian aircraft collided with a U.S. drone in the Black Sea. The February consumer price index (CPI) drew plenty of attention from investors, though it gave a mixed picture on inflation. Also in focus were regional… Continue reading Stock Market Today: Markets Rise as Bank Stocks Bounce

What the Markets’ New Tailwinds Could Look Like in 2023

Editor’s note: This is part two of a three-part series about what the economy and markets could look like this year. Part one — “Will Rising Interest Rates Lead to Soft Landing or Recession?” — explored the impact of the Fed’s rate hikes. Part three, coming next week, shares five investment strategies for investors to… Continue reading What the Markets’ New Tailwinds Could Look Like in 2023

Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

CEO Walter Bettinger said inflows grew significantly the day Silicon Valley Bank began to collapse. He also told CNBC that he bought 50,000 shares of Charles Schwab on Tuesday for his personal account. He said Charles Schwab is managed conservatively and has a different business model than regional banks. Loading Something is loading. Thanks for… Continue reading Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

Morgan Chittum Michael M. Santiago/Getty Images US stocks closed higher on cooling inflation data as trader shrug off concerns of a potential regional bank crisis. The Dow Jones Industrial Average snapped its five-day losing steak on Tuesday. Elsewhere, bitcoin surged 15% and hit a 9-month high in the morning. Loading Something is loading. Thanks for… Continue reading US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

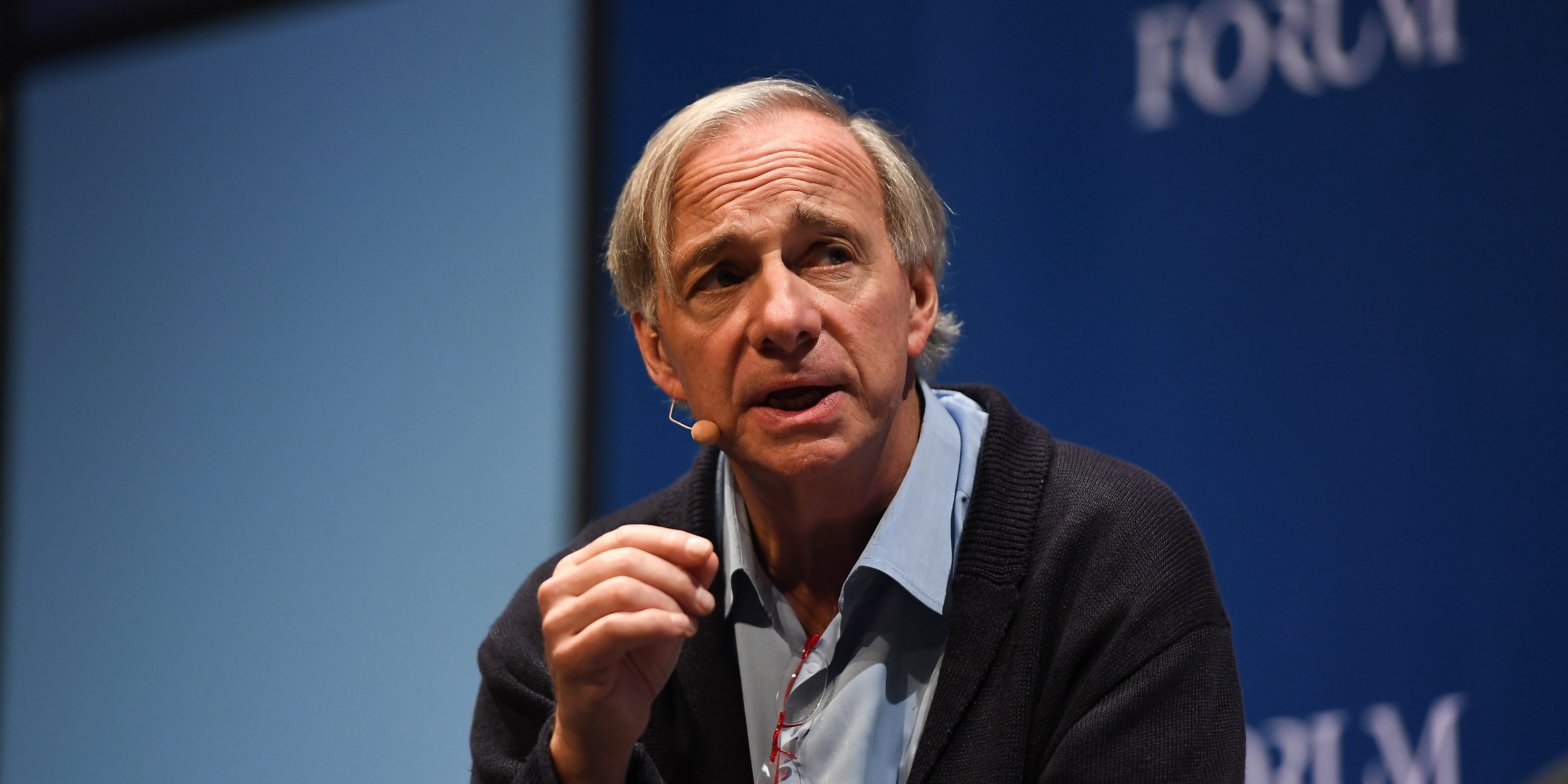

Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world

Ray Dalio said the Silicon Valley Bank failure is a “canary in the coal mine” for what’s to come. Dalio wrote Tuesday that this is part of the classic “bubble-bursting part” of the short-term debt cycle. He explained how it fits into broader historical trends and debt cycles. Loading Something is loading. Thanks for signing… Continue reading Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world

The Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says

The federal rescue of SVB depositors means all bank deposits are guaranteed, Roger Altman said. If that’s the case, “should the taxpayer allow the shareholders to realize the benefit of that?” He also told CNBC that SVB’s demise signals fragility in finance as well as out-of-date policies. Loading Something is loading. Thanks for signing up!… Continue reading The Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says