De-dollarization could lead to a vicious cycle of economic destruction, according to an Australian economic think tank. That’s because waning use of the dollar could bring on hyperinflation, researcher Michael Roach said. Hyperinflation could lead to higher interest rates, which will weigh on asset prices, according to Roach. Loading Something is loading. Thanks for signing… Continue reading De-dollarization will be a vicious cycle as hyperinflation leads to higher rates that will further erode the greenback’s power, think tank says

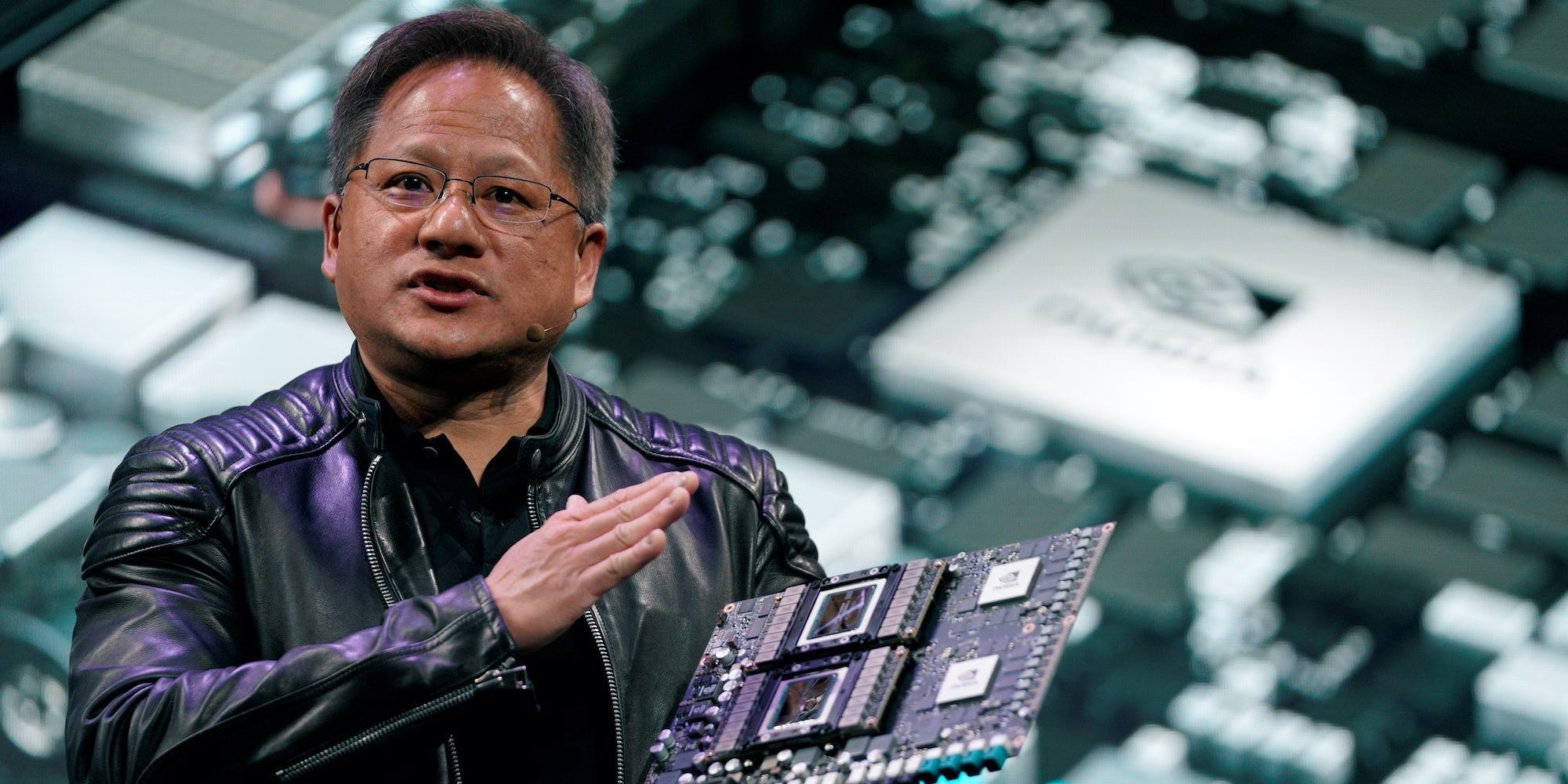

Nvidia stock is still a ‘top pick’ at Bank of America even after its stunning AI-driven 209% rally

Nvidia is still a “top pick” stock at Bank of America, even after its AI-driven year-to-date rally of 209%.The bank said Nvidia’s upcoming 2nd-quarter earnings report will be “less shock and awe” and more about execution.The biggest risk for Nvidia is its ability to scale the supply of its AI-enabling GPU chips, according to BofA.… Continue reading Nvidia stock is still a ‘top pick’ at Bank of America even after its stunning AI-driven 209% rally

What Is Deflation?

After persistent inflation since 2021, falling prices in the U.S. are causing some to worry that the opposite will occur: Deflation, or declining prices. “The Fed’s extreme policy actions of the COVID and post-COVID period are raising concerns over both inflation and eventually deflation,” says Steven Wieting, chief investment strategist at Citi Global Wealth. “The… Continue reading What Is Deflation?

What Is VWAP?

Investors have plenty of tools in their toolkit to help analyze price charts, including the volume-weighted average price (VWAP). But what is VWAP and how is it used? VWAP is a technical analysis indicator that combines volume and price to calculate an average value. It provides valuable insights into the average price at which traders… Continue reading What Is VWAP?

The S&P 500 could triple to 14,000 by 2034 as secular bull market cycle takes hold

The stock market’s strong year-to-date performance could just be the continuation of a long-term bull market.RBC’s Robert Sluymer said in a recent note that the S&P 500 could nearly triple to 14,000 by 2034.”The long-term secular trend for US equity markets remains positive with an underlying 16 to 18 year cycle supportive of further upside.”… Continue reading The S&P 500 could triple to 14,000 by 2034 as secular bull market cycle takes hold

Goldman Sachs: These are the 24 best stocks to buy now as the market rally stretches valuations higher

Markets have rallied on the back of strong earnings, good macroeconomic data, and bullish sentiment. But it’s easy to get swept up in blind optimism, and investors need to proceed with caution. Goldman Sachs compiled the 22 best investing ideas from its US analysts, regardless of sector. Investors have cheered lower inflation, signals that the… Continue reading Goldman Sachs: These are the 24 best stocks to buy now as the market rally stretches valuations higher

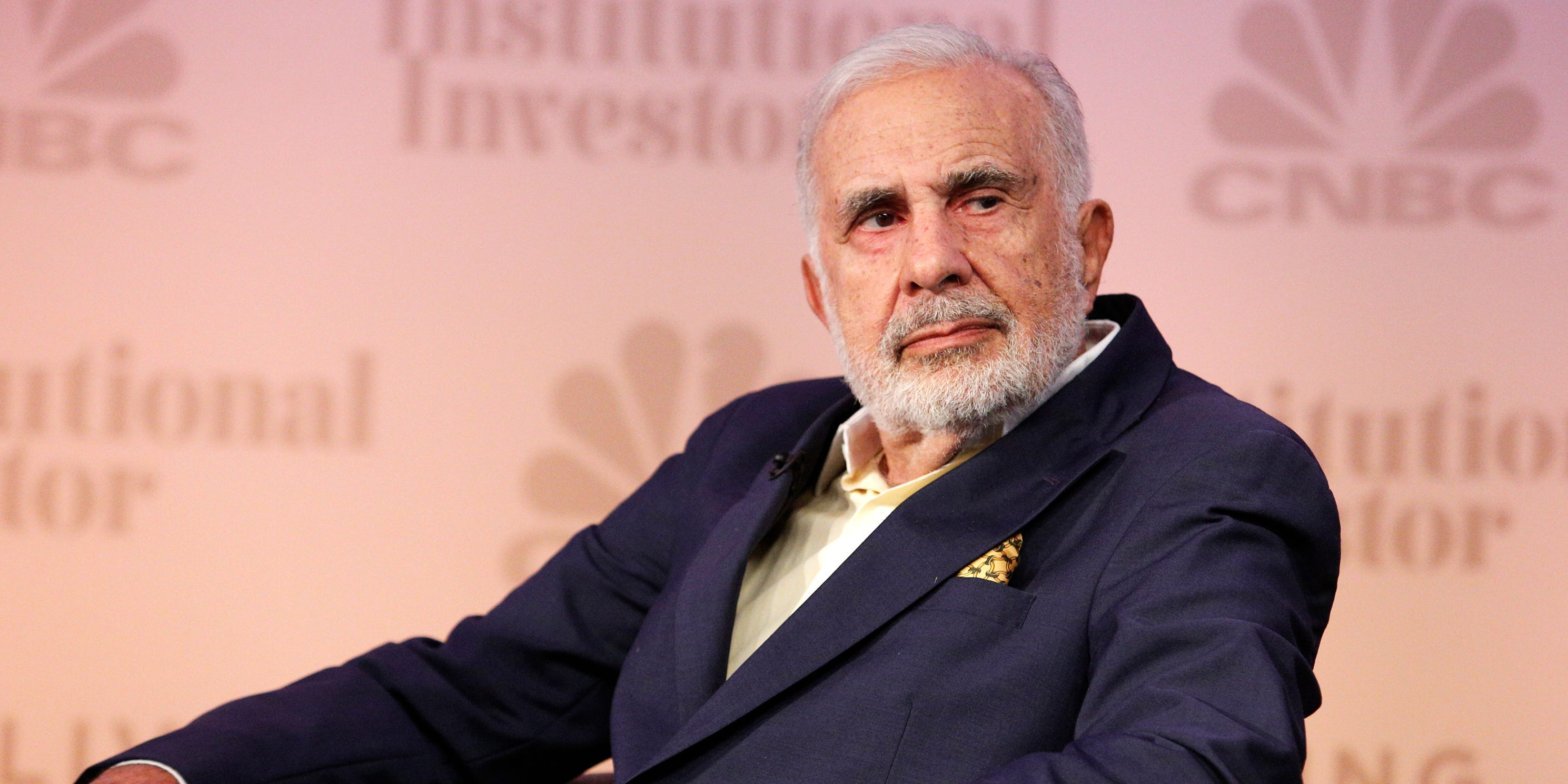

Embattled activist investor Carl Icahn’s firm plunges 30% after halving shareholders’ payouts

Shares in Carl Icahn’s firm Icahn Enterprises plunged 30% Friday. Those losses came after it said it would halve the amount it pays out to shareholders. The activist investor came under fire from famed short-seller Hindenburg Research earlier this year. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Embattled activist investor Carl Icahn’s firm plunges 30% after halving shareholders’ payouts

Mortgage payments are 19% more expensive than last year as home prices continue surging, Redfin says

Mortgage payments are 19% more expensive than last year, Redfin data shows. The typical homebuyer’s monthly mortgage payment was $2,605 during July. That’s largely due to surging home prices and higher mortgage rates, which have raised the cost of borrowing. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized… Continue reading Mortgage payments are 19% more expensive than last year as home prices continue surging, Redfin says