The half-point hike surprised markets Publishing date: Oct 26, 2022 • 3 days ago • 4 minute read • 6 Comments Bank of Canada governor Tiff Macklem raised interest rates by 50 basis points to 3.75 per cent Wednesday. Photo by Justin Tang/Bloomberg Advertisement 2 This advertisement has not loaded yet, but your article continues below.… Continue reading Bank of Canada swerves in ‘game of chicken’ with inflation: What economists say

The quiet quitters are getting quiet fired: The silent war playing out in offices

Victoria Wells: Remote work has made communication harder, fuelling a ‘quiet’ showdown between employees and employers Publishing date: Oct 25, 2022 • 4 days ago • 4 minute read • 114 Comments Quiet firing can be demoralizing for an employee, which is exactly the point. Photo by Gigi Suhanic/National Post photo illustration You’ve probably heard of… Continue reading The quiet quitters are getting quiet fired: The silent war playing out in offices

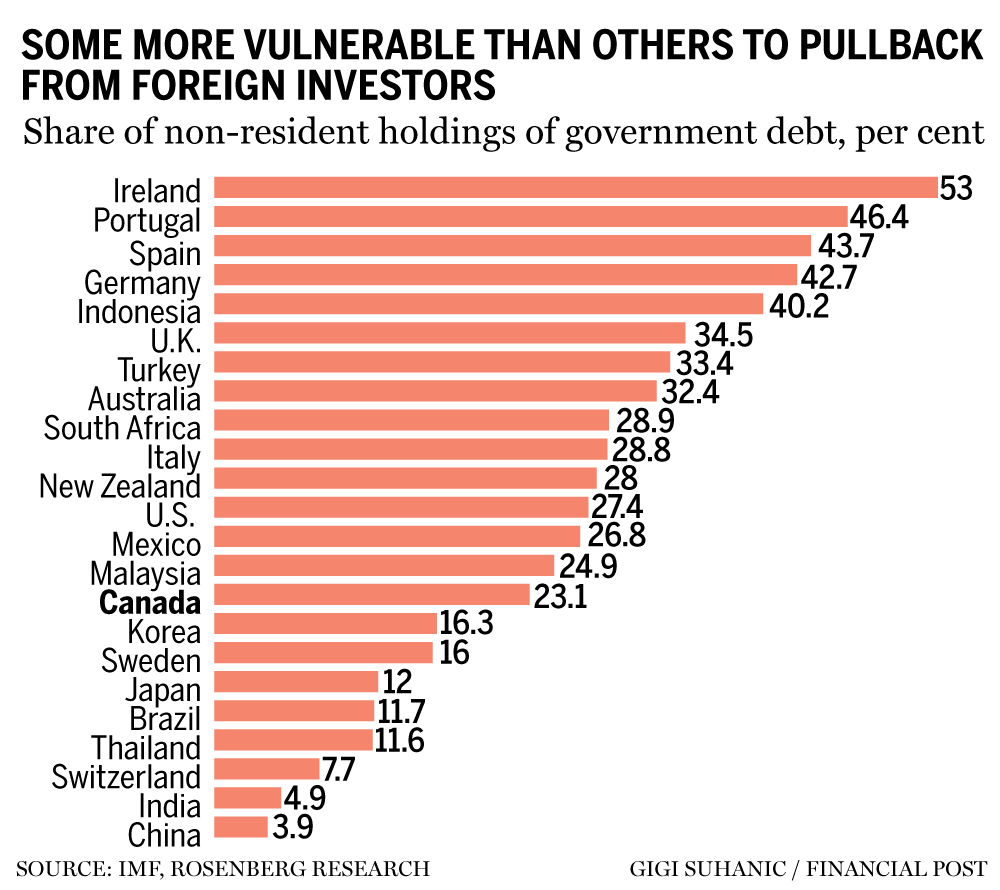

David Rosenberg: These economies are best positioned to withstand rising interest rates

Sharp increase in government debt threatens to derail global economy, meaning investors must be discerning of countries they focus on Publishing date: Oct 25, 2022 • 4 days ago • 5 minute read • 7 Comments A group of tourists walk past a temple in Thailand. The country is among countries investors may want to focus… Continue reading David Rosenberg: These economies are best positioned to withstand rising interest rates

Energy stocks could make up 30% of the S&P 500 by 2025, a massive increase from 2% in 2020 that will come at the expense of tech

Energy stocks are poised to take over the S&P 500 at the expense of the tech sector, according to Louis Navellier.The investment strategist expects the energy sector to represent 30% of the S&P 500 by 2025.That’s a marked increase from 2020, when energy made up just 2% of the popular investment index. Loading Something is… Continue reading Energy stocks could make up 30% of the S&P 500 by 2025, a massive increase from 2% in 2020 that will come at the expense of tech

Stocks could sink 25% as the liquidity crisis in Treasuries threatens to spill over to other markets, analyst says

A liquidity crisis is brewing within the $24 trillion US Treasury market, and the turmoil has the potential to sink stocks. Treasury liquidity is showing signs of weakness not seen since the Great Financial Crisis, warned James Demmert. “A liquidity crisis would most likely extend the current bear market in stocks to much deeper levels… Continue reading Stocks could sink 25% as the liquidity crisis in Treasuries threatens to spill over to other markets, analyst says

Chinese leader Xi Jinping’s power grab fueled a $6 trillion stock selloff and the yuan’s decline. These 4 charts capture the market meltdown.

China’s President Xi Jinping has tightened his grip on power — and that has rocked markets. Investors dumped Chinese stocks in a $6 trillion blowout as Xi shut reformers out of decision making. These 4 charts show how deep the meltdown in China-linked assets went last week. Loading Something is loading. Thanks for signing up!… Continue reading Chinese leader Xi Jinping’s power grab fueled a $6 trillion stock selloff and the yuan’s decline. These 4 charts capture the market meltdown.

Stocks crashed 50% in the 2008 crisis. Here’s how bad Jamie Dimon, Nouriel Roubini, Michael Burry, and other top commentators see it getting in the next recession.

A slew of factors weighing on the global economy has sparked comparisons to 2008, with dire predictions for stocks. Credit Suisse briefly shook markets on fears of collapse, spiking anxiety over another Lehman Brothers moment. Here’s how bad a the next downturn could hit the stock market, according to five top experts. Loading Something is… Continue reading Stocks crashed 50% in the 2008 crisis. Here’s how bad Jamie Dimon, Nouriel Roubini, Michael Burry, and other top commentators see it getting in the next recession.

The co-manager of Vanguard’s $48 billion income fund has beaten 88% of competitors this year by finding winning dividend stocks using this simple strategy

Vanguard’s Sharon Hill has overseen a fantastic performance for her $48 billion income-focused fund. She targets stocks with promising dividend growth, valuations, fundamentals, and sentiment. Hill shared her strategy for investing and risk management in detail with Insider. Sharon Hill isn’t your typical fund manager. She co-leads the Vanguard Equity Income Fund (VEIPX), which has… Continue reading The co-manager of Vanguard’s $48 billion income fund has beaten 88% of competitors this year by finding winning dividend stocks using this simple strategy