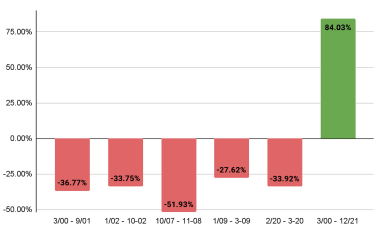

The stock market can be a scary place. Our unprecedented bull market run has finally run itself into the ground, and investors are now facing a new reality. Interest rates are rising, inflation is skyrocketing and stocks and bonds are down. Some investors are reacting with panic, while others are seeing it as more of… Continue reading Top Bear Market Tips from 10 Financial Advisers | Kiplinger

Crypto in My 401(k)? In One Way It Makes Sense, But on the Other Hand … | Kiplinger

cryptocurrency Don’t invest in Bitcoin or other cryptocurrencies in your 401(k) just because it’s cool. Deciding whether to include cryptocurrency in your qualified retirement plan depends on how you answer these three questions.Spoiler alert: If you plan to skip to the bottom of this article to find out whether you should include crypto in your… Continue reading Crypto in My 401(k)? In One Way It Makes Sense, But on the Other Hand … | Kiplinger

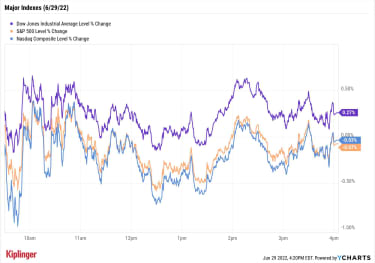

Stock Market Today: Markets Steady, But Bed Bath, Cruise Lines Tumble | Kiplinger

A slow macroeconomic news day resulted in one of the lowest-volume sessions of 2022, though a few individual equities endured more than their fair share of volatility. The S&P 500, which finished with a small gain Wednesday, posted the index’s smallest intraday range for the year, according to Michael Reinking, senior market strategist for the… Continue reading Stock Market Today: Markets Steady, But Bed Bath, Cruise Lines Tumble | Kiplinger

The 6 Hottest NFT Projects to Know About | Kiplinger

Non-fungible tokens, or NFTs, have exploded in popularity as a niche in the cryptocurrency space. An NFT is, at its core, a piece of data stored on a blockchain. But the ownership of that data can change. So, an NFT could be tied to the ownership of a real-world asset like a parcel of property,… Continue reading The 6 Hottest NFT Projects to Know About | Kiplinger

US dollar retains dominance in 2022 while China’s yuan gains share among global currency reserves

The US dollar retained its dominance as the world’s most widely held reserve currency, new data from the International Monetary Fund published Thursday shows. The dollar’s share of total allocated reserves was 59% in the first quarter of 2022, unchanged from the fourth quarter and down slightly from 59.4% a year ago. The Chinese yuan’s… Continue reading US dollar retains dominance in 2022 while China’s yuan gains share among global currency reserves

Bed Bath & Beyond has another 50% to fall, and its ‘dumpster fire’ first quarter means its days could be numbered, analysts say

Analysts this week are taking a grim view of Bed Bath & Beyond’s prospects as the stock craters in the wake of an earnings disaster and the CEO’s resignation. In the word’s of one analyst, it’s a “dumpster fire”. Shares have dropped 23% in the past two days, falling to $5.01 as of 11:25 a.m.… Continue reading Bed Bath & Beyond has another 50% to fall, and its ‘dumpster fire’ first quarter means its days could be numbered, analysts say

The blow-up of Three Arrows Capital has sparked a wave of crypto deleveraging, but that could soon end for 2 big reasons, according to JPMorgan

Investor confidence in the cryptocurrency market has been shaken to its core this year, as the implosion of TerraUSD jump-started a wave of deleveraging in the sector. The deleveraging has come from retail investors scaling back their margin accounts as well as miners who have to sell bitcoin after using it as leverage to expand… Continue reading The blow-up of Three Arrows Capital has sparked a wave of crypto deleveraging, but that could soon end for 2 big reasons, according to JPMorgan

Oil prices could be set to rise further as OPEC lacks additional supplies and China’s economic reopening pushes demand higher, RBC’s commodities chief says

Oil prices could soar even further as OPEC hits limits on its capacity while China’s economic reopening lifts demand, according to Helima Croft, RBC’s top commodities strategist. Saudi Arabia could add 1 million barrels per day to global markets, but other OPEC members like Libya are having production problems while OPEC partner Russia is facing… Continue reading Oil prices could be set to rise further as OPEC lacks additional supplies and China’s economic reopening pushes demand higher, RBC’s commodities chief says