When Charles Schwab first announced its acquisition of TD Ameritrade, it generated a flurry of calls from clients concerned about how the change would affect them. Now that the transition is just around the corner, those questions take on more urgency, but the anxiousness has largely dissipated. While the answers we’ve given our clients apply… Continue reading What to Do When Your Brokerage Merges

US stocks fall as Moody’s downgrades drag bank shares lower

Phil Rosen Gen Z is putting more stock into careers in finance, with one in four recent graduates considering the field a top career sector. Photo by ANGELA WEISS/AFP via Getty Images Stocks dropped Tuesday, with the Dow sliding more than 160 points and the Nasdaq shedding more than 120. Moody’s bank downgrades late Monday… Continue reading US stocks fall as Moody’s downgrades drag bank shares lower

US companies are barreling towards a $1.8 trillion wall of maturing corporate debt

There’s $1.8 trillion of corporate debt maturing over the next two years, Goldman Sachs estimated. Firms could be slammed with higher debt servicing costs as interest rates stay elevated. That could eat into corporate revenue and weigh on the US job market. Loading Something is loading. Thanks for signing up! Access your favorite topics in… Continue reading US companies are barreling towards a $1.8 trillion wall of maturing corporate debt

Markets are betting on a soft landing – but the economy is facing 3 hurdles to the ideal outcome

Markets are pricing in higher odds of a soft landing and Wall Street has pulled back on recession forecasts. UBS strategists said the economy and financial markets aren’t yet in the clear, however. There are three hurdles to the US sticking a soft landing, the Swiss bank said. Loading Something is loading. Thanks for signing… Continue reading Markets are betting on a soft landing – but the economy is facing 3 hurdles to the ideal outcome

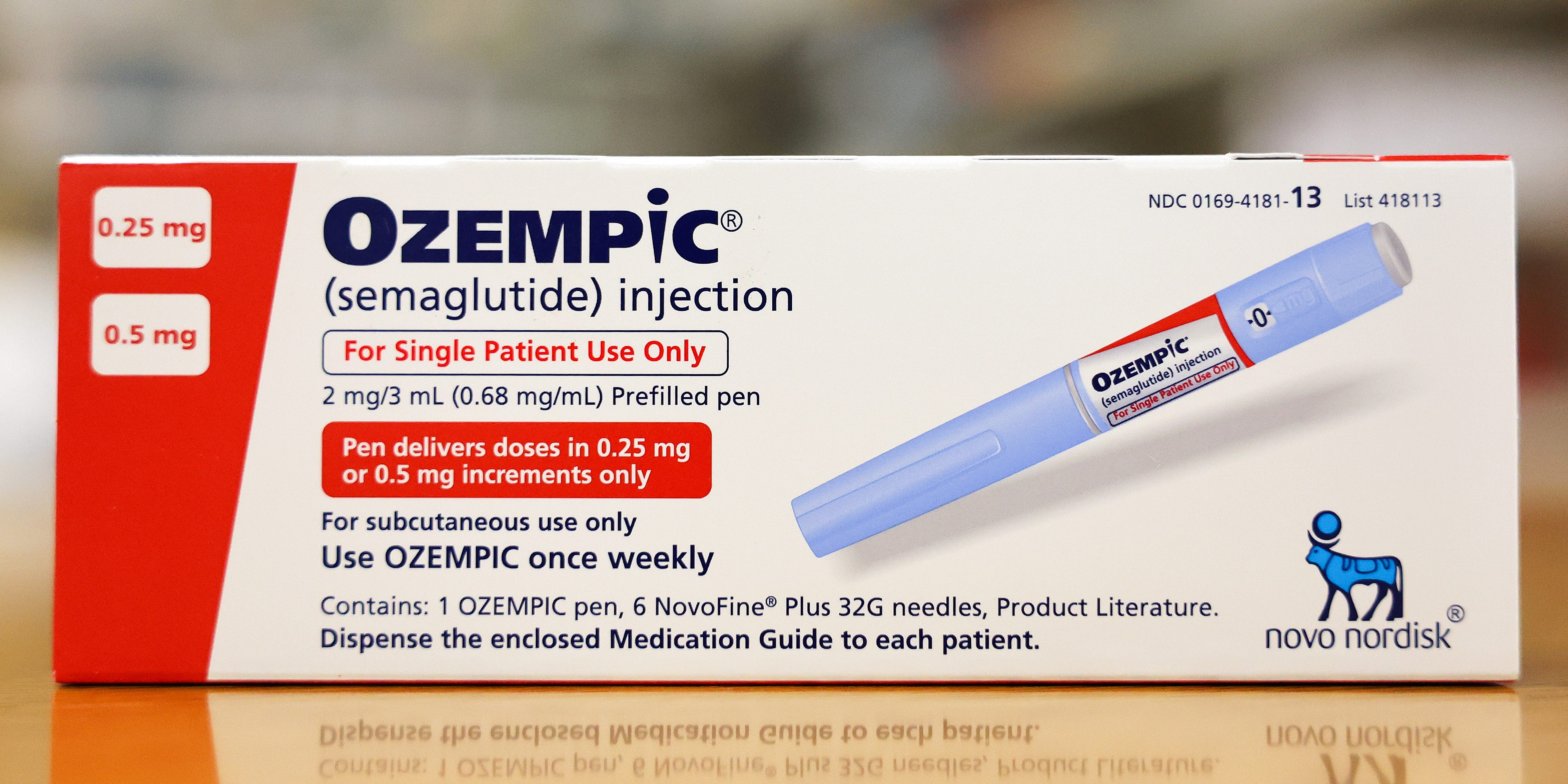

A new class of weight loss drugs is powering massive stock-market gains for Novo Nordisk and Eli Lilly

A new class of weight loss drugs are powering massive stock market gains for Novo Nordisk and Eli Lilly.Both stocks surged more than 16% on Tuesday, boosting the combined valuation of both companies to nearly $1 trillion.A new study showed Novo Nordisk’s Wegovy lowered the risk of heart attack or stroke by 20%. Loading Something… Continue reading A new class of weight loss drugs is powering massive stock-market gains for Novo Nordisk and Eli Lilly

Rising interest rates could re-emerge as a threat to stocks, Bank of America says

Stocks plunged last year as the Fed started raising interest rates, but they’ve bounced back in 2023. And yet, it might be time for investors to start worrying again, according to Bank of America. High rates “may pose an underpriced risk for the equity market,” analysts said in a note to clients Tuesday. Loading Something… Continue reading Rising interest rates could re-emerge as a threat to stocks, Bank of America says

Generational wealth 101: How to ensure your legacy

Watch: Capco Canada’s Gary Teelucksingh discusses strategies for transferring wealth Published Aug 07, 2023 • Last updated 13 hours ago • < 1 minute read It's important to have a plan in place to transfer generational wealth. Photo by JIM WELLS/CALGARY SUN/QMI AGENCY FILES Gary Teelucksingh, partner and chief executive of Capco Canada, talks with Financial… Continue reading Generational wealth 101: How to ensure your legacy

Making the most of your money: FP’s top personal finance videos

FP Video has the answers to your questions about personal finance Published Aug 06, 2023 • Last updated 1 day ago • 1 minute read FP Video can answer your questions on personal finance. Photo by Getty Images From saving money while you travel this summer to planning your legacy, FP Video has the answers to… Continue reading Making the most of your money: FP’s top personal finance videos