Analysts at Bank of America laid out three scenarios for the outlook on Brent crude oil prices. The international oil benchmark should average $102 per barrel in 2022 and 2023, BofA said. But it could drop to $75 in a recession or spike to $150 if European sanctions hit Russian supplies. Loading Something is loading.… Continue reading Oil prices could slump to $75 a barrel in a recession — or jump to $150 if European sanctions slam Russian supplies, BofA says

The stock market could surge 7% next week as quarter-end rebalancing drives buying spree for equities, JPMorgan says

The stock market could surge 7% next week as quarter-end rebalancing leads to a buying spree in equities, according to JPMorgan.The bank expects rebalancing trades to favor equities after a year-to-date decline of nearly 20%.”Next week’s rebalance is important since equity markets were down significantly over the past month, quarter and six-month time periods,” JPMorgan… Continue reading The stock market could surge 7% next week as quarter-end rebalancing drives buying spree for equities, JPMorgan says

Fear not, bitcoin bulls — the current rout will weed out the solid crypto operators from the weak ones. 3 experts explain how

Crypto crashes are actually beneficial for the market, industry experts believe. Specifically, a crash helps “stress test” newly built crypto infrastructure, leading to greater efficiency. Market routs and insolvency worries around crypto funds have raised concerns about the sector. Loading Something is loading. The cryptocurrency market has been on a bumpy ride this year, as… Continue reading Fear not, bitcoin bulls — the current rout will weed out the solid crypto operators from the weak ones. 3 experts explain how

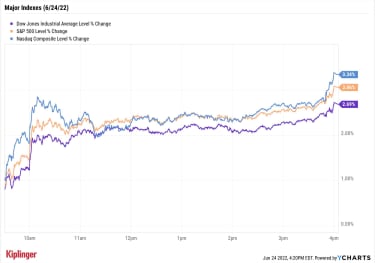

Dow soars more than 800 points and US stocks snap weekly losing streak as investors assess Fed’s course of future rate hikes

The S&P 500 spiked 3% Friday as US stocks surged and snapped a run of weekly declines. A drop in bond yields this week helped Wall Street’s key indexes advance after three weeks of losses. Investors spent the week assessing a round of warnings on recession risks. Loading Something is loading. US stocks on Friday… Continue reading Dow soars more than 800 points and US stocks snap weekly losing streak as investors assess Fed’s course of future rate hikes

A recession stemming from the Fed’s slow reaction to fight scorching-hot inflation is ‘uncomfortably possible’, says top economist Mohamed El-Erian

Top economist Mohamed El-Erian warned it is “uncomfortably possible” the Fed will tip the US into a recession. “The Fed didn’t recognize it had an inflation problem and didn’t respond fast enough,” El-Erian said. Despite recession fears, he expressed some optimism around the strength of its labor market. Loading Something is loading. As recession alarms… Continue reading A recession stemming from the Fed’s slow reaction to fight scorching-hot inflation is ‘uncomfortably possible’, says top economist Mohamed El-Erian

Move Over ETFs: Direct Indexing Is an Investment Strategy Worth Paying Attention to | Kiplinger

investing More flexibility, more control, the potential for higher returns and tax-reducing strategies: With pros like that, could direct indexing be right for you?Recently, direct indexing, a lesser-known investment approach, has started outpacing both ETFs and mutual funds in investor adoption. Direct indexing offers unique benefits that can’t be replicated in a traditional ETF or… Continue reading Move Over ETFs: Direct Indexing Is an Investment Strategy Worth Paying Attention to | Kiplinger

Stock Market Today: Stocks Stick the Landing in Successful Short Week | Kiplinger

The major indexes finished the holiday-shortened week with a flourish as a recent relief rally chalked up sizable gains across the four-day period. Federal Reserve Bank of St. Louis President James Bullard said Friday that “it is a little early to have this debate about recession probabilities in the U.S.” Meanwhile, he continued to pound… Continue reading Stock Market Today: Stocks Stick the Landing in Successful Short Week | Kiplinger

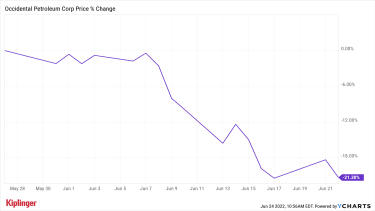

Could Buffett Buy Out Occidental Petroleum (OXY)? | Kiplinger

stocks All in, Berkshire Hathaway now owns a third of energy firm Occidental Petroleum. One analyst thinks Buffett might make a play for the rest.Warren Buffett keeps pumping cash into the oil patch, upping Berkshire Hathaway’s (BRK.B, $267.52) stake in Occidental Petroleum (OXY, $56.09) by more than a half-billion dollars in a series of recent… Continue reading Could Buffett Buy Out Occidental Petroleum (OXY)? | Kiplinger