ETFs While you can easily purchase individual preferred stocks, exchange-traded funds (ETFs) allow you to reduce your risk by investing in baskets of preferreds.Preferred stocks typically aren’t first, second or even third to mind when investors think about what they want to include in their portfolios. But if you’re an income hunter and you don’t… Continue reading 3 Preferred Stock ETFs for High, Stable Dividends | Kiplinger

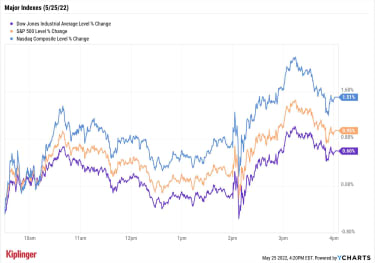

Stock Market Today: Retail Roars Back, Markets Build Positive Momo | Kiplinger

The major indexes staged a second consecutive sizable rally Thursday amid a number of encouraging retail reports and more signs that perhaps the recent downturn was a touch overdone. Michael Reinking, senior market strategist for the New York Stock Exchange, noted an important potential sea change in yesterday’s trading – namely, Dick’s (DKS) and other… Continue reading Stock Market Today: Retail Roars Back, Markets Build Positive Momo | Kiplinger

What You Need to Know About Mutual Fund Returns | Kiplinger

mutual funds A guide to the many ways these popular investments measure their performance.Past performance may be little guarantee of future results, but when we assess investments, especially mutual funds, past performance is an informative measure. But it’s not the only one. The trick is to understand what you’re looking at when you scrutinize performance,… Continue reading What You Need to Know About Mutual Fund Returns | Kiplinger

In Search of Relief at the Pump | Kiplinger

Matthew Lewis is a professor in the John E. Walker Department of Economics at Clemson University and a gas price expert. What factors have contributed to the sharp rise in gas prices?An increase in crude oil prices is the main reason. To a secondary extent, disruptions to the refinery market and pipeline distribution system can… Continue reading In Search of Relief at the Pump | Kiplinger

9 Great Alternative-Strategy Funds for Volatility | Kiplinger

There have been few places to hide for investors this year. Both stocks and bonds have tumbled – since the start of 2022, the Vanguard Balanced fund, a portfolio of 60% stocks and 40% bonds, has lost 13%. Moreover, interest rates are still rising, inflation is on the march, and the stock market continues to… Continue reading 9 Great Alternative-Strategy Funds for Volatility | Kiplinger

Legg Mason Low Volatility High Dividend ETF (LVHD) Pays Off | Kiplinger

ETFs Low-volatility funds like the Legg Mason Low Volatility High Dividend ETF have held up well during this year’s market turbulence.Low-volatility funds, which aim to offer a smoother ride, are living up to their name. Since the start of the year, U.S. stock funds with low-volatility strategies have dipped 7.7% on average, while the S&P… Continue reading Legg Mason Low Volatility High Dividend ETF (LVHD) Pays Off | Kiplinger

Stock Market Today: Nasdaq Jumps as Fed Minutes Fail to Flame Fears | Kiplinger

U.S. equities enjoyed a broad pop Wednesday following the release of minutes from the Federal Reserve’s most recent meeting, which showed that the central bank’s decisionmakers were willing to be both aggressive but flexible in the face of both inflationary and recessionary pressures. Much of what the Federal Open Market Committee said in the minutes… Continue reading Stock Market Today: Nasdaq Jumps as Fed Minutes Fail to Flame Fears | Kiplinger

Bond Values in a Volatile Market | Kiplinger

Investing for Income While the market’s instability may not be over just yet, the latter half of the year should be less daunting – and possibly more rewarding – for investors.Steel yourself for six more months of instability. The model: In May, the Federal Reserve hiked short-term interest rates by half a percentage point, the… Continue reading Bond Values in a Volatile Market | Kiplinger