Russia’s deepening isolation from the West is dramatically reshaping its economy. Chinese banks have offered billions of dollars to Russia as sanctions pressure Western lenders to exit the country. The volume of renminbi-backed loans has more than quadrupled as Russia seeks to move away from the dollar. Loading Something is loading. Thanks for signing up!… Continue reading Russia is becoming increasingly dependent on Chinese banks as its yuan borrowings more than quadruple

Invest Like the Rich: Are Direct Investments Right for You?

The wealthy have access to investments unavailable to the rest of us. But at least one type — direct investments — is now within reach. Direct investments enable investors to take stakes in non-public companies whose shares don’t trade on a stock exchange. A company — say, a brewery or a software developer — will… Continue reading Invest Like the Rich: Are Direct Investments Right for You?

How Stock Spinoffs Work — And How They’ve Performed

Anyone who has watched Better Call Saul or Frasier is familiar with the spinoff concept, in which characters from an existing series branch off in a new show with a different story line. It works sort of the same way in corporate America with stock spinoffs, when firms split off a part of their business… Continue reading How Stock Spinoffs Work — And How They’ve Performed

SEC’s Gary Gensler is waging war against crypto. Here’s a look at how his views on the industry have evolved over the years

The SEC has waged war against the cryptocurrency industry this year with a string of lawsuits. At the heart of it is SEC chief Gary Gensler – who has railed against crypto since taking office. Amid his regulatory battle against crypto, Insider maps the evolution of his views on the sector. Loading Something is loading.… Continue reading SEC’s Gary Gensler is waging war against crypto. Here’s a look at how his views on the industry have evolved over the years

The housing market is stuck: Americans can’t afford homes, investors aren’t buying property, and economists see little relief ahead

Low inventory, high mortgage rates, and high prices have created a difficult housing market. Homeowners have seen equity climb, but house hunters are having a hard time breaking into the market. Purchases by real estate investors plunged 45% in the second quarter compared to last year. Loading Something is loading. Thanks for signing up! Access… Continue reading The housing market is stuck: Americans can’t afford homes, investors aren’t buying property, and economists see little relief ahead

The stock market will hit record highs by the end of the year based on Goldilocks scenario, Bank of America says

The stock market could hit record highs before the end of the year, according to Bank of America.When stocks are up 10%-20% heading into September, the month’s returns are positive 65% of the time, BofA said.”2023 has a bullish setup for September and the rest of the year.” Loading Something is loading. Thanks for signing… Continue reading The stock market will hit record highs by the end of the year based on Goldilocks scenario, Bank of America says

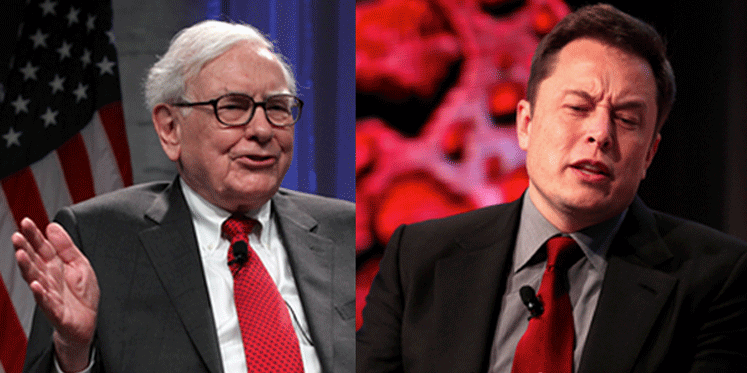

Warren Buffett’s toll roads, Elon Musk’s bottlenecks, and why both men prize the same kinds of businesses

Warren Buffett and Elon Musk find value in the same kinds of businesses. Buffett likes toll roads that give him monopoly power and the ability to raise prices easily. Musk wields huge influence by addressing bottlenecks like EV charging and space transportation. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading Warren Buffett’s toll roads, Elon Musk’s bottlenecks, and why both men prize the same kinds of businesses

A top-7% fund manager over the past 15 years shares the once-in-a-generation challenge she sees in markets — and names 6 stocks that look attractive right now

US Markets Loading… H M S Premium Fund manager Kimberly Scott sees value in mid caps while interest rates are elevated. Kimberly Scott, Macquarie Asset Management This story is available exclusively to Insider subscribers. Become an Insider and start reading now. Lofty interest rates are a once-in-a-generation headache for investors, according to Kimberly Scott. The… Continue reading A top-7% fund manager over the past 15 years shares the once-in-a-generation challenge she sees in markets — and names 6 stocks that look attractive right now