The death of a loved one is never easy. During this period of grief, the surviving spouse is likely not thinking about their taxes. Perhaps, they should. Tax experts say that the surviving spouse will likely experience dramatic changes to their taxes. As part of TheStreet’s ongoing tax series, we caught up with Jeffrey Levine, CPA and… Continue reading 3 Tax Tips for Recently Widowed – CPA Advice

These U.S. cities offer affordable homes to Main Street Americans

With home prices soaring in 2022, buyers may feel they have only two chances to land a new property – slim and none. “Middle-class Americans were already priced out due to the price gains in 2020 and 2021,” said Kevin Oakley, contributing editor at Builder Magazine. Interest rates are getting the majority of the blame,… Continue reading These U.S. cities offer affordable homes to Main Street Americans

Home Shortage Plus High Rates Equals Housing Crisis

The biggest problems confronting the housing market appear to be soaring home prices and mortgage rates plus a shortage of supply. The median price for existing-home sales totaled $407,600 in May, up 14.8% from May 2021, according to the National Association of Realtors. Year over year, prices have climbed for 123 straight months (more than… Continue reading Home Shortage Plus High Rates Equals Housing Crisis

3 Ways to Minimize Tax Consequences of Rebalancing

Retirement Daily’s Robert Powell caught up with Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners to discuss three ways to minimize the tax consequences of rebalancing. TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to… Continue reading 3 Ways to Minimize Tax Consequences of Rebalancing

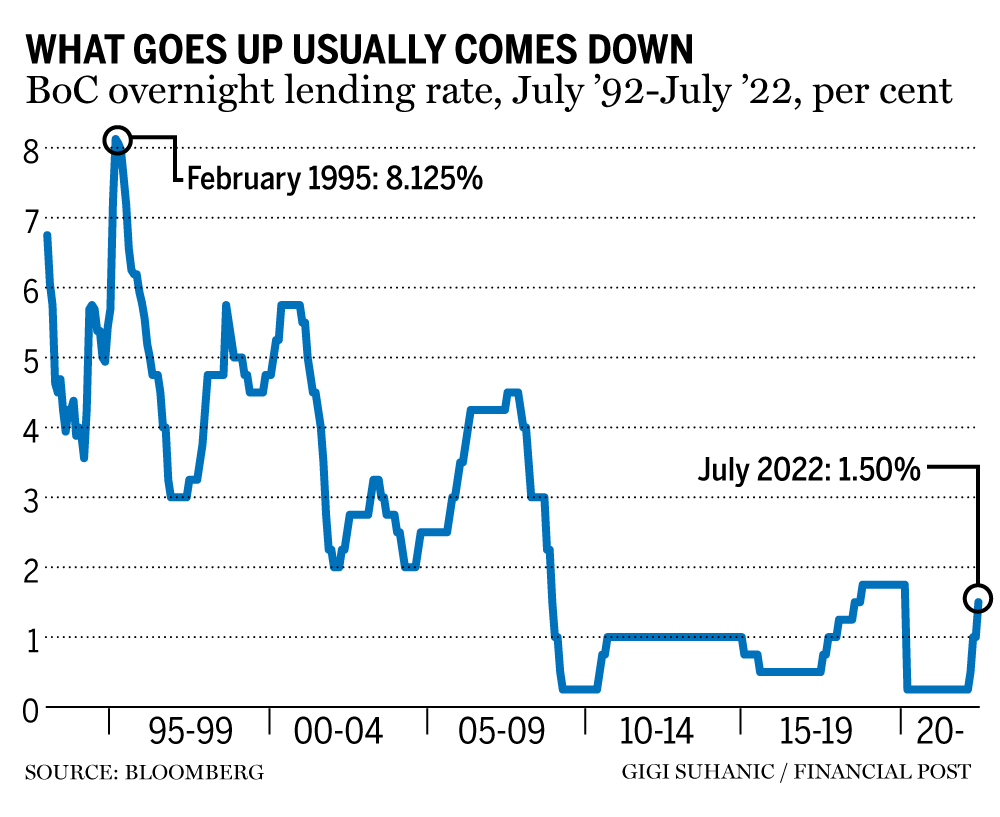

Interest rates are still rising, but investors should start preparing for when they come back down

Variable rates will likely be a benefit once again in the midterm Publishing date: Jul 12, 2022 • 1 day ago • 5 minute read • 8 Comments The Bank of Canada in Ottawa. Photo by Justin Tang/Bloomberg files The Bank of Canada over the past 30 years has had six periods of interest-rate hikes, ranging… Continue reading Interest rates are still rising, but investors should start preparing for when they come back down

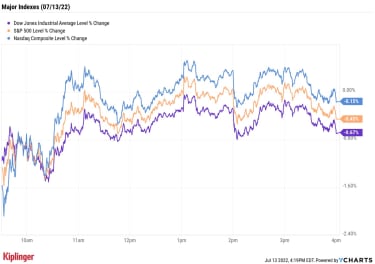

Stock Market Today: Scorching CPI Sends Stocks on Roller-Coaster Ride | Kiplinger

Another red-hot reading on inflation sparked a volatile session for stocks on Wednesday. Specifically, data released from the Labor Department this morning showed the consumer price index (CPI) jumped 1.3% month-over-month in June. On an annualized basis, consumer prices were up 9.1% – outpacing May’s 8.6% spike and marking the fastest year-over-year (YoY) rise since… Continue reading Stock Market Today: Scorching CPI Sends Stocks on Roller-Coaster Ride | Kiplinger

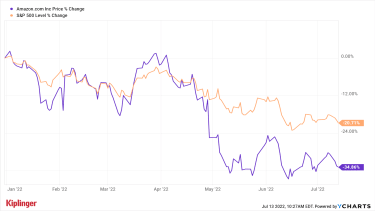

Amazon Prime Day’s Biggest Steal Might Be AMZN Stock | Kiplinger

Amazon.com’s (AMZN, $109.22) Prime Day is upon us once again. Alas, the frenzy of savings, discounts and deals on millions of items offered by the e-commerce giant is open only to Amazon Prime subscribers. Happily for investors, however, AMZN stock is as much on sale as anything to be found on the retailer’s website (which… Continue reading Amazon Prime Day’s Biggest Steal Might Be AMZN Stock | Kiplinger

With Markets Down, Is Now the Time for Young People to Invest? | Kiplinger

investing Many younger investors have never experienced stock market volatility and are wondering if they should buy now or steer clear. Answering these three questions could tell them what they need to know.“Should I invest some of the cash I’ve been sitting on?” I work with several successful young professionals who have done well in… Continue reading With Markets Down, Is Now the Time for Young People to Invest? | Kiplinger