Bond vigilantes are “saddling up” again as federal deficits balloon, said market veteran Ed Yardeni. He coined the vigilantes term, referring to investors who sought smaller deficits by sending yields higher. “[W]e’ve got the federal deficit widening when the economy is doing well. And I think the bond vigilantes are quite concerned about that.” Loading… Continue reading Bond vigilantes are ‘saddling up.’ Here’s how concerned investors might take action over the ballooning federal deficit.

The resilience of Russia’s stock market and its economy is a complete mirage masking deeper pain, Yale researchers say

The functioning of Russia’s stock market is an illusion, two Yale researchers told Insider. It’s part of the country’s efforts to mask pain in the economy amid costly war and sanctions. Investments in the country are likely going nowhere as Moscow’s economy spirals. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading The resilience of Russia’s stock market and its economy is a complete mirage masking deeper pain, Yale researchers say

Forget about a recession sinking the stock market. Rising rates threaten to spoil the party just like they did in 2022.

Yields on 10-year Treasury yields have surged well above 4%. This creates increased competition for stocks, which are riskier than Treasurys. With both stock valuations and interest rates high, stock prices could continue to fall. Stocks have surged in recent months as the US economy has proved resilient: job gains remain positive, the unemployment rate… Continue reading Forget about a recession sinking the stock market. Rising rates threaten to spoil the party just like they did in 2022.

Consumers have spent all of their excess savings from the pandemic. That’s just one reason why stocks are poised to fall, JPMorgan says

US consumers have spent all of their excess savings from the pandemic, according to JPMorgan.The bank highlighted the softening of the consumer as one reason why stocks are poised to continue their decline.”Even with a robust labor market, US corporates are seeing demand and prices soften with ongoing margin pressure.” Loading Something is loading. Thanks… Continue reading Consumers have spent all of their excess savings from the pandemic. That’s just one reason why stocks are poised to fall, JPMorgan says

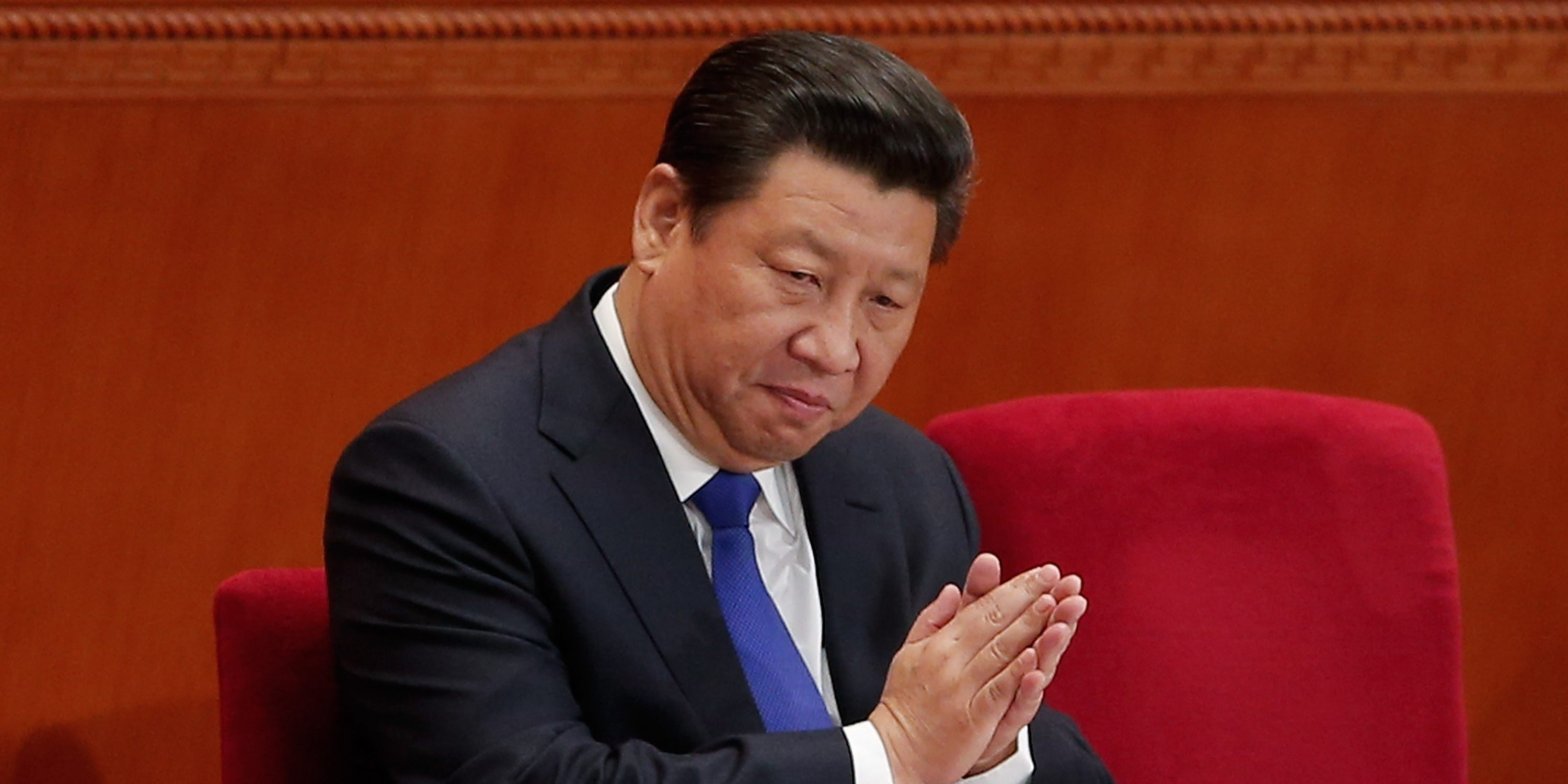

China’s economy is flailing. Here’s how its problems could spill into global markets.

China’s economy is facing headwinds ranging from an unstable property market to weak consumer demand. Experts told Insider that a worsening scenario in China bodes poorly for global markets and other economies like the US. Both Janet Yellen and Joe Biden have recently warned of China’s spillover risks. Loading Something is loading. Thanks for signing… Continue reading China’s economy is flailing. Here’s how its problems could spill into global markets.

Jeremy Grantham warns a recession is still coming and the Fed is ‘almost guaranteed to be wrong’

Jeremy Grantham told Bloomberg he still sees a US recession on the way. High interest rates will keep dragging on financial markets and a downturn could last into 2024. “I suspect inflation will never be as low as its average for the last 10 years.” Loading Something is loading. Thanks for signing up! Access your… Continue reading Jeremy Grantham warns a recession is still coming and the Fed is ‘almost guaranteed to be wrong’

US stocks fall as Dow heads for worst week since March amid China fears, rising bond yields

Phil Rosen An American flag hangs behind traders working on the floor of the New York Stock Exchange (NYSE) on October 11, 2019 in New York City. Drew Angerer/Getty Images US stocks tumbled Friday, with the Dow on track for its worst week since March. The S&P 500 and Nasdaq Composite are each headed for… Continue reading US stocks fall as Dow heads for worst week since March amid China fears, rising bond yields

Michael Burry is a ‘one-trick pony’ – and the ‘Big Short’ investor’s massive bet against the stock market is a sure loser, says veteran analyst

Michael Burry placed bets worth a notional $1.6 billion against the S&P and Nasdaq last quarter. The “Big Short” investor is a “one-trick pony” and his wager is a loser, analyst Marc Chaikin said. Chaikin argued past bears were shrewder, more influential, and had better track records than Burry. Loading Something is loading. Thanks for… Continue reading Michael Burry is a ‘one-trick pony’ – and the ‘Big Short’ investor’s massive bet against the stock market is a sure loser, says veteran analyst