Kim Moody: Canada needs to take a hard look at lowering personal tax rates and ensure people keep at least half of all gains

Published Oct 04, 2023 • 4 minute read

Ontario, Quebec, British Columbia and the Maritime provinces have personal tax rates of more than 50 per cent. Photo by Getty Images/iStockphoto Before 2015, Alberta had, by far, the lowest federal-provincial combined top marginal tax rate in Canada at 39 per cent. This comparative advantage contributed greatly to large amounts of investment and people going into Alberta.

That year, however, the federal Liberal Party formed the new government, and in Alberta, the NDP surprisingly came to power provincially. The new federal government promptly announced it was raising the rates on so-called high-income earners by “asking them to pay just a little bit more” (an offensive speaking point that was overused for the next four-plus years, especially when one understands how much high-income earners already pay when compared to the whole of Canada). The new “ask” would commence in 2016 by introducing a new high federal bracket that increased the top-end rate by four per cent.

Advertisement 2

This advertisement has not loaded yet, but your article continues below.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword. SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

Exclusive articles by Kevin Carmichael, Victoria Wells, Jake Edmiston, Gabriel Friedman and others.Daily content from Financial Times, the world’s leading global business publication.Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.Daily puzzles, including the New York Times Crossword. REGISTER TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

Access articles from across Canada with one account.Share your thoughts and join the conversation in the comments.Enjoy additional articles per month.Get email updates from your favourite authors. Article content

Article content

The Alberta government also introduced new higher rates for 2015 and 2016. When the dust settled, Alberta’s highest marginal personal tax rate increased to a top end of 48 per cent, a large increase from its previous low and significantly narrowing the gap between some of the provinces that already had high personal rates, such as Ontario, Quebec and some of the Maritime provinces.

After the four per cent federal increase, Ontario, Quebec and the Maritime provinces had personal rates of more than 50 per cent. Ontario settled into a combined federal–provincial tax rate of 53.53 per cent and it remains that today. Quebec and the Maritime provinces are similar. British Columbia recently joined that club.

Bluntly, Canada’s marginal personal income tax rates are far too high. When I mention this to some of my left-leaning friends, they may rebut: “Kim, you realize that Canada’s highest marginal rates historically have been in the 80-plus-per-cent range … right? From that comparison, our current highest rates are a bargain.”

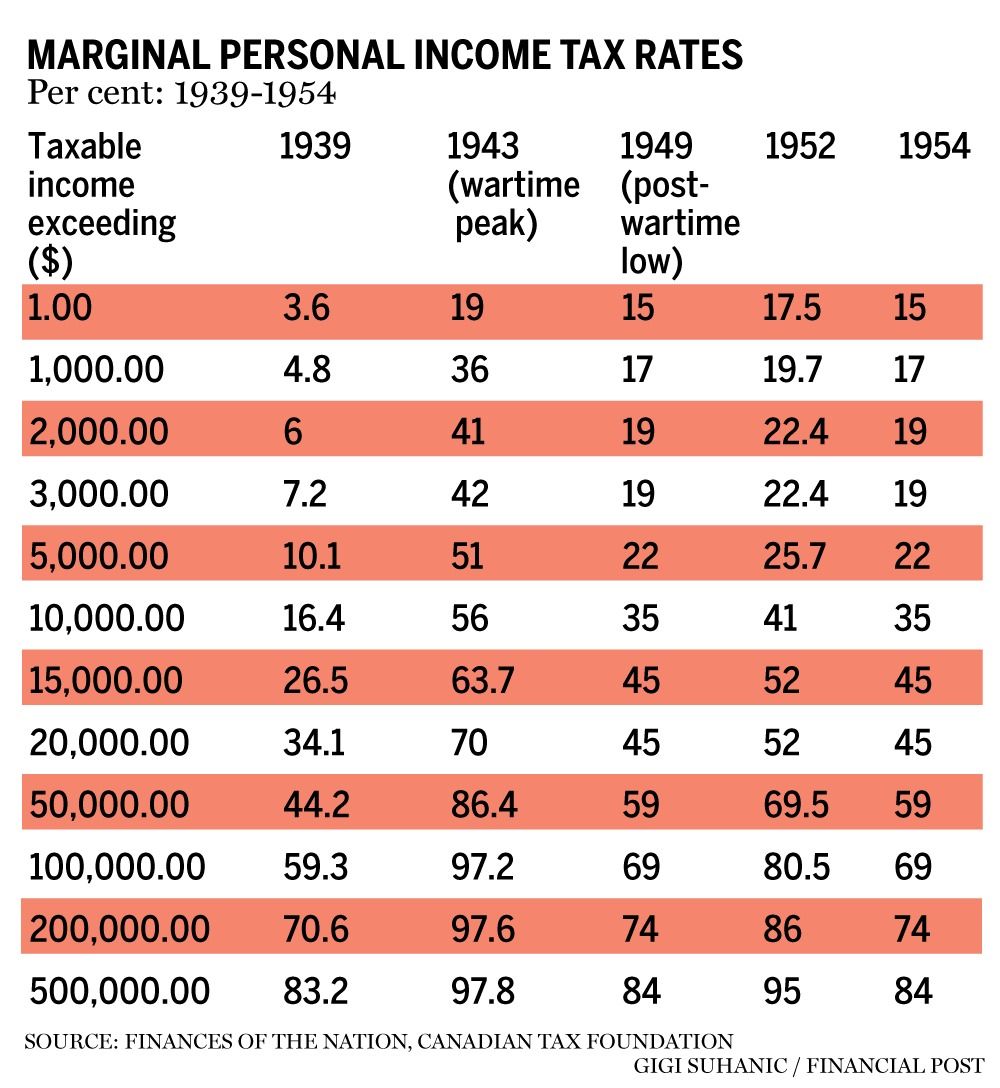

Technically, they are not wrong. Have a look at the data in the accompanying table from a 1954 publication, Finances of the Nation, by the Canadian Tax Foundation. You’ll quickly see that the highest marginal rates topped 80 per cent, with the high being 97.8 per cent in 1943.

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

Advertisement 3

This advertisement has not loaded yet, but your article continues below.

Article content

But let’s put some of that into context. First, Canada’s personal income tax system was relatively young from the 1930s to the 1950s. The amount of actual taxpaying individuals compared to the population as a whole was very low compared to today. In addition, capital gains were not taxable back then (capital gains did not become taxable in Canada until 1972). So, of course, there was no shortage of gamesmanship taken by the small number of high-income taxpayers to convert their income into non-taxable capital gains.

In 1962, the federal government — led by John Diefenbaker — had the courage to convene The Royal Commission on Taxation to review the entire taxation system and make recommendations about what Canada should do. In 1966, the Royal Commission released its voluminous report and recommendations. Regarding personal tax rates, the report stated this in Chapter 11:

“We are persuaded that high marginal rates of tax have an adverse effect on the decision to work rather than enjoy leisure, on the decision to save rather than consume, and on the decision to hold assets that provide monetary returns rather than assets that provide benefits in kind. We think there would be great merit in adopting a top marginal rate no greater than 50 per cent. With such a maximum marginal rate, taxpayers would be assured that at least half of all gains would be theirs after taxes. We think there is a psychological barrier to greater effort, saving and profitable investment when the state can take more than one half of the potential gain.”

Advertisement 4

This advertisement has not loaded yet, but your article continues below.

Article content

In 1974, American economist Arthur Laffer discussed a similar topic when he mused about the relationship between taxation rates and the resulting levels of government tax revenue. The “Laffer curve” assumes that no tax revenue is raised at the extreme tax rates of zero per cent and 100 per cent, meaning that somewhere between these extremes is a rate that maximizes government tax revenue. Finding that maximum rate is a tricky exercise for governments.

In my experience, personal behaviours significantly change when personal tax rates approach 50 per cent (similar to what the Royal Commission discussed in its report above). People will search for ways to lower their tax bills, especially when the perception is that there is not much value being provided when compared to the cost (or, as many politicians say, “investment”).

There is a reason why significant amounts of high-income earners/wealthy persons have recently been leaving Canada. And it’s the same reason why this country has a difficult time attracting top-end talent in medicine, biotech, technology, professional sports and other industries/professions. Whenever I raise this alarm bell, I routinely get a rebuttal that I’m exaggerating. I’m not.

Advertisement 5

This advertisement has not loaded yet, but your article continues below.

Article content

Related Stories

New tax rules might mean donating more to charity this year

Rejection of CRA expense denial sweet music to taxpayer’s ears

Tax system not built to keep up with inflation

Canada needs to take a hard look at this issue to lower personal tax rates and ensure people that “at least half of all gains would be theirs.” And it might go a long way to improve its lagging productivity … an important topic for another day.

Kim Moody, FCPA, FCA, TEP, is the founder of Moodys Tax/Moodys Private Client, a former chair of the Canadian Tax Foundation, former chair of the Society of Estate Practitioners (Canada) and has held many other leadership positions in the Canadian tax community. He can be reached at kgcm@kimgcmoody.com and his LinkedIn profile is www.linkedin.com/in/kimmoody.

Article content