Netflix shares poised for biggest drop in almost a decade Author of the article: Bloomberg News Jeran Wittenstein and Nick Turner The Netflix logo is seen on top of their office building in Hollywood, California, January 20, 2022. The streaming service ended the year with 221.8 million subscribers, just below target, after booming during coronavirus… Continue reading Netflix, Peloton bring pandemic-stock era to shuddering halt as shares plunge

Oilpatch sees ‘significant’ boost in investment for second straight year

Investment in Canada’s oil and natural gas industry will rise 22 per cent this year to $32.8 billion Author of the article: Bloomberg News Robert Tuttle Investment in Canadian oil sands, the world’s third largest oil reserves, will jump by a third to $11.6 billion. Photo by REUTERS/Dado Ruvic/Illustration Investment in Canada’s oil and natural… Continue reading Oilpatch sees ‘significant’ boost in investment for second straight year

Stephen Harper — activist investor? Why the former PM’s path after politics shouldn’t surprise anyone

Now 62, Harper is looking to make his mark in perhaps the biggest way since his near-decade as Canada’s leader Publishing date: Jan 20, 2022 • 1 day ago • 9 minute read • 387 Comments Former Canadian Prime Minister Stephen Harper speaks at a conference in Washington in 2017. In contrast with many of other… Continue reading Stephen Harper — activist investor? Why the former PM’s path after politics shouldn’t surprise anyone

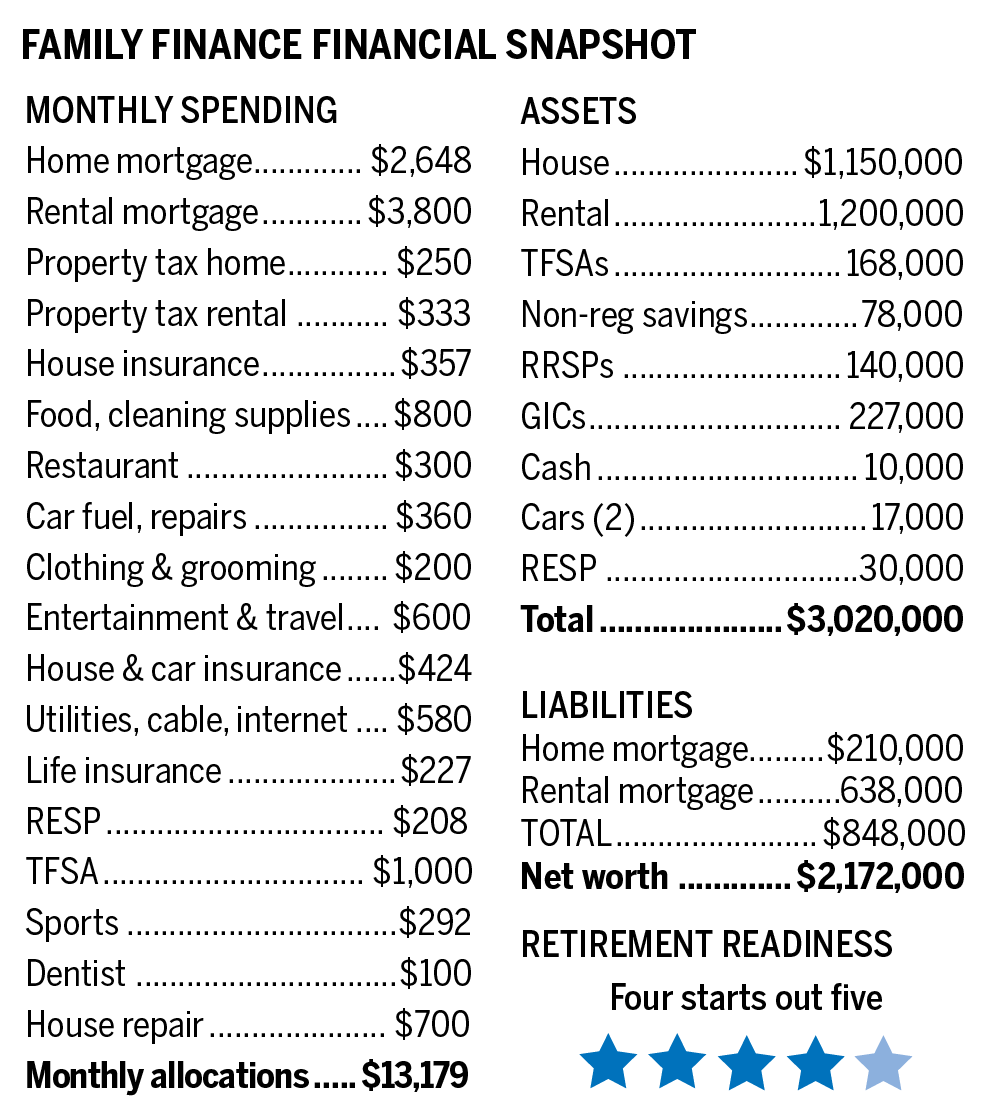

Spectre of inflation adds to early retirement risk for this young B.C. couple

Tom and Charlene will have to depend on savings to make retirement work, expert says Early retirement means that if inflation picks up, the company pension will lose purchasing power and interest rates will tend to rise. A couple we’ll call Tom and Charlene, both 40, live in B.C. with their seven-year-old son Sam. They… Continue reading Spectre of inflation adds to early retirement risk for this young B.C. couple

Here are 2 charts that explain why the stock market meltdown and bitcoin’s slump are correlated — and that crypto is not a safe-haven asset like gold

Bitcoin’s past performance suggests the asset class is less like gold and more like stocks.In prior stock market corrections, bitcoin plummeted while gold served as an effective hedge.”The correlation between bitcoin and high-growth benchmark ARKK still stands at ~60% year-to-date,” Fairlead’s Katie Stockton said in a Friday note.Sign up here for our daily newsletter, 10… Continue reading Here are 2 charts that explain why the stock market meltdown and bitcoin’s slump are correlated — and that crypto is not a safe-haven asset like gold

WallStreetBets users plan to publish a book of memes documenting the GameStop saga — and it already has $24,000 in backing on Kickstarter

WallStreetBets.REUTERS/Dado Ruvic/Illustration/File Photo WallStreetBets users plan to launch a meme book that documents last year’s GameStop short squeeze. The goal of the project is to “capture the moments in time when GameStop was all anyone was thinking about.” The project has raised $24,000 on Kickstarter, surpassing its funding goal of $20,000. Sign up here for our daily… Continue reading WallStreetBets users plan to publish a book of memes documenting the GameStop saga — and it already has $24,000 in backing on Kickstarter

Play-to-earn crypto games have exploded onto the scene and are shaking up gaming business models. Here’s how they work, and where the value comes from for investors.

Axie Infinity media kit Value for play-to-earn crypto games comes from a variety of sources, not just one thing. A game’s popularity and demand for its underlying crypto token are all part of the equation, along with transaction fees. Such a business model relies on a constant new flow of players entering the ecosystem and… Continue reading Play-to-earn crypto games have exploded onto the scene and are shaking up gaming business models. Here’s how they work, and where the value comes from for investors.

Investors trying to navigate tech volatility should focus on the ‘ABCs’: AI, big data, and cybersecurity, says UBS

Tech volatility should prompt investors to focus on the ABCs of the sector – AI, big data and cybersecurity stocks, says UBS. Those themes within tech offer high-potential, long-term growth, said the global wealth manager. The Nasdaq Composite has dropped into a correction, down more than 10% from its all-time high. Investors should adopt a… Continue reading Investors trying to navigate tech volatility should focus on the ‘ABCs’: AI, big data, and cybersecurity, says UBS