Peter Hodson: Investors often fear the worst, and the worst does not always occur A trader works on the floor of the New York Stock Exchange. Photo by ANGELA WEISS/AFP via Getty Images files I recently visited a friend’s cottage, which had no phone, cell coverage or Wi-Fi. I was completely off the grid for… Continue reading Five things — good and bad — affecting investors this summer

David Rosenberg: Five reasons we haven’t seen the market bottom yet

Just like in 2000-2002 and 2007-09, we are in the early chapters of this bear market Publishing date: Aug 11, 2022 • 1 day ago • 4 minute read • 7 Comments Bear markets only end in the mature stage of the recession when investors see the whites of the eyes of the recovery, writes David… Continue reading David Rosenberg: Five reasons we haven’t seen the market bottom yet

Stock Market Today: S&P, Nasdaq Rack Up Longest Weekly Win Streak of 2022 | Kiplinger

Stock Market Today Preliminary data from the University of Michigan indicated consumer sentiment is improving in August.Stocks closed out the week with a bang Friday, boosted by an encouraging reading on consumer sentiment. Ahead of today’s opening bell, the University of Michigan said its preliminary consumer sentiment index rose to 55.1 in August from July’s… Continue reading Stock Market Today: S&P, Nasdaq Rack Up Longest Weekly Win Streak of 2022 | Kiplinger

Wall Street is more hawkish than the Fed and that suggests continued upside for stocks as sentiment improves, Fundstrat says

A bullish counter trade is forming as Wall Street gets more hawkish than the Fed, according to Fundstrat’s Tom Lee.Lee highlighted that economists expect the Fed to raise interest rates through 2023 to 5%.Meanwhile, only one Wall Street bank sees positive gains for the S&P 500 in 2022. Loading Something is loading. Wall Street has… Continue reading Wall Street is more hawkish than the Fed and that suggests continued upside for stocks as sentiment improves, Fundstrat says

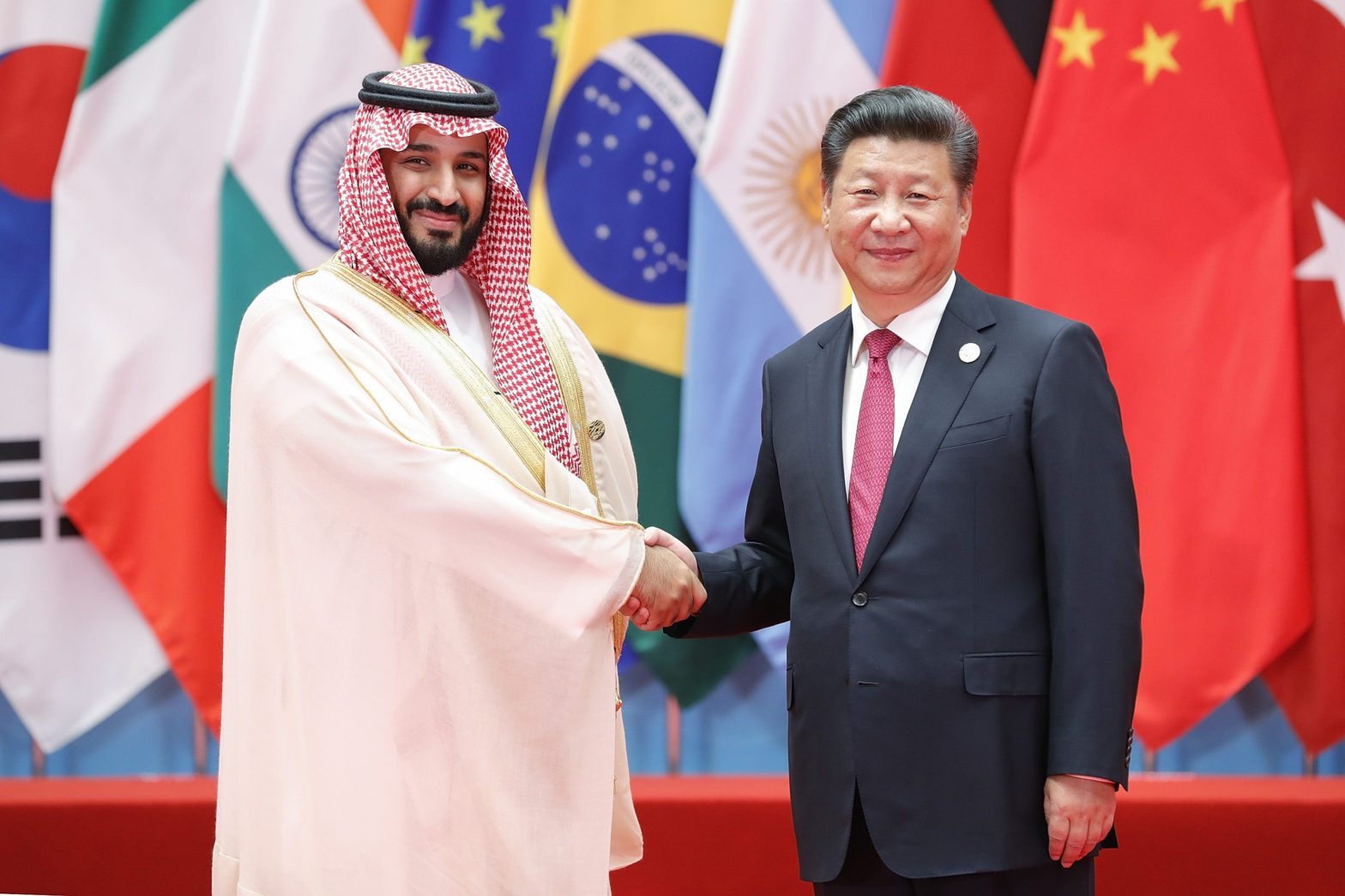

China’s Xi Jinping may visit Saudi Arabia next week with oil likely to top the agenda after Biden fails to secure a big production boost, report says

Xi Jinping is expected to visit Saudi Arabia next week, according to the Guardian. The Chinese leader will likely be received with elaborate ceremonies as relations with Saudi Arabia grow closer. Xi’s trip follows a visit to the kingdom from US President Joe Biden last month. Loading Something is loading. Chinese President Xi Jinping is… Continue reading China’s Xi Jinping may visit Saudi Arabia next week with oil likely to top the agenda after Biden fails to secure a big production boost, report says

Dutch police arrested a suspected developer of the US-sanctioned Tornado Cash crypto mixer and are looking into potentially more arrests

A developer of the sanctioned Tornado Cash platform has been arrested by Dutch Police. The platform was sanctioned by the US Treasury this week over connections to North Korean money laundering. Dutch police say that more arrests are possible as they look into decentralized fintech firms. Loading Something is loading. The Netherlands Crime Agency (FIOD)… Continue reading Dutch police arrested a suspected developer of the US-sanctioned Tornado Cash crypto mixer and are looking into potentially more arrests

Russia’s wealth fund could add China’s yuan as the Kremlin explores other currencies while sanctions keep dollar and euro assets frozen

Russia is looking to add China’s yuan, India’s rupee, and Turkey’s lira to its wealth fund. The central bank disclosed its policy outlook for the coming three years, and noted that other currencies could also be added to the mix. Russia’s wealth fund held just under $200 billion in July. Loading Something is loading. Russia’s… Continue reading Russia’s wealth fund could add China’s yuan as the Kremlin explores other currencies while sanctions keep dollar and euro assets frozen

Warren Buffett’s Berkshire Hathaway has plowed over $25 billion into Chevron and Occidental this year. One energy guru suggests why.

Warren Buffett’s Berkshire Hathaway has bet big on Chevron and Occidental Petroleum this year. Josh Young said Buffett likely felt both companies were undervalued, and trusted their management. The energy-stock guru also highlighted the pair’s scale and how crude prices affect their profits. Loading Something is loading. Warren Buffett’s Berkshire Hathaway has unexpectedly piled into… Continue reading Warren Buffett’s Berkshire Hathaway has plowed over $25 billion into Chevron and Occidental this year. One energy guru suggests why.