Editor’s note: This is part two of a three-part series about what the economy and markets could look like this year. Part one — “Will Rising Interest Rates Lead to Soft Landing or Recession?” — explored the impact of the Fed’s rate hikes. Part three, coming next week, shares five investment strategies for investors to… Continue reading What the Markets’ New Tailwinds Could Look Like in 2023

Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

CEO Walter Bettinger said inflows grew significantly the day Silicon Valley Bank began to collapse. He also told CNBC that he bought 50,000 shares of Charles Schwab on Tuesday for his personal account. He said Charles Schwab is managed conservatively and has a different business model than regional banks. Loading Something is loading. Thanks for… Continue reading Charles Schwab CEO says clients poured in $4 billion at the height of the SVB panic

US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

Morgan Chittum Michael M. Santiago/Getty Images US stocks closed higher on cooling inflation data as trader shrug off concerns of a potential regional bank crisis. The Dow Jones Industrial Average snapped its five-day losing steak on Tuesday. Elsewhere, bitcoin surged 15% and hit a 9-month high in the morning. Loading Something is loading. Thanks for… Continue reading US stocks rise as bank stocks rebound and CPI shows inflation continues to cool

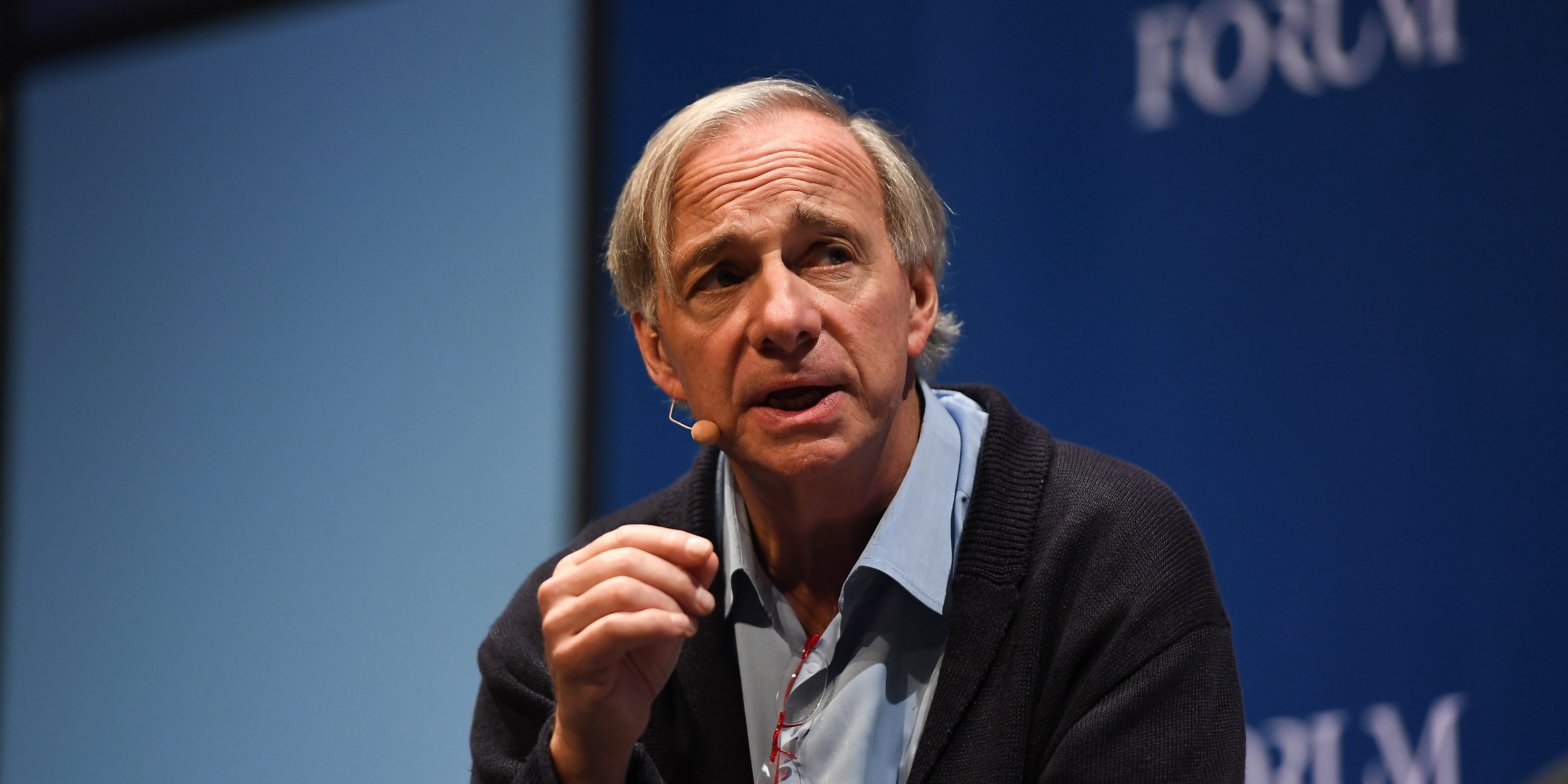

Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world

Ray Dalio said the Silicon Valley Bank failure is a “canary in the coal mine” for what’s to come. Dalio wrote Tuesday that this is part of the classic “bubble-bursting part” of the short-term debt cycle. He explained how it fits into broader historical trends and debt cycles. Loading Something is loading. Thanks for signing… Continue reading Billionaire investor Ray Dalio says the Silicon Valley Bank failure marks a ‘canary in the coal mine’ that will have repercussions beyond the VC world

The Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says

The federal rescue of SVB depositors means all bank deposits are guaranteed, Roger Altman said. If that’s the case, “should the taxpayer allow the shareholders to realize the benefit of that?” He also told CNBC that SVB’s demise signals fragility in finance as well as out-of-date policies. Loading Something is loading. Thanks for signing up!… Continue reading The Silicon Valley Bank rescue means regulators have guaranteed deposits for the entire US financial system, Evercore founder Roger Altman says

SVB’s collapse completely screwed things up for companies with bad credit

The SVB collapse is going to make it a lot more expensive for companies with bad credit to raise capital.The spread on junk-rated bonds relative to US Treasuries has surged to the widest level since December 30.SVB’s fall also eliminates a key source of funding for start-ups that would typically be denied by traditional banks.… Continue reading SVB’s collapse completely screwed things up for companies with bad credit

If a Canadian bank fails, how much do you get back?

What you need to know about how safe your money is In Canada, bank deposits are guaranteed by the Canada Deposit Insurance Corporation up to a certain amount. Photo by Getty Images “Money in the bank” is a phrase that conveys security. But what happens when the bank fails? That’s a question that was brought… Continue reading If a Canadian bank fails, how much do you get back?

How fallout from the SVB collapse could complicate life for some of Canada’s big banks

Especially those with operations in the U.S. Bank buildings in Toronto’s financial district. Photo by Peter J Thompson/National Post files The collapse of Silicon Valley Bank is unlikely to have a significant direct impact on Canada’s Big Six banks, but fallout from the U.S. tech lender’s demise could nevertheless complicate life for those with operations… Continue reading How fallout from the SVB collapse could complicate life for some of Canada’s big banks