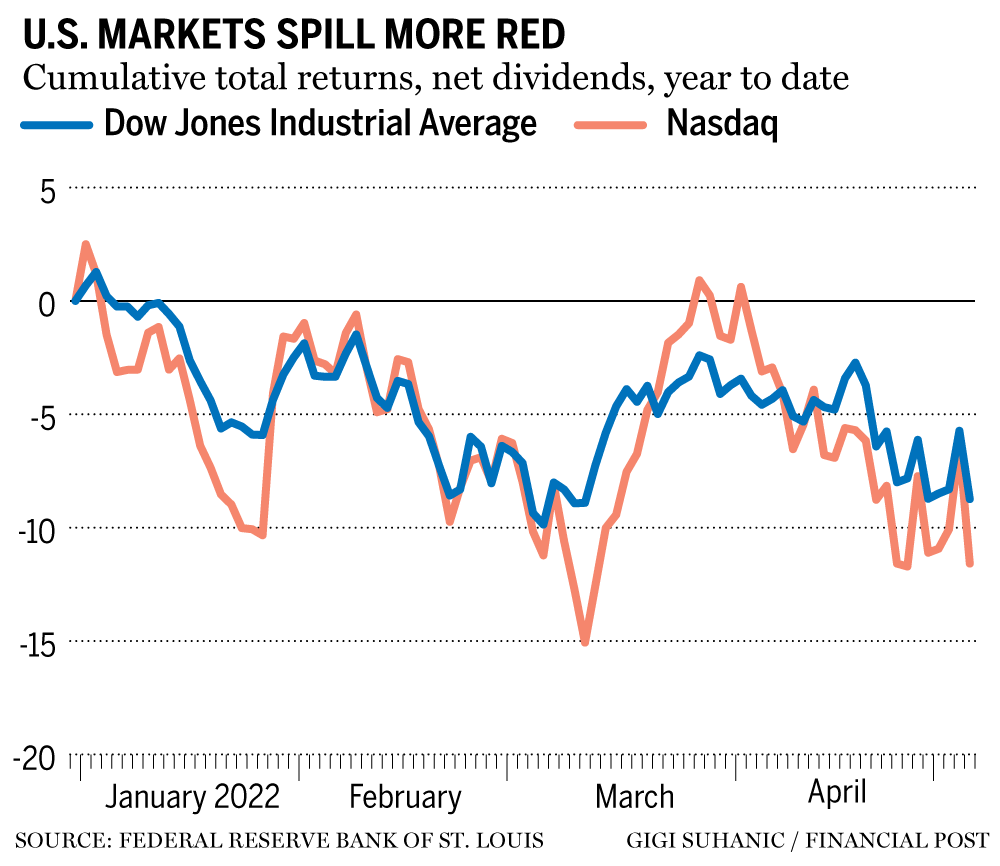

Gglobal market selloff that saw the S&P 500 post its worst first four months of a year since 1939 has further to run, analysts say Author of the article: Bloomberg News Rita Nazareth A trader works on the trading floor at the New York Stock Exchange on Thursday as investor sentiment cratered in the face… Continue reading Stock futures are falling again after the Dow’s worst day since October 2020

Martin Pelletier: The markets are throwing a tantrum, but this time central banks may not bail them out

Review your portfolio and consider taking a balanced path that isn’t dependent on permanently low interest rates Publishing date: May 06, 2022 • 5 hours ago • 3 minute read • 7 Comments The Marriner S. Eccles Federal Reserve building in Washington, DC. Photo by JIM WATSON/AFP via Getty Images files As central banks are being… Continue reading Martin Pelletier: The markets are throwing a tantrum, but this time central banks may not bail them out

Vicious stock reversal is a symptom of the Fed’s feedback problem

Any signs of strength should be seized as an opportunity to offload stocks Author of the article: Bloomberg News Katie Greifeld and Vildana Hajric U.S. Federal Reserve chairman Jerome Powell. Photo by Jim Watson/AFP via Getty Images Question for market experts: When U.S. stocks staged their biggest rally in two years Wednesday after the Federal… Continue reading Vicious stock reversal is a symptom of the Fed’s feedback problem

Stocks are tanking with the Dow down almost 1,000 points

All three main Wall Street benchmarks erased gains made during a relief rally on Wednesday Author of the article: Publishing date: May 05, 2022 • 19 hours ago • 2 minute read • 68 Comments About 95 per cent of the companies in the S&P 500 retreated on Thursday. Photo by Michael Nagle/Bloomberg U.S. stocks closed… Continue reading Stocks are tanking with the Dow down almost 1,000 points

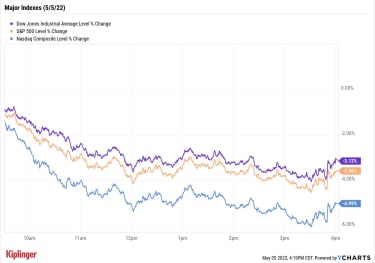

Stock Market Today: Stocks Suffer Worst Losses of 2022 | Kiplinger

Stock Market Today Investors snapped out of their brief post-Fed euphoria and rushed to the exits Thursday, with high-priced tech among the most punished stocks.The major indexes wiped out yesterday’s relief-rally gains and then some Thursday in a market-wide rout as Wall Street took a more sober look at the investing landscape. For one, most… Continue reading Stock Market Today: Stocks Suffer Worst Losses of 2022 | Kiplinger

How Jonas Eisert and his agency Loftfilm revolutionised the world of explainer videos

MUNICH, May 6, 2022 /PRNewswire/ — The basis for the success of the explainer videos by Jonas Eisert and his team is their expertise and unique approach. Loftfilm productions enable companies to stand out from the competition and win over customers. Shortly after it was founded in 2016, the German agency Loftfilm established itself in… Continue reading How Jonas Eisert and his agency Loftfilm revolutionised the world of explainer videos

China’s slowdown means there’s no way Beijing will hit its growth targets — so don’t rely on it to cushion the world against recession, economist Stephen Roach warns

There’s no way China is going to hit its 5.5% target for growth this year, Stephen Roach told CNBC Friday. That’s a big deal for the global economy, which can’t rely on China to bail it out again, he said. “That cushion’s gone,” the economist said, noting the “formidable pressures’ facing Beijing right now. Loading… Continue reading China’s slowdown means there’s no way Beijing will hit its growth targets — so don’t rely on it to cushion the world against recession, economist Stephen Roach warns

Jeremy Grantham rings the alarm on housing as mortgage rates rise, saying the US won’t be able to ‘skate through’ a property crisis

Legendary investor Jeremy Grantham has issued a warning about the US housing market as mortgage rates rise. He said a crash in the property market would be much more dangerous for the economy than a plunge in stocks. The GMO founder has said markets — including housing — are in a “superbubble” that is about… Continue reading Jeremy Grantham rings the alarm on housing as mortgage rates rise, saying the US won’t be able to ‘skate through’ a property crisis