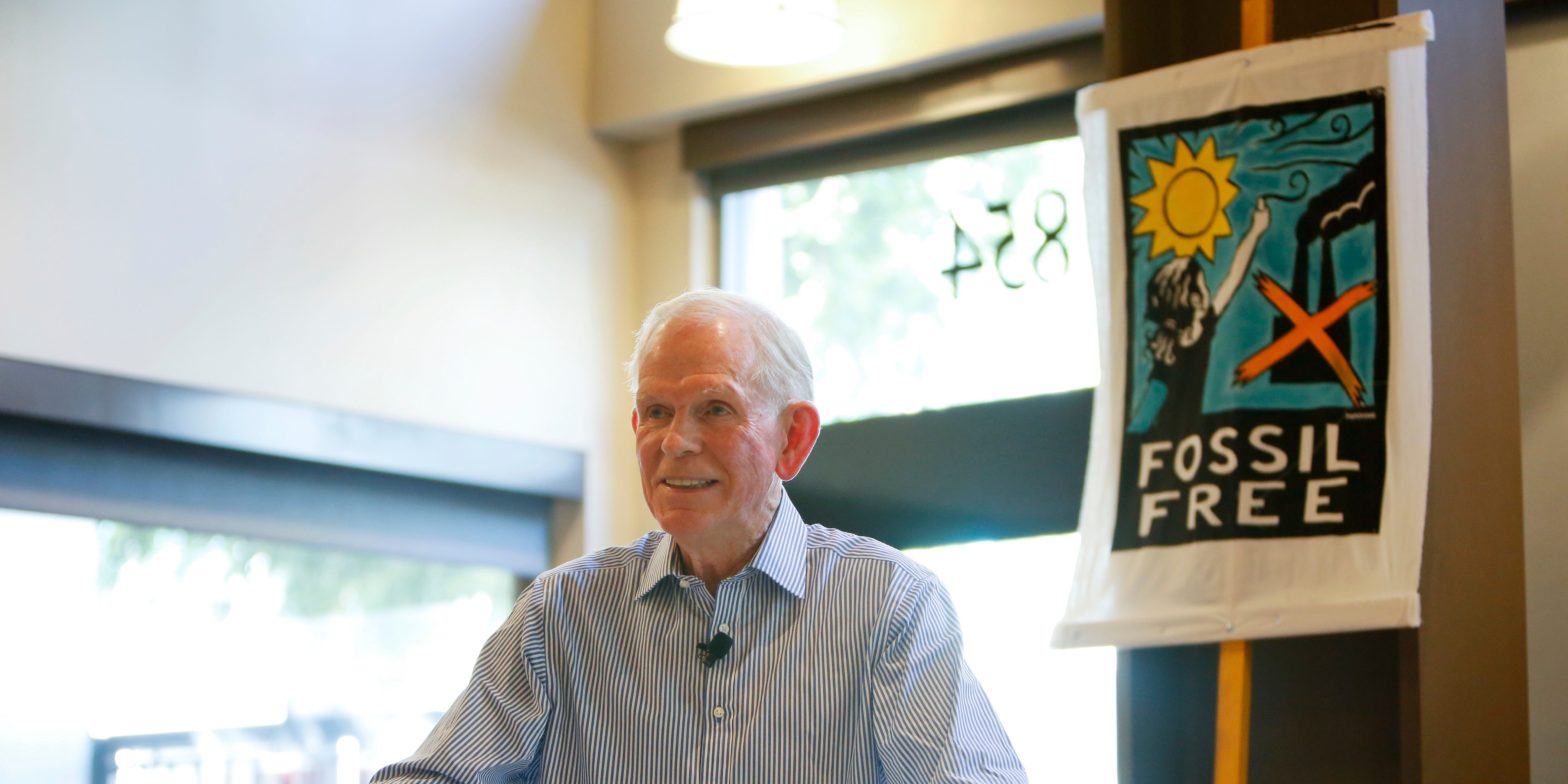

Even after the rapid rise of commodity prices, it’s not too late for investors to buy energy stocks, according to Jeremy Grantham’s GMO.GMO highlighted attractive valuations and favorable supply and demand dynamics that suggest there’s plenty of more upside ahead for commodity stocks.”The clean energy transition will take decades to play out and will, in… Continue reading Jeremy Grantham’s GMO says investors can still make money on commodities stocks — and should load up on fossil fuel names as the world transitions to clean energy

The commodities shock has raised fears of 1970s-style stagflation happening again. Here’s why this time could be different.

Rising commodity prices will put pressure on global economic growth, the Bank for International Settlements said. By some measures, today’s situation looks even more disruptive than what was seen in the 1970s, a BIS report noted. But a repeat of the 1970s stagflation, with low or no growth and high inflation, is unlikely, BIS said.… Continue reading The commodities shock has raised fears of 1970s-style stagflation happening again. Here’s why this time could be different.

Warren Buffett, Michael Burry, and other elite investors just revealed major changes to their stock portfolios. Here are 5 key trades they made.

Theron Mohamed Warren Buffett. Reuters Warren Buffett, Michael Burry of “The Big Short,” and others shared portfolio updates this week. Ray Dalio, Jim Simons, and Stanley Druckenmiller also disclosed their stock holdings as of March 31. Key trades included a big bet on Chevron, a wager against Apple, and several meme-stock purchases. Loading Something is… Continue reading Warren Buffett, Michael Burry, and other elite investors just revealed major changes to their stock portfolios. Here are 5 key trades they made.

From burgers to breakfast cereal, some key ingredients are being hit by food export bans — industry experts tell us what might be next

Zahra Tayeb Getty Images Food prices are soaring from export bans and it’s affecting everything from burgers to cereal. Commodities including wheat, sugar, and cooking oils have become fewer to find. “Prices are real high and they don’t seem to be going down any soon,” an industry expert said. Loading Something is loading. Heatwaves, poor… Continue reading From burgers to breakfast cereal, some key ingredients are being hit by food export bans — industry experts tell us what might be next

How to Get the Best Deal When Trading in a Car

Used car prices have largely followed the rising inflationary rate of other commodities over the past 18 months, with the average price of used vehicle 40% higher than a year ago, according to CoPilot, a vehicle shopping platform that monitors auto prices. While auto industry data indicates that used car prices may be leveling off,… Continue reading How to Get the Best Deal When Trading in a Car

Here’s Some Good News if You’re Still Trying to Lose Your ‘Covid 15’

So many of us look back at those first few months —or years — of the pandemic with a mix of wistfulness and irritation. For some, it was a great time to snuggle down into the comfort of home, learn to bake increasingly tricky foods and start a new hobby like cultivating beehives (guilty). For… Continue reading Here’s Some Good News if You’re Still Trying to Lose Your ‘Covid 15’

When to Use Tax Form 1099-R: Distributions From Pensions, Annuities, Retirement, etc.

For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. Form 1099-R is used to report the distribution of retirement benefits such as pensions, annuities, or other retirement plans. Variations of Form 1099-R include: Our TurboTax Live experts… Continue reading When to Use Tax Form 1099-R: Distributions From Pensions, Annuities, Retirement, etc.

S&P 500 on track to hit bear market today as it falls 20% from record close

S&P 500 and Nasdaq logged their seventh straight week of losses Author of the article: Reuters Noel Randewich and Amruta Khandekar If the S&P 500 closes below 20 per cent or more, it would confirm a bear market for the first time since the 2020 Wall Street plunge brought on by the COVID-19 pandemic. Photo… Continue reading S&P 500 on track to hit bear market today as it falls 20% from record close