stocks Amazon.com’s four-digit price tag is coming down as the e-tailer announces a 20-for-1 AMZN stock split effective in June.Shares in Amazon.com (AMZN, $2,785.58) popped at Thursday’s opening bell in an otherwise down market after the e-commerce colossus said it would effect a 20-for-1 stock split and buy back up to $10 billion of its… Continue reading Amazon Stock Split Puts It in Play to Join the Dow | Kiplinger

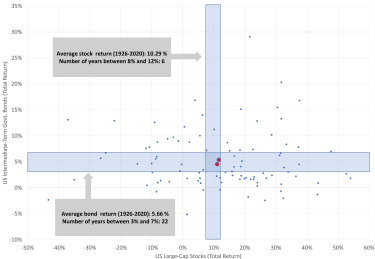

Bond Advice for Today’s Market: Think Big Picture | Kiplinger

There is an old joke that some statisticians tell, that “a person with their head in an oven and their feet in the freezer is comfortable — on average.” Statisticians are not known for their sense of humor (clearly), but the joke is an effective warning about some of the shortcomings of relying on averages.… Continue reading Bond Advice for Today’s Market: Think Big Picture | Kiplinger

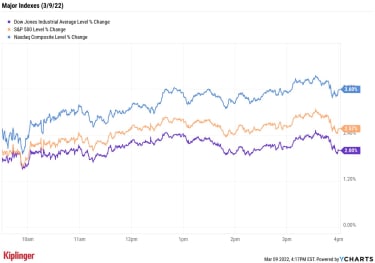

Stock Market Today: Tech Stocks Lead Relief Rally | Kiplinger

Stock Market Today The Nasdaq had its best day since November 2020, while the S&P 500 posted its biggest one-day advance in almost two years.The markets staged a robust relief rally that saw all but two sectors – energy (-3.1%) and utilities (-0.7%) – finish in the green. Boosting investor sentiment were headlines indicating that… Continue reading Stock Market Today: Tech Stocks Lead Relief Rally | Kiplinger

Biden’s Cryptocurrency Executive Order Paves the Way for Regulation | Kiplinger

cryptocurrency A new executive order aims to begin shaping national policy concerning cryptocurrencies, from development to national security to consumer and investor protections.The White House on Wednesday announced steps toward regulating digital-asset transactions through a new cryptocurrency executive order (EO) issued on March 9. And while regulation has infamously gotten the bad rap that it… Continue reading Biden’s Cryptocurrency Executive Order Paves the Way for Regulation | Kiplinger

‘Big Short’ investor Michael Burry returns to Twitter with a nod to the 1970s, as the world battles with inflation and an energy crunch

“Big Short” investor Michael Burry took to Twitter after months with a cryptic tweet that seemed like a nod to the 1970s. The ’70s, dubbed as a period of “Great Inflation,” showed high inflation can have a devastating effect on an economy. His tweet may have also been a reference to the energy crisis of… Continue reading ‘Big Short’ investor Michael Burry returns to Twitter with a nod to the 1970s, as the world battles with inflation and an energy crunch

Investment giant Pimco risks losing up to $2.6 billion if Russia defaults on its debt

Pimco sold $1.1 billion of credit default swaps that compensate holders if Russia fails to make payments on its debt. The asset manager also holds $1.5 billion of Russian government bonds, the FT reported Wednesday. It stands to lose on both fronts if sanctions-battered Russia defaults, which Fitch says is imminent. Loading Something is loading.… Continue reading Investment giant Pimco risks losing up to $2.6 billion if Russia defaults on its debt

US stock futures dip as investors focus on diplomatic talks between Russia and Ukraine ahead of key inflation data

US futures and European shares fell on Thursday ahead of key inflation data and with Russia/Ukraine talks in focus. Asian markets rallied overnight, with Japan’s Nikkei leaping 3.9%, the most in almost 2 years. Oil rose 5%, paring some of the previous day’s losses, as the chances of OPEC raising output appeared to wane. Loading… Continue reading US stock futures dip as investors focus on diplomatic talks between Russia and Ukraine ahead of key inflation data

Oil prices climb 5% after UAE appears to backtrack on its earlier call for OPEC+ to boost output faster

Oil climbed more than 5% Thursday after the UAE appeared to tone down its message that OPEC+ should boost output. “We favor production increases and will be encouraging OPEC to consider higher production levels,” UAE’s ambassador to Washington said Wednesday. The UAE reportedly hadn’t consulted other OPEC+ members before making that statement. Loading Something is… Continue reading Oil prices climb 5% after UAE appears to backtrack on its earlier call for OPEC+ to boost output faster