Ottawa’s inconsistent commitment to fiscal prudence is beginning to trouble some members of the Liberal family Published Jan 28, 2023 • Last updated 20 hours ago • 5 minute read 23 Comments Deputy Prime Minister and Minister of Finance Chrystia Freeland testifies at the Public Order Emergency Commission in Ottawa. Photo by Blair Gable/Reuters files A… Continue reading Friends of the Liberal government are adding to the pressure on Freeland to constrain spending

Bank of Canada signals rate hike pause: Here are the week’s top 7 stories

Watch Financial Post reporter Stephanie Hughes count down the stories that made headlines Tiff Macklem raised interest rates this week; CN Rail warned 2023 might prove rocky for earnings; Chrystia Freeland promised the next budget will be fiscally prudent. Photo by Wire services Stephanie Hughes, finance reporter for the Financial Post, walks you through the… Continue reading Bank of Canada signals rate hike pause: Here are the week’s top 7 stories

Canada has $300-billion cash buffer to soften blow of coming recession, says RBC’s CEO

Dave McKay says ‘unprecedented liquidity’ will provide powerful stimulus for recovery RBC chief executive Dave McKay, in an interview with BNN Bloomberg, said Canada is headed for a slowdown as higher interest rates designed to curb inflation slow consumer spending. Photo by Al Charest/Postmedia “Unprecedented liquidity” in the market will buoy Canada’s economy as it… Continue reading Canada has $300-billion cash buffer to soften blow of coming recession, says RBC’s CEO

Jack Mintz: A ‘just transition’ out of energy? Ask the people of Hanna about that

Ottawa’s agenda is to replace lost jobs with jobs that are sustainable jobs, but not necessarily well-paying Published Jan 26, 2023 • Last updated 1 day ago • 4 minute read 47 Comments Labour Minister Seamus O’Regan speaking during a news conference in Ottawa. Photo by Adrian Wyld/THE CANADIAN PRESS files The talk of the town… Continue reading Jack Mintz: A ‘just transition’ out of energy? Ask the people of Hanna about that

5 things to remember when the company you invested in goes bankrupt

Peter Hodson: A bankruptcy is devastating, but it would be a mistake to let it put you off investing for good Xebec Adsorption Inc. was a a once-popular $1.4-billion company in the clean-energy space that surprised many investors by filing for bankruptcy protection last September. Photo by Pierre Obendrauf/The Gazette Have you ever had one… Continue reading 5 things to remember when the company you invested in goes bankrupt

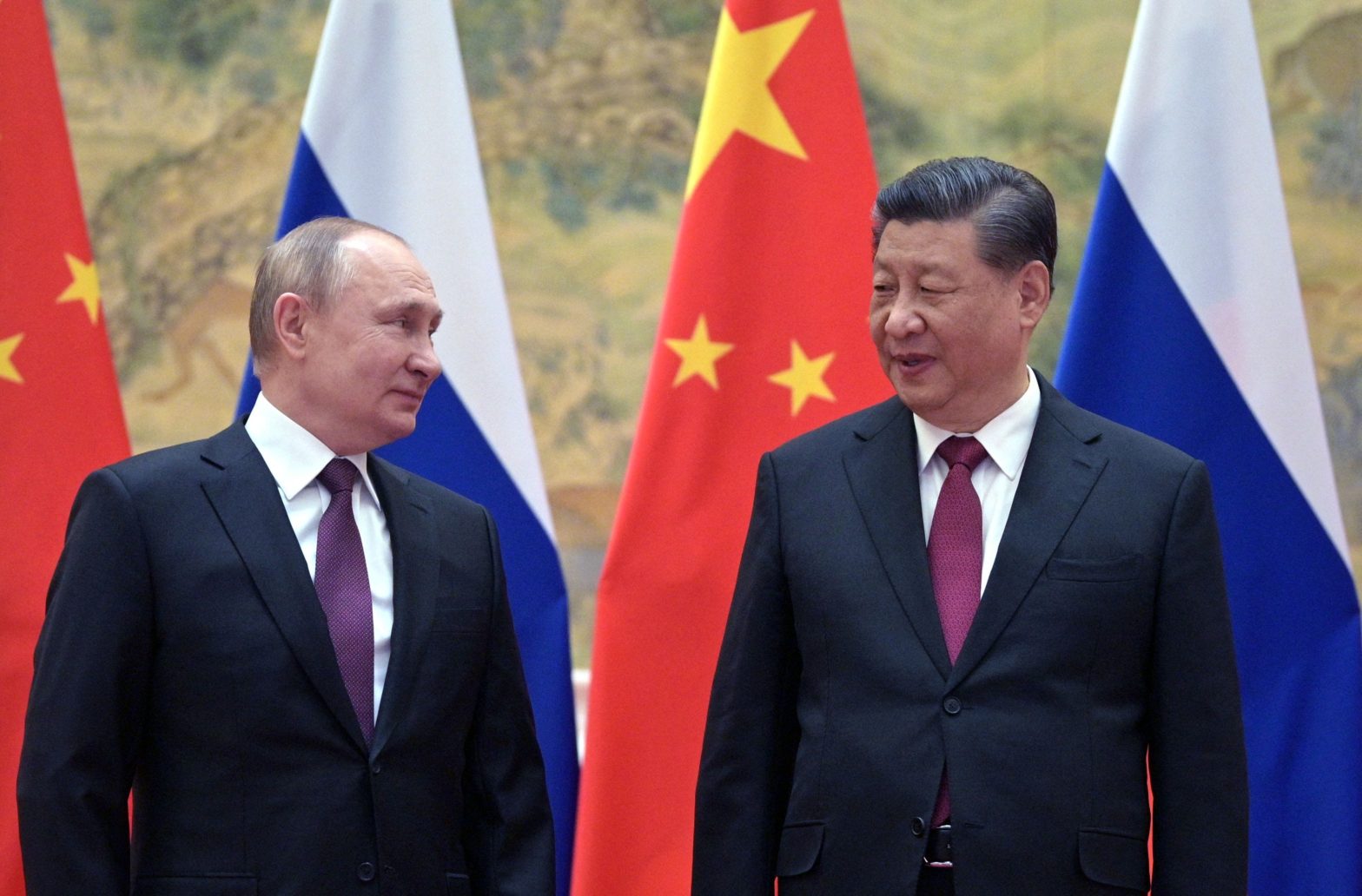

Russia and Iran plan a gold-backed stablecoin, while Brazil and Argentina seek a shared currency. Here are 5 rising threats to the dollar’s dominance of global trade.

Zahra Tayeb The dollar’s dominance of global trade and reserves is facing several new threats. Getty Images The dollar’s supremacy in global trade faces fresh challenges as several countries float plans to use local currencies in commerce. Russia and Iran are working to create a gold-backed stablecoin, while China is increasingly using the yuan in… Continue reading Russia and Iran plan a gold-backed stablecoin, while Brazil and Argentina seek a shared currency. Here are 5 rising threats to the dollar’s dominance of global trade.

Russia faces new sanctions on its energy exports – but this time China and India may not come to Putin’s rescue

The European Union’s upcoming ban on Russian oil products could spell more turmoil for the Kremlin. China and India are unlikely to buy refined Russian fuels that were once sold to the EU, which will ban them on February 5. That’s in contrast to Russian crude oil, which were snapped up by China and India… Continue reading Russia faces new sanctions on its energy exports – but this time China and India may not come to Putin’s rescue

Inflation has cooled, but investors risk being caught off guard by a ‘head fake’ that could kill the latest stock-market rally

Stocks are off to a strong start in 2023 after last year’s selloff, with cooling inflation a pillar of support. But there’s stickiness in services inflation, and that poses downside risks for equities, analysts said. Wage growth has eased but an even slower pace would suit the Fed’s inflation-fighting goal. Loading Something is loading. Thanks… Continue reading Inflation has cooled, but investors risk being caught off guard by a ‘head fake’ that could kill the latest stock-market rally