Don’t miss: This cash back app pays actual cash A low credit score can cost you thousands in interest — here’s how you can prevent that 5 mistakes Canadian parents are making with their life insurance “When we’re scrolling, we’re being influenced.” Parween Mandar, a certified financial counselor and trauma facilitator, sees the effects that… Continue reading ‘No one’s posting receipts’: How social media FOMO can land you in tens of thousands of debt, and three signs you are in trouble

CRA denies transit employee’s costs from working away from home, gets taken to court

Jamie Golombek: To deduct unreimbursed food and lodging employment expenses, several conditions must be met A Go train at Toronto’s Union Station. Photo by Peter J. Thompson/National Post Some taxpayers try to write off the cost of getting to work as a deductible expense for tax purposes. But other than the odd exceptional case, those… Continue reading CRA denies transit employee’s costs from working away from home, gets taken to court

5 investing red flags from ChatGPT put under the microscope

Peter Hodson: The robots aren’t ready to take over yet Screens displaying the logos of OpenAI and ChatGPT. Photo by Lionel Bonaventure/AFP via Getty Images Let’s call this Artificial Intelligence Week since three giant companies all had significant news on the so-called next big thing. Advertisement 2 This advertisement has not loaded yet, but your… Continue reading 5 investing red flags from ChatGPT put under the microscope

Bank of Canada releases minutes for first time: Read the full text here

Strong jobs market and economic growth led central bank to hike rates, minutes reveal The Bank of Canada issued its “summary of Governing Council deliberations” for the first time on Feb. 8. Photo by David Kawai/Bloomberg Summary of Governing Council deliberations: Fixed announcement date of January 25, 2023 Advertisement 2 This advertisement has not loaded… Continue reading Bank of Canada releases minutes for first time: Read the full text here

Bank of Canada rate hike reflected labour tightness, stronger-than-expected growth

Second rationale was ‘the risk of inflation getting stuck somewhere above 2%’ Author of the article: Reuters Steve Scherer and David Ljunggren Published Feb 08, 2023 • 2 minute read 6 Comments Bank of Canada governor Tiff Macklem during a news conference in Ottawa. Photo by Justin Tang/Bloomberg files OTTAWA — The Bank of Canada… Continue reading Bank of Canada rate hike reflected labour tightness, stronger-than-expected growth

Stocks With the Highest Dividend Yields in the S&P 500

Experienced equity income investors know that blindly buying stocks with the highest dividend yields can be a dangerous game. Indeed, an unusually high dividend yield can actually be a warning sign. That’s because stock prices and dividend yields move in opposite directions. It’s possible that a too-good-to-be-true dividend yield is simply a side effect of… Continue reading Stocks With the Highest Dividend Yields in the S&P 500

Stock Market Today: Stocks Fall After Fed Speeches

Selling on Wall Street resumed Wednesday, with the major benchmarks spending the entirety of the session in negative territory. In focus today were speeches from several Federal Reserve officials – especially following Fed Chair Jerome Powell’s message yesterday that indicated the central bank’s fight against inflation is far from over. The latest batch of earnings… Continue reading Stock Market Today: Stocks Fall After Fed Speeches

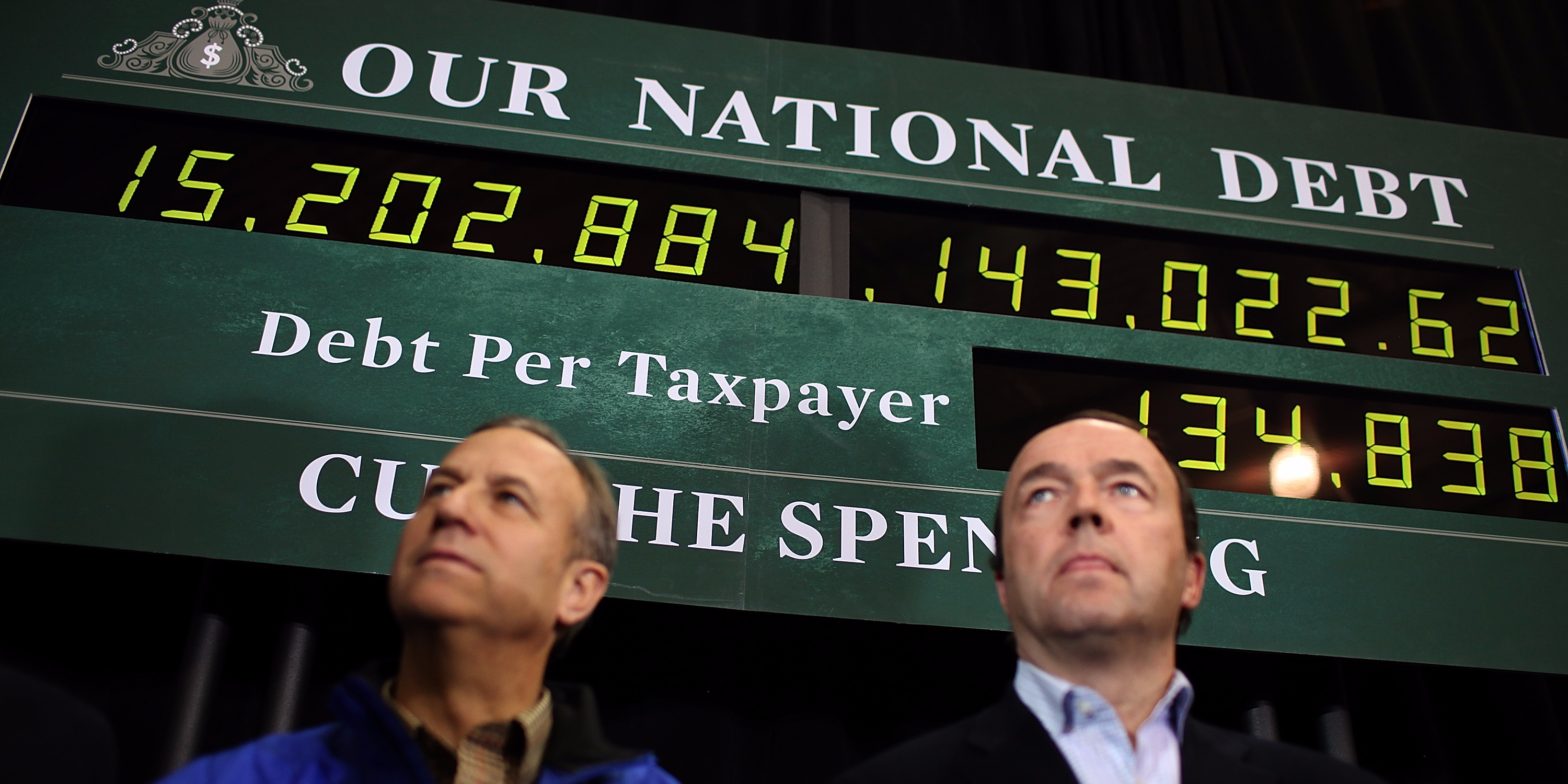

Fears of a US debt crisis are ‘imaginary’, and what the economy needs is more investment in critical infrastructure, economist says

A US debt crisis is an “imaginary” fear, and policymakers should focus on “real” problems, UC Berkeley economist Barry Eichengreen said. He stressed the importance of investment, which could stimulate the economy and lighten the debt burden. “Those who imagine an imminent debt crisis are making much ado about nothing.” Loading Something is loading. Thanks… Continue reading Fears of a US debt crisis are ‘imaginary’, and what the economy needs is more investment in critical infrastructure, economist says