Many new investors view day trading as an efficient way to earn funds quickly. The idea behind the concept is to make trades over short periods to take advantage of short-term price changes while profiting at the same time. TurboTax Premier makes it easy and fast to import, upload, and accurately report your investments, effortlessly.… Continue reading Day Trading Taxes: What New Investors Should Consider

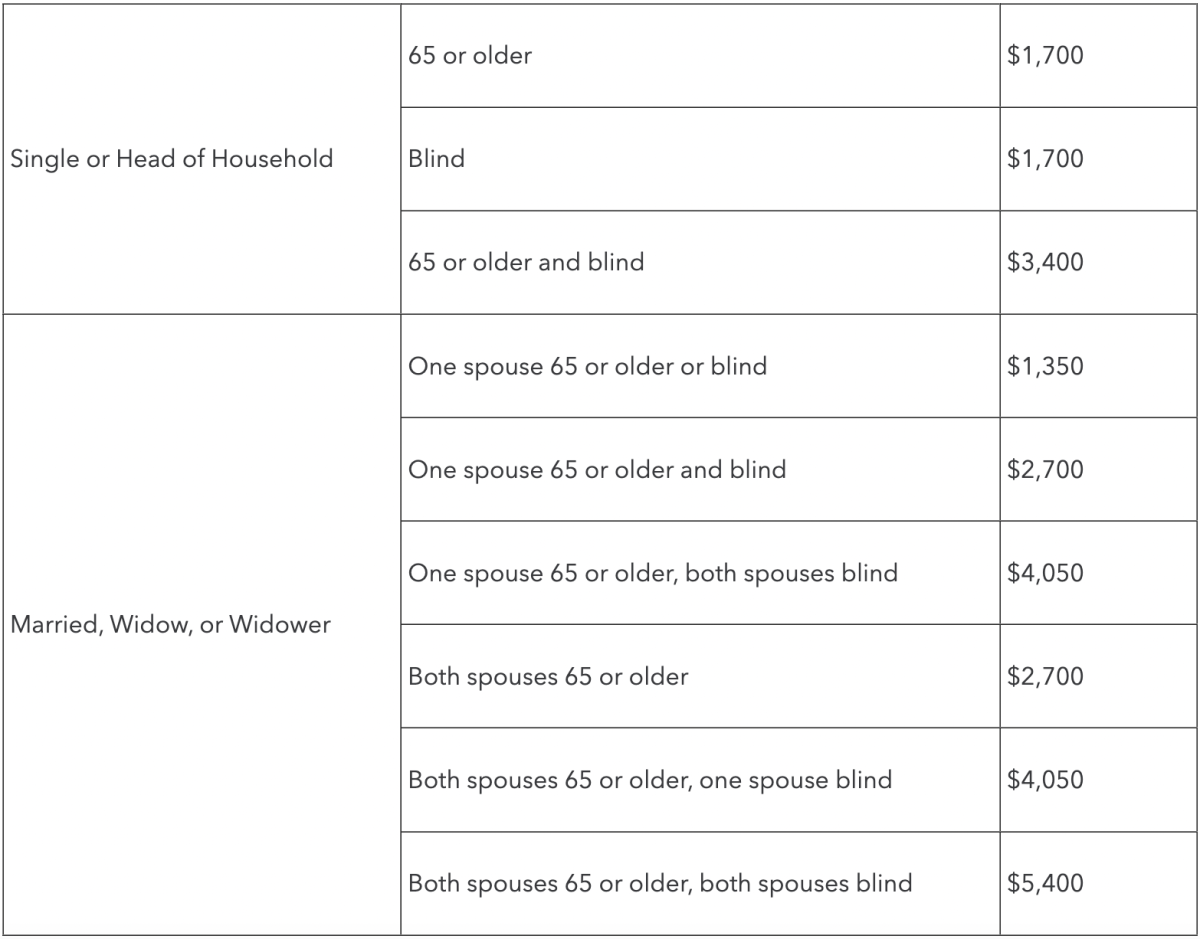

Standard Deduction vs. Itemized Deductions: Which Is Better?

Nearly 90% of taxpayers claim the standard deduction vs. itemized deductions. As you prepare to file your next tax return, should you do the same? Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online… Continue reading Standard Deduction vs. Itemized Deductions: Which Is Better?

8 things you may not have known were tax-deductible

1. Business-related entertainmentYou may be taking clients out to win their business, but you’re probably having a little fun as well. At least, the IRS assumes you are. Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to… Continue reading 8 things you may not have known were tax-deductible

Where Is Consumer Fraud Worst? And How Can You Avoid It?

Florida ranks as the No. 1 state for financial fraud perpetrated on consumers, and Miami stands as the No. 1 tourist city for fraud, according to a study from Feedzai, a financial risk management firm. In particular, Florida heads the list for in-store debit-card fraud, the report said. “The number of in-store card transactions showed… Continue reading Where Is Consumer Fraud Worst? And How Can You Avoid It?

Taxable Income vs. Nontaxable Income: What You Should Know

What’s not taxableNontaxable income won’t be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts… Continue reading Taxable Income vs. Nontaxable Income: What You Should Know

The Apple Watch is $70 Off Today Only

Today only, you can save up to $70 on Apple’s flagship smartwatch which has all the bells and whistles you’d expect. You can score an Apple Watch Series 7 for nearly $70 off. Jacob Krol/TheStreet The Arena Media Brands, LLC and respective content providers to this website may receive compensation for some links to products… Continue reading The Apple Watch is $70 Off Today Only

What’s the Difference Between a Tax Credit and a Tax Deduction?

“Just write it off.” “Go ahead and deduct it.” “I think there’s a tax credit for that.” Our TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a… Continue reading What’s the Difference Between a Tax Credit and a Tax Deduction?

Can You Deduct 401k Savings From Your Taxes?

The contributions you make to your 401(k) plan can reduce your tax liability at the end of the year as well as your tax withholding each pay period. However, you don’t actually take a tax deduction on your income tax return for your 401(k) plan contributions. This is because you receive the benefit of a… Continue reading Can You Deduct 401k Savings From Your Taxes?