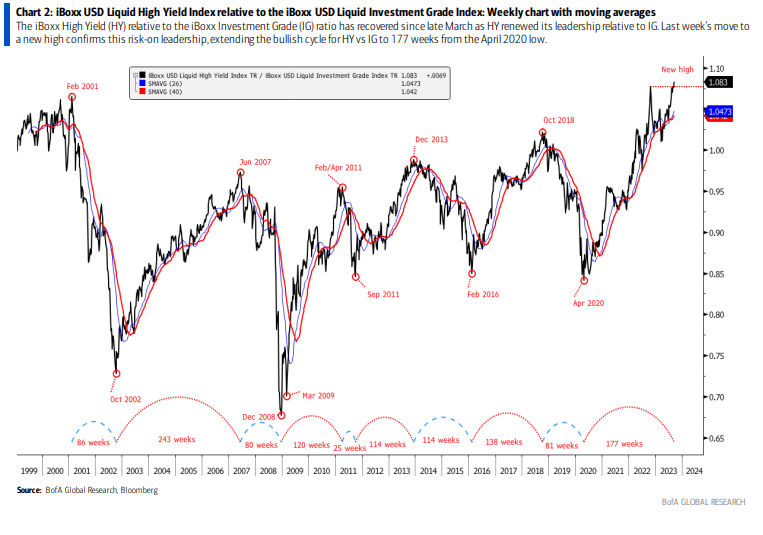

The bond market just flashed a bullish signal that suggests a risk-on environment for stocks.The bullish signal is based on risky high-yield bonds outperforming relative to corporate bonds.This is the second longest stretch of outperformance for high-yield bonds, according to Bank of America. Loading Something is loading. Thanks for signing up! Access your favorite topics… Continue reading CHART OF THE DAY: It’s a risk-on environment for stocks based on this bond market signal

Oil prices could rise to $120 a barrel on further supply cuts, and that would bring economic growth to a halt next quarter, JPMorgan says

Brent crude prices could potentially hit $120 a barrel, JPMorgan warned. That’s assuming oil supply will face even more pressure in the coming months. Prices that high could bring global economic growth to a near standstill. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed while you’re on… Continue reading Oil prices could rise to $120 a barrel on further supply cuts, and that would bring economic growth to a halt next quarter, JPMorgan says

Remember when NFTs sold for millions of dollars? 95% of the digital collectibles are now probably worthless.

Most NFTs are now likely worthless, less than two years after a massive bull run in the digital collectibles. A new study found 95% of over 73,000 NFT collections have a market cap of 0 ETH. Out of the top collections, the most common price for an NFT is now $5-$10. Loading Something is loading.… Continue reading Remember when NFTs sold for millions of dollars? 95% of the digital collectibles are now probably worthless.

Stock Market Today: Stocks Close Flat With Fed Meeting in Focus

It was a choppy start to the week as investors looked ahead to Wednesday afternoon’s policy announcement from the Federal Reserve. Focus is also on the latest slate of initial public offerings (IPOs) about to hit the market, especially in the wake of last week’s blockbuster IPO from chipmaker Arm Holdings (ARM, -4.5%). The… Continue reading Stock Market Today: Stocks Close Flat With Fed Meeting in Focus

Tech stocks will rally through year-end and beyond despite Fed fears as ‘tidal wave’ of AI spending drives new bull market, Wedbush says

AI-driven growth will fuel the tech rally into the year’s end and beyond, Wedbush Securities Dan Ives said. The bull run will continue despite uncertainty over the Fed’s interest rates and an elevated 10-year Treasury yield. Tech spending has been stable in the third quarter, laying the groundwork for further gains Loading Something is loading.… Continue reading Tech stocks will rally through year-end and beyond despite Fed fears as ‘tidal wave’ of AI spending drives new bull market, Wedbush says

Russia’s energy trade is making a comeback amid soaring global oil prices

Russia’s oil and gas trade is on the up after more than a year of struggling in the face of sanctions. The nation is expected to make $7.6 billion this month from oil and gas sales, Reuters estimates. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed… Continue reading Russia’s energy trade is making a comeback amid soaring global oil prices

What Jerome Powell says now matters more than what the Fed actually does

It’s highly unlikely the Federal Reserve will raise interest rates again Wednesday. But traders will be closely eyeing Jerome Powell’s post-decision press conference. The Fed chair is expected to signal that borrowing costs could stay higher for longer, with the fight against inflation not yet over. Loading Something is loading. Thanks for signing up! Access… Continue reading What Jerome Powell says now matters more than what the Fed actually does

The stock market’s current valuation is ‘a really good deal’ for long-term investors trying to build wealth, Wharton professor Jeremy Siegel says

The stock market’s current valuation represents “a really good deal” for investors, according to Wharton professor Jeremy Siegel.The S&P 500 is trading at a forward price-to-earnings ratio of about 19x, slightly above its historical average.Siegel expects the stock market to hold up relatively well into year-end despite high interest rates and a rising US dollar.… Continue reading The stock market’s current valuation is ‘a really good deal’ for long-term investors trying to build wealth, Wharton professor Jeremy Siegel says