Investors seeking out the best consumer discretionary stocks have had a tough time in recent years – and this challenging environment could continue in the near term. Creating uncertainty across the sector is stubbornly high inflation, a rising interest rate environment and anxiety over a potentially larger slowdown or recession in the U.S. economy. Still,… Continue reading Best Consumer Discretionary Stocks to Buy Now

Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Stocks opened lower Thursday before reversing course mid-morning and rallying into the close. Sparking the turnaround were reports that several of the country’s largest banks – including blue chip stocks JPMorgan Chase (JPM (opens in new tab)) and Bank of America (BAC (opens in new tab)) – will provide beaten-down regional lender First Republic Bank… Continue reading Stock Market Today: Stocks Rally on Credit Suisse, First Republic Bank Rescue News

Dow jumps 372 points as US stocks surge on rescue plans for struggling banks

US stocks closed higher Thursday, swinging from earlier losses. First Republic Bank will receive a $30 billion deposit from larger rivals. JPMorgan earlier estimated the Fed’s emergency loan program may inject $2 trillion into the US banking system. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed… Continue reading Dow jumps 372 points as US stocks surge on rescue plans for struggling banks

Home construction unexpectedly surged in February as slump in lumber prices offset pain of rising mortgage rates

US housing starts surged in February, with the upside surprise boosted by falling lumber prices in the month. Construction projects pushed through a period of rising mortgage rates. Lumber prices climbed Thursday to trade above $400 per thousand board feet Thursday. Loading Something is loading. Thanks for signing up! Access your favorite topics in a… Continue reading Home construction unexpectedly surged in February as slump in lumber prices offset pain of rising mortgage rates

Cathie Wood blames the Fed for driving SVB and Signature Bank to collapse

Cathie Wood said the central bank’s tightening campaign was fuel for the banking crisis. In a series of tweets, she described the Fed as the “primary culprit” for SVB’s failure. “I am baffled that banks and regulators could not convince the Fed that disaster loomed.” Loading Something is loading. Thanks for signing up! Access your… Continue reading Cathie Wood blames the Fed for driving SVB and Signature Bank to collapse

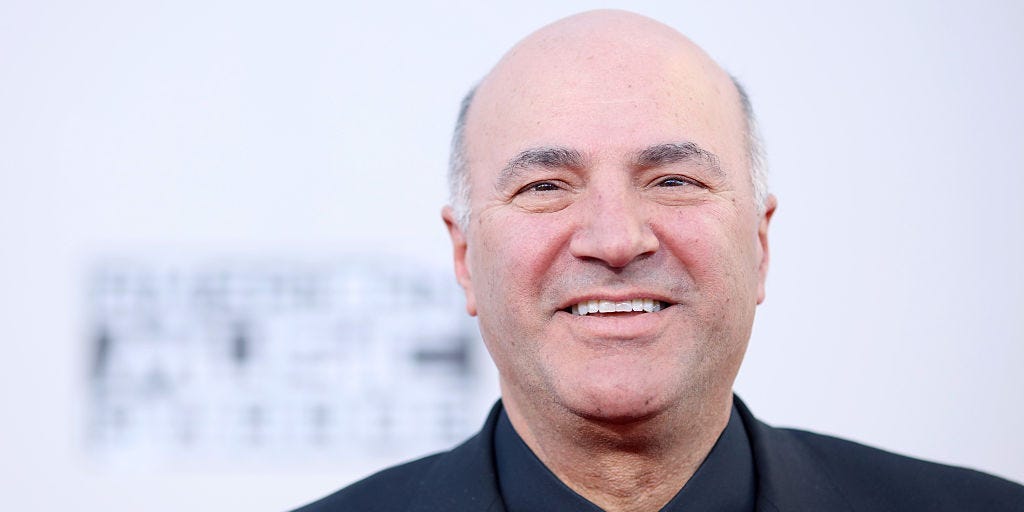

‘Shark Tank’ investor Kevin O’Leary says he’s telling startup CEOs to limit bank deposits and brace for the next ‘black swan idiot’ blowup

“Shark Tank” investor Kevin O’Leary is advising his CEOs to limit their deposits at banks. That comes after the blowup of SVB, which was caused by “idiot” bank managers, O’Leary said. “There’s always the next black swan idiot manager in big and small banks,” O’Leary said. Loading Something is loading. Thanks for signing up! Access… Continue reading ‘Shark Tank’ investor Kevin O’Leary says he’s telling startup CEOs to limit bank deposits and brace for the next ‘black swan idiot’ blowup

Silicon Valley Bank acted like a hedge fund, and ‘they deserve what they got,’ bank analyst says

SVB was a “hedge fund in drag,” taking risky bets at a poor time, Chris Whalen said. But other banks shouldn’t be blamed for losses in their bond portfolios, he told CNBC. Instead, the losses are the Fed’s responsibility after it hiked rates aggressively, he added. Loading Something is loading. Thanks for signing up! Access… Continue reading Silicon Valley Bank acted like a hedge fund, and ‘they deserve what they got,’ bank analyst says

REITs and RELPs give investors commercial real estate exposure, but they are distinctly different vehicles

Chris Warner: Commercial real estate can be an important additional asset class for the right investors Published Mar 15, 2023 • 5 minute read Commercial and residential buildings in Vancouver. Photo by James MacDonald/Bloomberg The best-performing asset class in many portfolios last year was commercial real estate. That was certainly the case for Nicola Wealth… Continue reading REITs and RELPs give investors commercial real estate exposure, but they are distinctly different vehicles