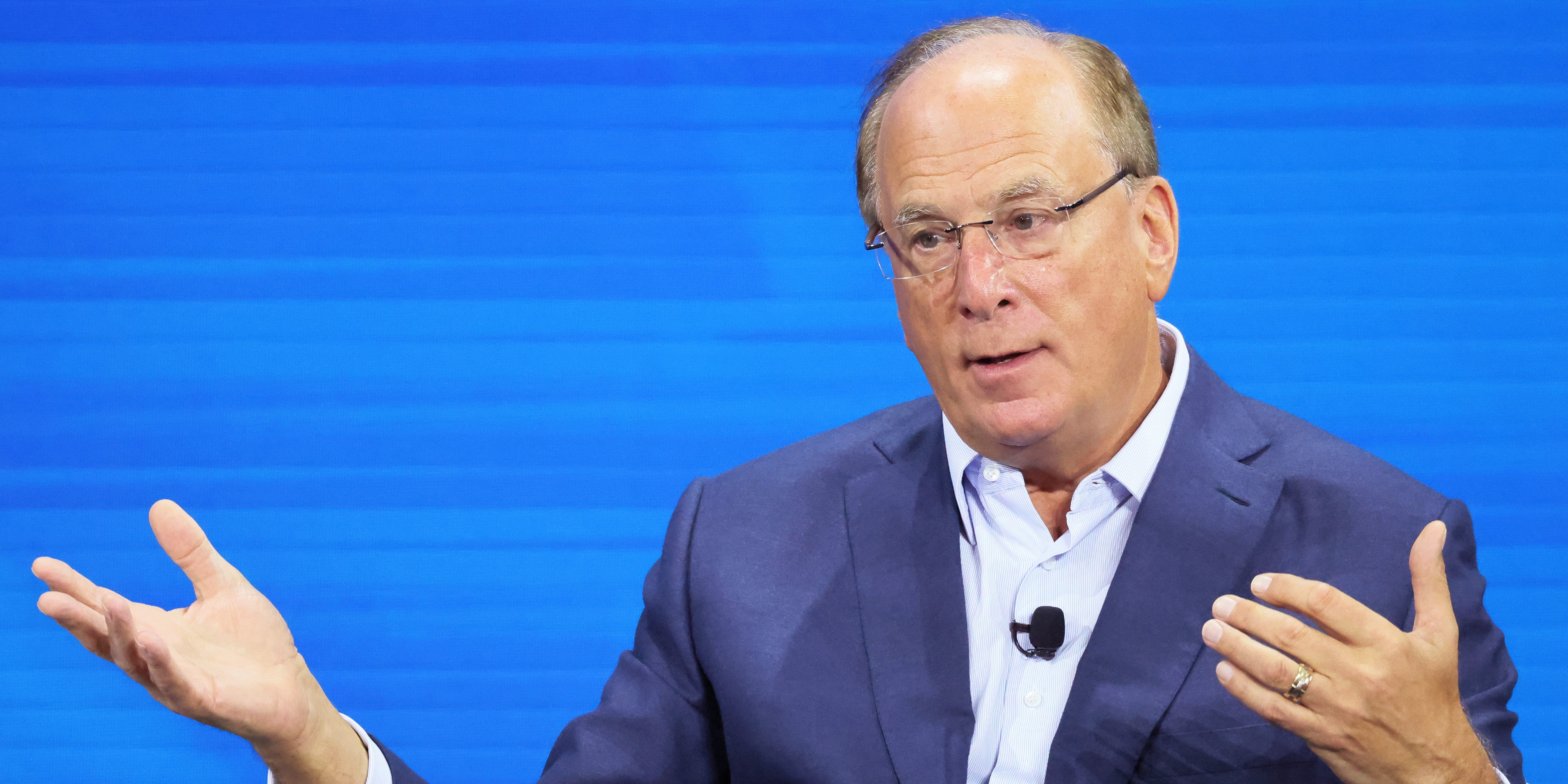

BlackRock’s Larry Fink says inflation will stay higher for longer because of geopolitical issues. The CEO of the world’s largest asset manager explained why the US will not enter a big recession in 2023. That’s due to a large amount of money flowing into the economy from recent stimulus bills, Fink told CNBC. Loading Something… Continue reading BlackRock’s Larry Fink says there’s no big recession headed for the US economy, but inflation will be ‘stickier for longer’

Here’s why a potential crash in the commercial real estate market could look a lot like the 2008 crisis, according to one CEO

The commercial real estate sector could see a 2008-like crash, according to one CEO. Experts have been sounding alarms for commercial property since the collapse of SVB in March. The sector is largely financed by small- to mid-sized regional lenders, and $1.5 trillion in debt will soon mature. Loading Something is loading. Thanks for signing… Continue reading Here’s why a potential crash in the commercial real estate market could look a lot like the 2008 crisis, according to one CEO

Russia’s economy is hurting – and a new wave of EU sanctions aimed at crippling its ‘war machine’ are coming. Here are 6 key developments in the past week.

Russia’s economy is hurting and a new wave of EU sanctions targeting its “war machine” are coming. Growing links to China, an unstable currency and “cherry-picked” data are key developments. Here are six key things to know about what’s going on in Russia over the past week. Loading Something is loading. Thanks for signing up!… Continue reading Russia’s economy is hurting – and a new wave of EU sanctions aimed at crippling its ‘war machine’ are coming. Here are 6 key developments in the past week.

3 specialized vehicles to keep conservative 60/40 investors happier

No idea if 60/40 is entering another lost decade or not, but we are not taking the risk Published Apr 10, 2023 • Last updated 5 days ago • 4 minute read Traders working on the floor of the New York Stock Exchange. Photo by Michael M. Santiago/Getty Images files If you google 60/40, you will… Continue reading 3 specialized vehicles to keep conservative 60/40 investors happier

Fears that the US dollar will collapse are nonsense, and doomsayers are often hawking gold, investment chief says

Dollar collapse fears are bogus as the greenback can’t be replaced anytime soon, Brad McMillan said. A lot of the talk is often from doomsayers trying to push gold, Commonwealth Financial’s CIO said. The dollar “is not only the established choice and, in most cases, the smart choice, but it is the only choice.” Loading… Continue reading Fears that the US dollar will collapse are nonsense, and doomsayers are often hawking gold, investment chief says

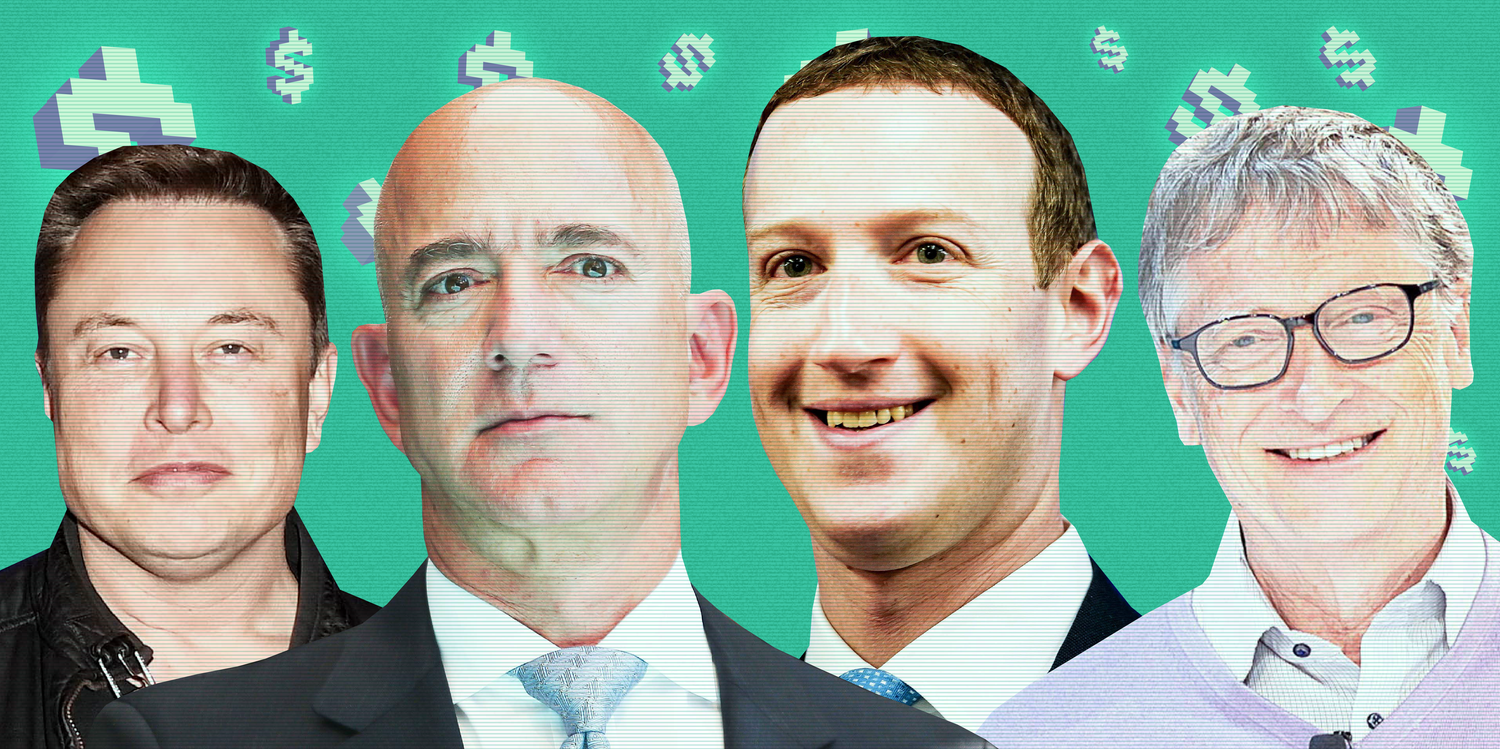

The stock market rally in 2023 has added $213 billion to the wealth of the world’s top 10 billionaires

A strong start to the stock market this year has helped reverse some of the big losses billionaires saw in 2022.So far this year, the world’s top 10 billionaires added a collective $213 billion to their net worth.The top billionaires include Bernard Arnault, Elon Musk, Jeff Bezos, Bill Gates, and Warren Buffett. Loading Something is… Continue reading The stock market rally in 2023 has added $213 billion to the wealth of the world’s top 10 billionaires

Howard Marks says rock-bottom rates are history, bitcoin has its uses, and AI won’t replace the best investors. Here are his 8 best quotes from a new interview.

Howard Marks says interest rates won’t return to zero anytime soon. The billionaire investor warns the ballooning US federal debt may cause problems in the future. Marks says AI won’t replace the best investors, and the banking fiasco shone a light on bitcoin. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading Howard Marks says rock-bottom rates are history, bitcoin has its uses, and AI won’t replace the best investors. Here are his 8 best quotes from a new interview.

LinkedIn’s top economist explains the AI trend that could mark a tipping point – and the under-the-radar labor market shifts unfolding now

In an interview with Insider, LinkedIn’s head of macroeconomics broke down labor market trends and AI. LinkedIn data shows the number of jobs on the site mentioning ChatGPT jumped by 51% from 2021 to 2022. AI’s impact is in its early days, he said, but once non-tech firms start using it, the productivity jump could… Continue reading LinkedIn’s top economist explains the AI trend that could mark a tipping point – and the under-the-radar labor market shifts unfolding now