The fintech company Milo is offering a home-loan product that uses bitcoin as collateral. The company is marketing the product to foreign investors who want to purchase US real estate. Redfin says investors were responsible for over 18% of property transactions in the fourth quarter. As US real-estate prices hit records in many markets, some… Continue reading The ‘crypto mortgage’ could become yet another way that investors crowd out traditional homebuyers

As Russia invaded the Ukraine, bitcoin plunged — here’s what Sam Bankman-Fried, Michael Saylor and other top voices in crypto had to say about it

Bitcoin and other cryptocurrencies sank as Russian forces invaded Ukraine this week. Loading Something is loading. The conflict raised questions about bitcoin’s role — as a haven, a tool for the unbanked, and an authority-free zone. Here’s what Sam Bankman-Fried, Michael Saylor and three other top voices in crypto had to say. Russian forces attacked… Continue reading As Russia invaded the Ukraine, bitcoin plunged — here’s what Sam Bankman-Fried, Michael Saylor and other top voices in crypto had to say about it

Will Ontario’s plan for 1.5 million new homes change anything?

What’s in the task force’s report? The task force estimates Ontario can add 1.5 million homes to the province’s housing stock over the next ten years by following a series of 55 recommendations, which fall into five main areas: Change planning policies and zoning regulations so they allow for both greater density and a wider… Continue reading Will Ontario’s plan for 1.5 million new homes change anything?

FP Answers: What happens if I pass away before — or just after — collecting my CPP?

Despite concerns about premature death, most Canadians live longer than they think they will Publishing date: Feb 22, 2022 • 2 days ago • 4 minute read • 6 Comments If you pass away before collecting or soon after starting CPP, the money contributed remains part of the plan’s total pool of capital. Photo by Getty… Continue reading FP Answers: What happens if I pass away before — or just after — collecting my CPP?

OAS? CPP? GIS? Breaking down Canada’s alphabet soup of retirement benefits

The benefits everyone is entitled to In Canada, there are three sources of retirement income, which are often known as the three pillars. The first two pillars are government-sponsored programs. Pillar one is made up of Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), available to people of retirement age, while the second… Continue reading OAS? CPP? GIS? Breaking down Canada’s alphabet soup of retirement benefits

Why it might (sometimes) be a good idea to borrow for your RRSP

How it works for investors Borrowing money is so common that many Canadians likely do it without thinking twice about the risks. But it’s important to understand an RRSP loan before committing to one. To borrow for an RRSP, you take out a lump sum at a modest interest rate, and put it into your… Continue reading Why it might (sometimes) be a good idea to borrow for your RRSP

Stock Market Today: Stocks Slip Further as Sanctions Mount | Kiplinger

Stock Market Today The U.S. and U.K. announced additional sanctions as the Russia-Ukraine crisis continued to ramp up, sending the major indexes further into the red Wednesday.The S&P 500 dipped deeper into correction territory Wednesday amid additional fallout of Russia’s attacks on Ukraine. A U.S. official told NBC News that Russia has “nearly 100 percent… Continue reading Stock Market Today: Stocks Slip Further as Sanctions Mount | Kiplinger

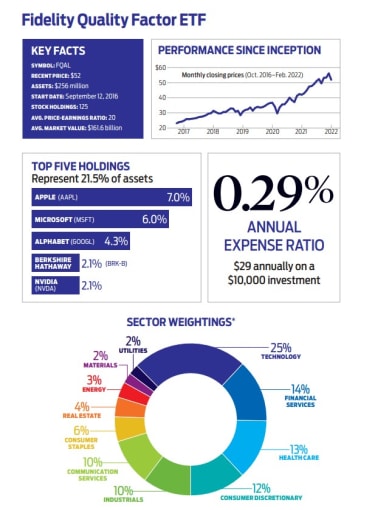

Fidelity Quality Factor ETF Flies Under the Radar | Kiplinger

ETFs Investors will likely benefit from a “flight to quality” in 2022 and this Fidelity fund offers higher rewards and lower risk than its peers.When the market gets rough, you hear a lot about a “flight to quality.” In the stock market, that means companies that have a lower risk profile thanks to traits such… Continue reading Fidelity Quality Factor ETF Flies Under the Radar | Kiplinger