Stock Market Today Weekly unemployment claims add to a bevy of positive economic data points, driving a wide rebound across the major indexes.Stocks logged a broad advance Thursday in the wake of the smallest weekly jobless claims number since John Lennon called it quits with the Beatles. The Labor Department reported just 187,000 initial unemployment… Continue reading Stock Market Today: 53-Year-Low Jobless Claims Lift the Market | Kiplinger

Kiplinger ESG 20: ESG Stocks Not Immune From Downturn | Kiplinger

ESG After a bullish 2021 for stocks with impressive ESG credentials, a pullback is under way; our ESG picks also stumble.Market volatility early in 2022 hasn’t dragged down only growth stocks and blue-chip names. It has also had a brownout effect on the Kiplinger ESG 20, our list of favorite stocks and funds that excel… Continue reading Kiplinger ESG 20: ESG Stocks Not Immune From Downturn | Kiplinger

Income Investors Should Look Beyond the Ukraine Invasion | Kiplinger

stocks Unless you invested in a Russian-themed ETF or an emerging markets index fund, the destruction of Moscow’s capital markets is a distraction for investors.The politico who uttered “never let a good crisis go to waste” might have been onto something. This is not to sound insensitive to Ukraine and all victims, but without an… Continue reading Income Investors Should Look Beyond the Ukraine Invasion | Kiplinger

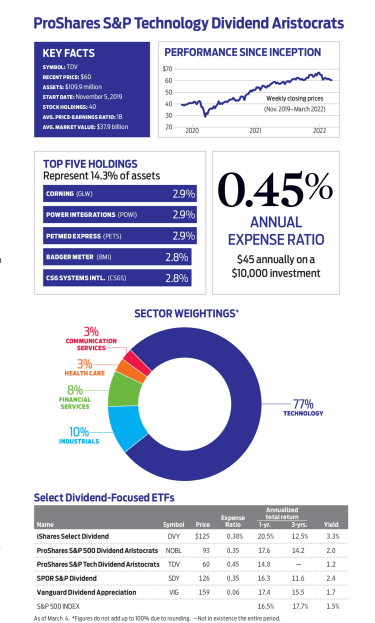

TDV: A Fund Featuring Dividend-Paying Tech Stocks | Kiplinger

ETFs Tech was the biggest payer of dividends among all S&P 500 sectors in 2021, according to CFRA.It may surprise you that in 2021, the technology sector was the largest payer of dividends among sectors in the S&P 500 Index, according to investment research firm CFRA. Tech stocks contributed more than 17% of the overall… Continue reading TDV: A Fund Featuring Dividend-Paying Tech Stocks | Kiplinger

Stock Market Today: Stocks Jolted Awake as Oil Enters Bear Market | Kiplinger

Stock Market Today Oil slumps below $100 per barrel and into bear territory, providing the equity market with some much-needed relief.Another precipitous decline in oil prices, as well as hints of an easing in other inflationary pressures, managed to snap losing streaks across the major indexes Tuesday. U.S. crude oil futures continued their recent dive,… Continue reading Stock Market Today: Stocks Jolted Awake as Oil Enters Bear Market | Kiplinger

10 Small-Cap ETFs to Buy for Big Upside | Kiplinger

Over the last 29 years, U.S. exchange-traded fund (ETF) assets have grown to over $7.2 trillion across more than 7,600 funds. They’ve become the product of choice for individual and institutional investors alike. However, of those several trillion dollars, only a small fraction – roughly 4% – gets put into small-cap ETFs, according to the… Continue reading 10 Small-Cap ETFs to Buy for Big Upside | Kiplinger

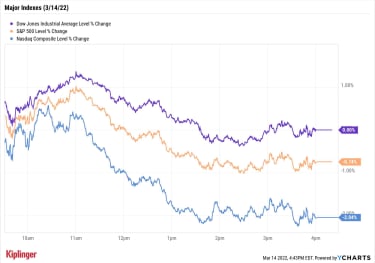

Stock Market Today: Oil Cools Off, But Stocks Remain Stymied | Kiplinger

Stock Market Today Peace talks were among several factors that weighed on crude prices Monday, but rising Treasury rates kept equities grounded.Recently red-hot energy prices were hosed down on Monday, but that gave only limited relief to equities, and only in a few select quarters. U.S. crude oil futures plunged 5.8% to $103.01 per barrel,… Continue reading Stock Market Today: Oil Cools Off, But Stocks Remain Stymied | Kiplinger

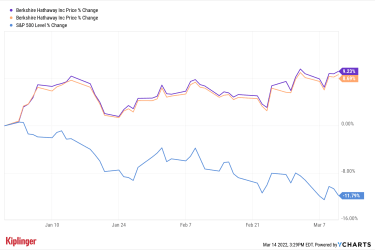

Berkshire Hathaway Class A Shares Hit $500,000 Mark | Kiplinger

Warren Buffett’s Berkshire Hathaway (BRK.B, $326.60) is having a great year in a down market, and on Monday, it quietly hit a milestone. The company’s far-lesser-traded Class A shares were priced at $500,000 on the nose intraday for the first time in their history. That’s right. For a fleeting moment, a piece of Buffett’s holding company cost… Continue reading Berkshire Hathaway Class A Shares Hit $500,000 Mark | Kiplinger