We’ve all seen the rising cost of oil and its ripple effect through the economy, especially on prices at the pump. You may have also read that the U.S. is energy independent or that we export more oil than we import and that Russian oil only makes up 3% of all U.S. oil imports. So… Continue reading Why Are Gas Prices So High If U.S. Is Energy Independent? | Kiplinger

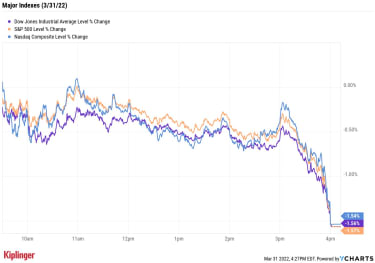

Stock Market Today: Stocks Close Out Worst Quarter Since Q1 2020 | Kiplinger

Stocks spent the last day of March much as they’ve spent the past few months – trading in negative territory. Today’s decline followed an onslaught of economic reports. On the inflation front, data from the Commerce Department showed that the personal consumption expenditures (PCE) index – which measures the price change of goods and services… Continue reading Stock Market Today: Stocks Close Out Worst Quarter Since Q1 2020 | Kiplinger

7 Defense Stocks to Buy as Geopolitical Risks Rise | Kiplinger

Russia’s invasion of Ukraine has, among other things, unsettled much of the stock market. However, one corner of the market has experienced a lift as a result, and stands to keep benefiting should this conflict continue or other geopolitical risks rise: defense stocks. “Even before the Russia and Ukraine conflict became front-page news, there was… Continue reading 7 Defense Stocks to Buy as Geopolitical Risks Rise | Kiplinger

10 Best Inflation-Fighting ETFs for Higher Costs | Kiplinger

Inflation continues to be top of mind for investors, with costs for energy, food and other products hovering near levels not seen in 40 years. This has investors seeking out ways to protect their portfolio against higher prices – either with individual equities or inflation exchange-trade funds (ETFs). And this trend is likely to continue… Continue reading 10 Best Inflation-Fighting ETFs for Higher Costs | Kiplinger

5 Hotel Stocks to Buy for a Summer Travel Boom | Kiplinger

It’s a volatile stock market out there right now as investors eye the start of the Federal Reserve’s first rate-hike cycle in years and geopolitical uncertainty stemming from the war in Ukraine. With so much attention focused on these two issues, many investors might be missing opportunities available in a recovering travel industry, particularly among… Continue reading 5 Hotel Stocks to Buy for a Summer Travel Boom | Kiplinger

Stock Market Today: Tesla, Tech Lift Stocks After Rocky Open | Kiplinger

Stock Market Today Tesla popped amid a filing suggesting another stock split; gains in mega-cap technology names also helped carry the major indexes.The market got off to a disorganized start to the week, but one that still saw the major indexes finish in positive territory. Tesla (TSLA, +8.0%) had an outsized say in the market’s… Continue reading Stock Market Today: Tesla, Tech Lift Stocks After Rocky Open | Kiplinger

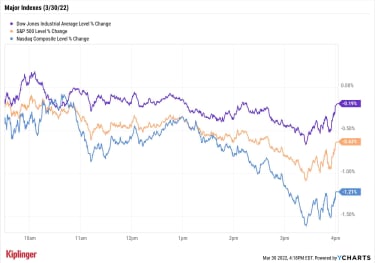

Stock Market Today: Stocks’ Win Streak Snapped Despite Good Jobs News | Kiplinger

Stock Market Today Optimism about peace in Eastern Europe faded Wednesday, chilling a stock market that had recently heated up.Positive momentum in the major indexes ran out Wednesday as a resurgence in Russian military activity overshadowed good news on the employment front. Less than a day after pledging to pull back operations in Kyiv, Russian… Continue reading Stock Market Today: Stocks’ Win Streak Snapped Despite Good Jobs News | Kiplinger

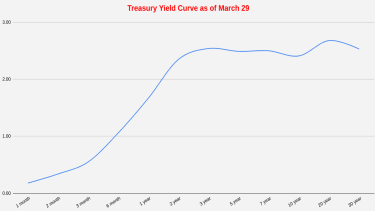

Why Inverted Yield Curve Panic Is Overdone | Kiplinger

stocks Yes, a 2-and-10 yield curve inversion has predicted many past recessions. But it’s an imprecise signal – and one that leads equity investors astray.In case you haven’t heard by now, the “2-and-10” yield curve momentarily inverted this week. Some market participants and financial media have responded with alarm, and given this signal’s singular track… Continue reading Why Inverted Yield Curve Panic Is Overdone | Kiplinger