For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. Form 1099-MISC used to be a self-employed person’s best friend at tax time. However, this form recently changed, and it no longer includes nonemployee compensation the way it… Continue reading 1099-MISC Instructions and How to Read the Tax Form

What, Me Worry? Last-Minute Taxes

For information on the third coronavirus relief package, please visit our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post. According to the Internal Revenue Service, 20-25% of all Americans wait until the last two weeks before the deadline to prepare their returns. At that late date, there… Continue reading What, Me Worry? Last-Minute Taxes

TurboTax Guide to Self-Employment Taxes in Today’s Gig Economy

Many Americans have recently found themselves joining the gig economy as either a self-employed individual, a freelancer, or a similar short-term worker. If you fall into one of these categories, you are likely wondering how self-employment tax is handled compared with what you’ve done before. Here, we’ll help you feel confident in your understanding of… Continue reading TurboTax Guide to Self-Employment Taxes in Today’s Gig Economy

Taxes and Divorce: Here’s What to Know About Filing Taxes After Divorce

It might surprise you to read, that about 50% of Americans divorce. That is reportedly the sixth-highest rate in the world. We’ve seen a number of these divorces play out on Wall Street last year. Last year, Microsoft ( (MSFT) – Get Microsoft Corporation Report) co-founder Bill Gates and his wife Melinda finalized their divorce.… Continue reading Taxes and Divorce: Here’s What to Know About Filing Taxes After Divorce

Manhattan Apartment Rents Hit Peak As Prices Rise Nationally

Manhattan residential real estate is going gangbusters. The borough’s median monthly apartment rent, including landlord concessions, for new leases signed in March totaled a record $3,644. That’s up 0.4% from February, 23% from March 2021 and 4.8% from two years ago, at the start of the pandemic. The data come from real estate brokerage Douglas… Continue reading Manhattan Apartment Rents Hit Peak As Prices Rise Nationally

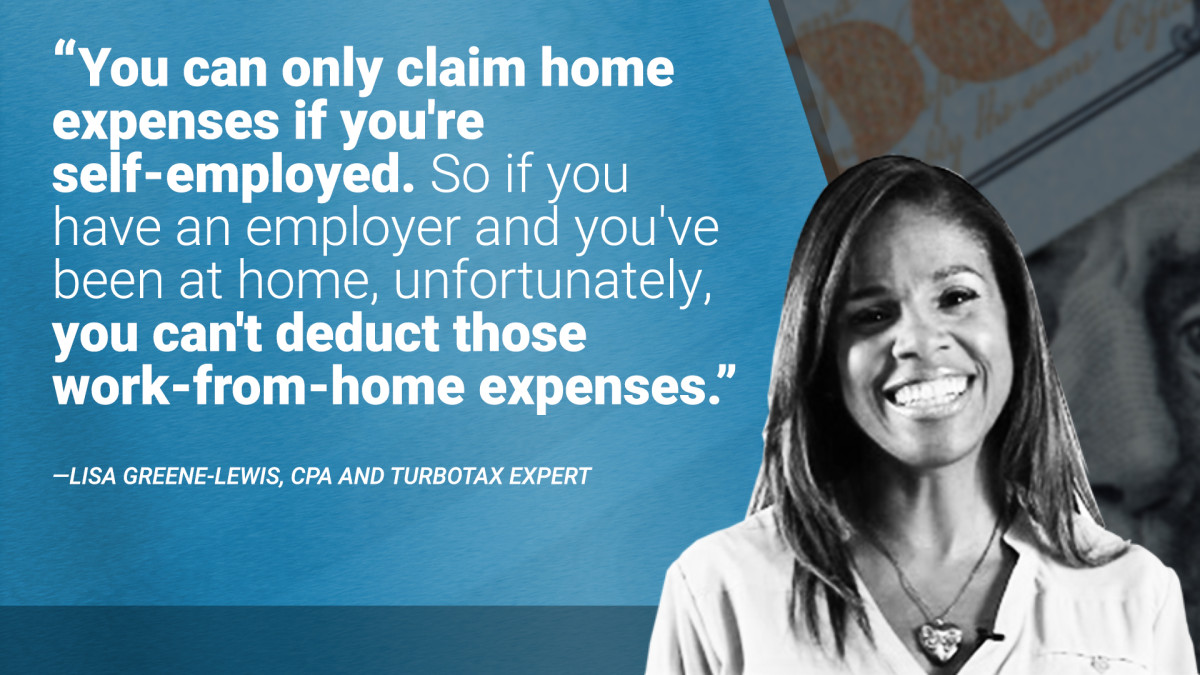

Taxes & Remote Working: Deductions for Employees Working From Home

Did you know that roughly 26% of Americans worked from home during 2021? And that number is expected to stay relatively steady for the new few years. In fact, about 22% of the American workforce is expected to be working remotely through 2025, according to freelancing platform Upwork. If you were among the workforce displaced last… Continue reading Taxes & Remote Working: Deductions for Employees Working From Home

It’s a Great Time for Home Improvements – Here’s When Its Tax Deductible

The remodeling boom soared in 2021 due to a number of reasons, including the ongoing pandemic and an increasing number of people working from home. Spending and remodeling are expected to remain strong in 2022, with signs that things could slow down by the end of the year, according to Harvard’s Leading Indicator of Remodeling Activity… Continue reading It’s a Great Time for Home Improvements – Here’s When Its Tax Deductible

5 Situations to Consider Tax-Loss Harvesting

Tax-loss harvesting is the method of selling investments at a loss in order to reduce the amount of money you’ll owe for income taxes. To help you sort this out, we’ve explained some key terms and outlined five instances of when you might consider this. TurboTax Premier makes it easy and fast to import, upload,… Continue reading 5 Situations to Consider Tax-Loss Harvesting