The bad news for the housing market continues to mount. Existing-home sales fell for a seventh straight month in August, dropping 0.4% from July and 19.9% from a year earlier, according to the National Association of Realtors. The annualized sales pace was the lowest since May 2020, early in the pandemic. The median existing-home-sale price dropped… Continue reading Housing Slump Continues as Existing-Home Sales Drop

Buy Now, Pay Later Payments: New Rules Consumers Should Know

Buy now, pay later consumer models are taking the U.S. payments sector by storm. BNPL payment models are mostly resonating with U.S. online shoppers, who make a modest initial payment up front and pay the remaining balance on scheduled due dates – often four payments made over four months. Currently, BNPL mobile apps like Klarna,… Continue reading Buy Now, Pay Later Payments: New Rules Consumers Should Know

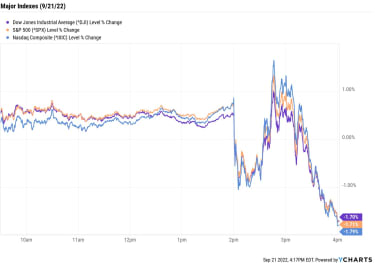

Stock Market Today: Stocks Go on Wild Ride as Fed Targets More Rate Hikes | Kiplinger

Stocks spent most of Wednesday in positive territory, but went on a roller-coaster ride after the Federal Reserve, as expected, issued its third straight 75 basis point rate hike. The Fed’s rate hike sparked plenty of chatter among Wall Street’s experts, with the main focus on what the central bank plans to do next. Today’s… Continue reading Stock Market Today: Stocks Go on Wild Ride as Fed Targets More Rate Hikes | Kiplinger

The stock market is in a bottoming process that will lead to 17% upside by early 2023 as the Fed gears up for a data-dependent pause, Stifel says

US stocks are in the middle of a bottoming process that will ultimately lead to more gains ahead, according to Stifel.Stifel highlighted several positive upcoming catalysts, including the Fed pausing future rate hikes.The investment firm expects the S&P 500 to surge 17% to 4,400 by the first quarter of 2023. Loading Something is loading. The… Continue reading The stock market is in a bottoming process that will lead to 17% upside by early 2023 as the Fed gears up for a data-dependent pause, Stifel says

Putin’s self-sanctioning of Russian energy supplies will be absorbed by Europe, but Moscow will never be able to replace those customers, Kremlin critic Bill Browder says

Vladimir Putin is only hurting himself by slashing gas supplies to Europe, Russian-American financier Bill Browder said. That’s because Europe will be be able to absorb the pain of the energy crisis, but Russia can’t easily replace those customers. “He’s done himself an amazing self-sacrifice, which will serve our purposes,” Browder said of the halt… Continue reading Putin’s self-sanctioning of Russian energy supplies will be absorbed by Europe, but Moscow will never be able to replace those customers, Kremlin critic Bill Browder says

The Fed is embracing a possible housing-market correction as a way to get ‘red-hot’ prices back to a more sustainable level

The housing market is in a slump. That’s a good thing, according to Fed Chair Jerome Powell. After years of “red-hot” prices, a correction can help boost home affordability, he added. The Fed is poised to keep raising rates into 2023, meaning the market decline is likely in its early stages. Loading Something is loading.… Continue reading The Fed is embracing a possible housing-market correction as a way to get ‘red-hot’ prices back to a more sustainable level

Investors are pricing in an additional 125-basis-point rate hike over the next 2 Fed meetings

Investors on Thursday were pricing in 1.25 percentage points in additional rate hikes through the rest of the year The pricing suggests the fed funds target rate will hit a range of 4.25%-4.5% by the end of 2022. UBS anticipates a recession if the Fed raises rates closer to 5%. Loading Something is loading. Investors… Continue reading Investors are pricing in an additional 125-basis-point rate hike over the next 2 Fed meetings

Turkish Lira hits record low after the country’s central bank moves forward with another rate cut despite soaring inflation

The Turkish Lira fell to a record low on Thursday after the country’s central bank cut interest rates.Turkey’s central bank has been cutting rates despite soaring inflation due to pressure from the country’s president.Turkey’s inflation rate topped 80% in August, and the central bank responded with a 100 basis point rate cut. Loading Something is… Continue reading Turkish Lira hits record low after the country’s central bank moves forward with another rate cut despite soaring inflation