stocks Active or tactical investors and traders might want to lean into the market’s volatility via high-quality, high-vol stocks.If there’s been one constant through the first few months of 2022, it’s that volatility has come back with a vengeance. And yet as counterintuitive as it might sound, investors should think twice before dumping high-volatility stocks… Continue reading 20 High-Volatility Stocks for the Market’s Next Swing | Kiplinger

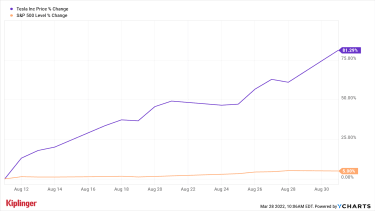

Will a Second Tesla Stock Split Spark Another Rally? | Kiplinger

stocks The 2020 TSLA split sparked an 80% run in shares. But is Tesla set up for another rally after its proposal for a new share split?Tesla (TSLA, $1,010.64) on Monday signaled its second stock split in less than two years and became the third company in the trillion-dollar market cap club to propose a… Continue reading Will a Second Tesla Stock Split Spark Another Rally? | Kiplinger

BofA’s Savita Subramanian: Stocks Are in for a Volatile Year | Kiplinger

stocks A lot has happened already in 2022, says the head of equity and quantitative strategy at BofA Securities. But the market’s roller-coaster ride is far from over.Savita Subramanian is head of equity and quantitative strategy at BofA Securities. Read on as we ask Subramanian about finding opportunities in this volatile market, as well as her stance… Continue reading BofA’s Savita Subramanian: Stocks Are in for a Volatile Year | Kiplinger

Micron (MU) Earnings on Tap as End of Q4 Season Approaches | Kiplinger

Micron Technology (MU, $77.35) will headline this week’s relatively bare earnings calendar, with the chipmaker slated to report its fiscal second-quarter results after Tuesday’s close. Analysts, on average, are anticipating earnings of $1.97 per share for the three-month period, up 101% on a year-over-year (YoY) basis. On the top line, the consensus estimate is for… Continue reading Micron (MU) Earnings on Tap as End of Q4 Season Approaches | Kiplinger

Why Bonds Belong in Your Portfolio | Kiplinger

Interest rates are rising and stock prices are falling, so investors naturally start thinking about bonds. But be careful. Peter Lynch, the manager of Fidelity Magellan fund during its spectacular run in the 1980s, once said, “Gentlemen who prefer bonds don’t know what they are missing.” Generally, I agree. Dow 36,000, the book I coauthored,… Continue reading Why Bonds Belong in Your Portfolio | Kiplinger

6 Stocks Rewarding Investors With Generous Buybacks | Kiplinger

Stock buybacks for 2021 might exceed $1 trillion according to preliminary data from Standard & Poor’s. That’s a big number. To put it in context, the market capitalization of the New York Stock Exchange (NYSE) at the end of December 2021 was $27 trillion, suggesting that about 4% of shares are being repurchased. But it’s… Continue reading 6 Stocks Rewarding Investors With Generous Buybacks | Kiplinger

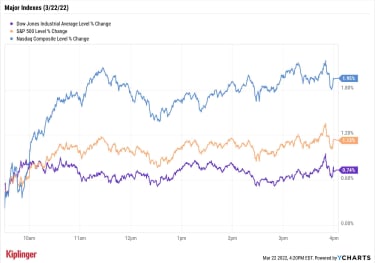

Stock Market Today: Markets Rebound Despite Higher Rate Expectations | Kiplinger

Stocks broadly recovered Tuesday as investors continued to weigh Federal Reserve Chair Jerome Powell’s more hawkish tone on inflation and its potential impact on the size and pace of future interest rate hikes. Kristina Hooper, chief global market strategist for Invesco, says the Fed might be hoping to influence the yield curve more by words… Continue reading Stock Market Today: Markets Rebound Despite Higher Rate Expectations | Kiplinger

4 Regional Bank Stocks Rooting for More Rate Hikes | Kiplinger

bank stocks Rate-sensitive regional bank stocks could be among the top beneficiaries of the Fed’s hiking cycle, especially if the U.S. manages to avoid a yield inversion.The Federal Reserve recently announced a much-anticipated hike in interest rates – a 25-basis-point uptick that’s expected to be just the first of several this year. The Fed’s hawkishness… Continue reading 4 Regional Bank Stocks Rooting for More Rate Hikes | Kiplinger