Kroger shares hit an all-time high Friday after Bank of America upgraded the grocer to a buy rating. The bank raised its price objective by 23% as it sees elevated levels of grocery inflation to continue at least through the first half of 2023. Kroger shares zipped past $62 a share in Friday trading. Loading… Continue reading Food price inflation will continue through 2023 and be passed on to consumers, making grocery chain Kroger’s a ‘buy’, Bank of America says

The FDIC is warning banks about crypto risk and wants firms to notify the regulator about their activities in the space

The FDIC in a letter to banks Thursday flagged risks surrounding crypto-related activity. The regulator wants banks to notify it of their current or planned crypto-related activities. The FDIC said it will consider the safety and soundness, financial stability, and consumer protection aspects of the banks’ crypto activities. Loading Something is loading. The Federal Deposit… Continue reading The FDIC is warning banks about crypto risk and wants firms to notify the regulator about their activities in the space

Capture Adventure This Summer with $30 Off the GoPro Hero10

Whether you’re headed to the beach, a tropical island, or off on a week-long adventure, this waterproof action camera is ideal for capturing what lies ahead. The Arena Media Brands, LLC and respective content providers to this website may receive compensation for some links to products and services on this website. Summertime is all about… Continue reading Capture Adventure This Summer with $30 Off the GoPro Hero10

Tax Deductions for Rental Property Depreciation

Explaining depreciationDepreciation is the process by which you would deduct the cost of buying or improving rental property. Depreciation spreads those costs across the useful life of the property. TurboTax Premier is designed for all levels of investing and investment types from stocks, to crypto, to ESPPs, and even rental income. It guides you through… Continue reading Tax Deductions for Rental Property Depreciation

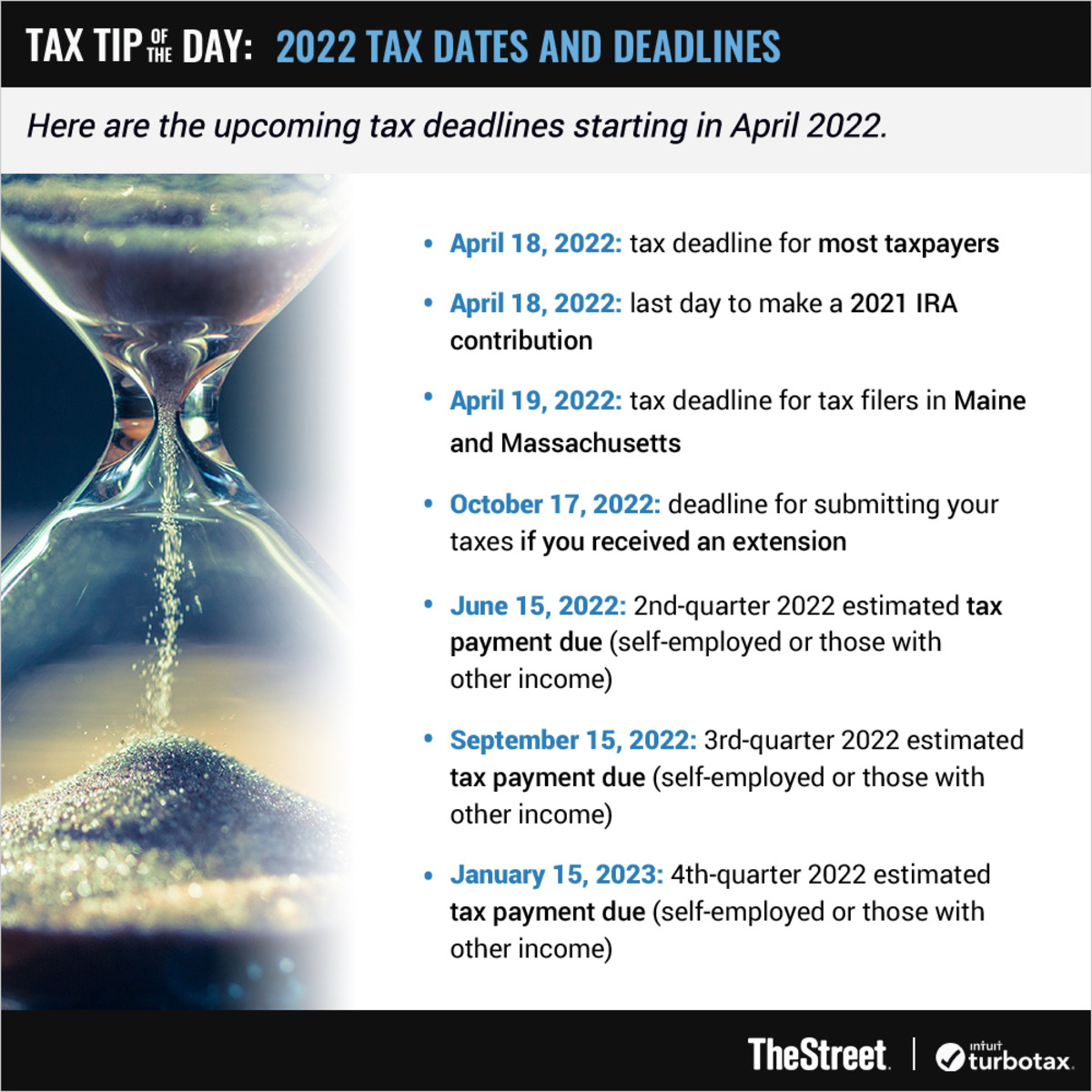

Don’t Miss These Tax Deadlines (You’re Running Out of Time)

The tax deadline is quickly approaching. This year, it’s NOT April 15. Here’s a rundown of the most important tax deadlines and dates to know! 2022 tax filers beware. For most, the tax deadline is on Monday, April 18, 2022. According to the Internal Revenue Service (IRS), holidays impact tax deadlines in the same way… Continue reading Don’t Miss These Tax Deadlines (You’re Running Out of Time)

Guide to Schedule D: Capital Gains and Losses

Most people use the Schedule D form to report capital gains and losses that result from the sale or trade of certain property during the year. As of 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms.… Continue reading Guide to Schedule D: Capital Gains and Losses

What Is IRS Form 5498: IRA Contributions Information?

For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. When you save for retirement with an individual retirement arrangement, you probably receive Form 5498 each year. The institution that manages your IRA must report all contributions you… Continue reading What Is IRS Form 5498: IRA Contributions Information?

Electric vehicle startups face their toughest challenge: making cars

Investors have bet heavily hoping to find the next Tesla, but many EV groups are struggling to make the production process work Author of the article: Financial Times Peter Campbell in Bicester An Arrival Generation 2 Electric Vehicle is pictured in this undated still image obtained on January 16, 2020. Photo by Courtesy Arrival Ltd./Handout… Continue reading Electric vehicle startups face their toughest challenge: making cars