A price cap on Russian oil could backfire on the global economy, Indonesia’s finance minister warned. If a price cap is met with retaliation from Russia, it could result in oil prices being pushed higher. The move could also set a precedent for other commodities, which would hurt some of Indonesia’s exports. Loading Something is… Continue reading A Russian oil price cap will backfire on the global economy and the plan likely influenced OPEC’s production cut, Indonesian finance minister says

The UK’s recent market turmoil wasn’t caused by the mini-budget, and the chaos was a result of interest rate ‘differentials’, Britain’s business secretary says

The turbulence in UK financial markets stems from the gap between UK and US interest rates, acob Rees-Mogg said Wednesday. The turbulence is “primarily caused by interest-rate differentials rather than by the fiscal announcement,” he said. The pound rose Wednesday on speculation the Bank of England may extend emergency bond buying. Loading Something is loading.… Continue reading The UK’s recent market turmoil wasn’t caused by the mini-budget, and the chaos was a result of interest rate ‘differentials’, Britain’s business secretary says

Investors shouldn’t get bullish on the stock market until 3 things happen, and should use any rally to rotate out of growth names ahead of a stagflationary recession, BofA says

Investors should hold off on buying the dip in stocks until earnings begin to decline, according to Bank of America.The bank said the risk of a stagflationary recession means investors should use rallies to sell growth stocks.”Higher discount rates reward firms that produce high profits today, not speculators seeking profits far in the future,” BofA… Continue reading Investors shouldn’t get bullish on the stock market until 3 things happen, and should use any rally to rotate out of growth names ahead of a stagflationary recession, BofA says

Mortgage Rates Near 7% As Fed Aims To Cool ‘Red Hot’ U.S. Housing Market

“Application volumes for both refinancing and home purchases declined and continue to fall further behind last year’s record levels,” the Mortgage Bankers Association said Wednesday. Mortgage rates jumped to the highest levels in more than sixteen years last week, data from an industry group indicated Wednesday, as borrowing costs edged towards the 7% mark amid… Continue reading Mortgage Rates Near 7% As Fed Aims To Cool ‘Red Hot’ U.S. Housing Market

Three Stocks That Can Thrive in a Recession: Morningstar

Many economists say a recession is likely by the end of this year. So which stocks can do well during a downturn? Morningstar investment specialist Susan Dziubinski offers some guidelines. “First, recession-proof companies typically provide goods and services that consumers will continue to pay for no matter what’s going on in the economy,” she wrote… Continue reading Three Stocks That Can Thrive in a Recession: Morningstar

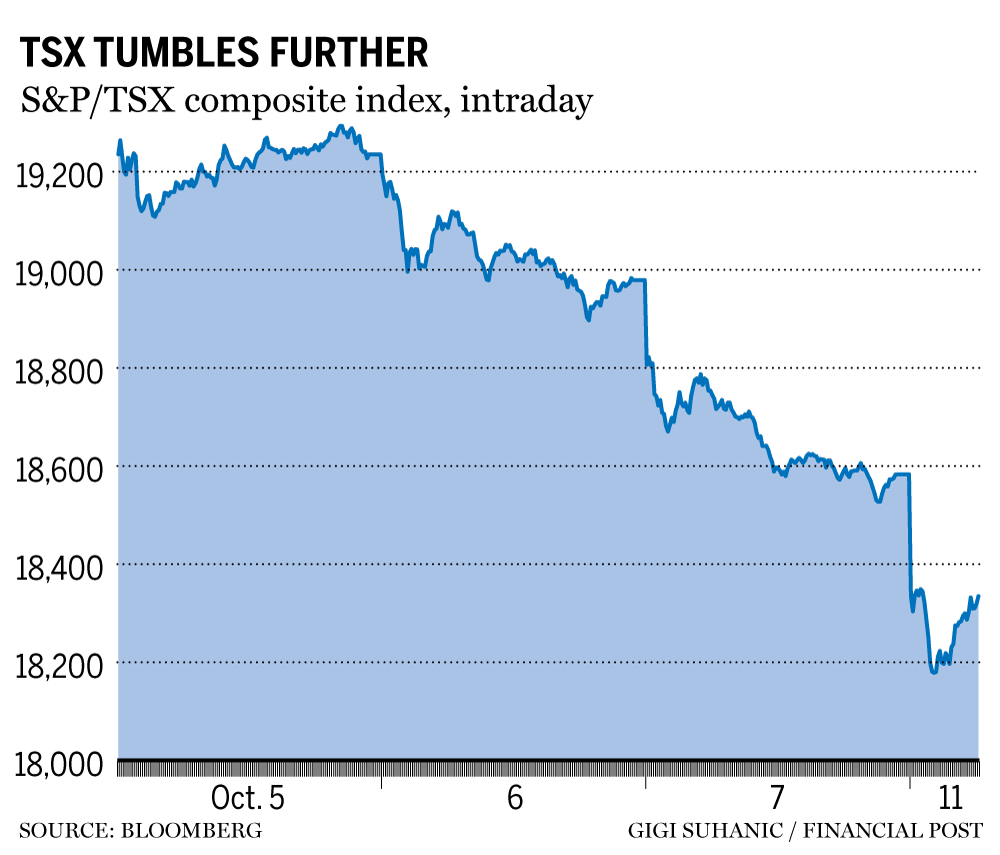

TSX is plunging even deeper into the red than U.S. stocks today

S&P/TSX composite index ended down 366.45 points, or nearly 2%, at 18,216.68 Author of the article: The S&P/TSX composite index fell Tuesday, as worries about a global recession unnerved investors returning from a long weekend, with commodity-linked energy and material stocks among big losers. Photo by REUTERS/Mark Blinch/File Photo Canada’s main stock index fell on… Continue reading TSX is plunging even deeper into the red than U.S. stocks today

Stock Market Today: Nasdaq, S&P 500 Fall Again as Treasury Yields Rise

Most stocks closed lower for a fifth straight day Tuesday, as rising government bond yields turned up the heat once again. The Nasdaq Composite (-1.1% at 10,426) and the S&P 500 Index (-0.7% at 3,588) finished in the red as the 10-year Treasury yield climbed 5.2 basis points to 3.937%. (A basis point = 0.01%.)… Continue reading Stock Market Today: Nasdaq, S&P 500 Fall Again as Treasury Yields Rise

Why Experts Think Q3 Earnings Could Be Awful

Earnings season is once again upon us and it’s forecast to be brutal. Increased labor costs, rising input prices, supply-chain disruptions, higher interest rates and a strong dollar are just some of the factors expected to weigh on corporate profit margins and, by extension, earnings per share. With those challenges and more, it’s easy to… Continue reading Why Experts Think Q3 Earnings Could Be Awful