Knowing about water risks and the wave of innovations spurred by these concerns can help guide investors’ long-term decision-making Global water demand is set to outstrip supply by 40 per cent by 2030. Photo by ATHLEEN CHARLEBOIS/DAILY MINER AND NEWS/POSTMEDIA NETWORK By David Rosenberg, Julia Wendling and Alena Neiland Advertisement 2 This advertisement has not… Continue reading David Rosenberg: How investors can navigate the global water crisis

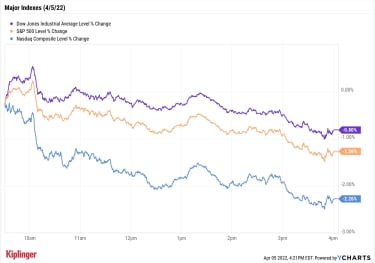

Stock Market Today: Signs of Fed Aggressiveness Spook Bulls | Kiplinger

Stock Market Today Fed Governor Brainard says a rapid shrinking of the central bank’s balance sheet is in order, sending rates higher and stocks well into the red Tuesday.Fresh reason to believe that the Federal Reserve could put the pedal to the metal as it fights high inflation cooled U.S. equities Tuesday. Ahead of tomorrow’s… Continue reading Stock Market Today: Signs of Fed Aggressiveness Spook Bulls | Kiplinger

5 Restaurant Stocks Rising Above the Rest | Kiplinger

Restaurant stocks could be growthy comeback play in 2022, though they’re hardly a slam dunk. Restaurants are pulling numerous levers to resuscitate sales of on-premise dining, drive-thru pickup and delivery channels to recover from some of the ill-effects COVID-19 had on consumers’ patronage. And their efforts are only being further complicated by inflationary pressures, supply-chain… Continue reading 5 Restaurant Stocks Rising Above the Rest | Kiplinger

7 Travel Stocks to Buy as COVID Cases Retreat | Kiplinger

Americans and their global counterparts are getting ready to enjoy a more open world in 2022 – good news for travel stocks. According to the Centers for Disease Control and Prevention, the seven-day average of COVID-19 cases in the U.S. is at its lowest level since last summer. “After more than a year of waiting,… Continue reading 7 Travel Stocks to Buy as COVID Cases Retreat | Kiplinger

Lumber prices are flirting with a crucial level as mortgage rates jump above 5% for first time in years

Lumber futures are coming under pressure as the housing market gets more restrictive for new buyers.Lumber prices remain subdued below critical support at $1,000 per thousand board feet.Mortgage rates surged above the 5% level on Tuesday for the first time in years. Loading Something is loading. Lumber futures are struggling to reclaim a crucial support… Continue reading Lumber prices are flirting with a crucial level as mortgage rates jump above 5% for first time in years

Nasdaq plunges more than 2% to lead US stock sell-off as Fed official signals more aggressive tightening

US stocks dropped Tuesday, led by the Nasdaq’s 2.3% plunge, on hawkish comments from a top Fed official. Fed Governor Lael Brainard said the central bank could start shrinking its balance sheet at “a rapid pace” as soon as May. The 10-year yield shot up 14 basis points to more than 2.55%, hitting the highest… Continue reading Nasdaq plunges more than 2% to lead US stock sell-off as Fed official signals more aggressive tightening

Germany seizes $25 million in bitcoin as it shuts down a Russian-language darknet marketplace for illegal drugs

German authorities said Tuesday they seized $25 million worth of bitcoins while shutting down a darknet marketplace. The authorities confiscated 543 bitcoins worth in closing down the Hydra Market drug marketplace. Hydra Market had at least $1.32 billion in sales turnover in 2020 alone. Loading Something is loading. German law enforcement authorities said Wednesday they’ve… Continue reading Germany seizes $25 million in bitcoin as it shuts down a Russian-language darknet marketplace for illegal drugs

Russia default risk over the next 5 years soars to nearly 90% after US blocks bond payment

Russia’s five-year default risk soared to 87.7% on Tuesday, according to ICE Data Services. That’s up from 77.7% on Monday and 24.1% on February 24 when Russia launched its war on Ukraine. The US Treasury said Tuesday Russia will no longer be able to make sovereign bond payments using accounts at American banks. Loading Something… Continue reading Russia default risk over the next 5 years soars to nearly 90% after US blocks bond payment