With the southeast U.S. and the Caribbean in the middle of hurricane season, the top priority is revered for helping the elderly and infirm and keeping home and business structures safe when a major storm approaches. Hurricane season, defined as between June 30 and Nov. 30 in 2022, can also wreak havoc on a household’s… Continue reading Keeping Financial Documents Safe in a Hurricane

Goldman, Other Banks Are Paying More for Your Money

Inflation, which is at its highest for 40 years, is a headache for consumers. From food to gasoline to just about everything else, inflation is burning household budgets. Aware of how reduced household spending could hobble the economy — consumption is, after all, the engine of American growth — the Federal Reserve has started to raise interest… Continue reading Goldman, Other Banks Are Paying More for Your Money

Realty Income Off for 6th Week as Yield Swells; Here’s the Chart

Realty Income (O) does not like the rising rate environment, particularly when it comes amid worries about the real estate market and amid the broad bear market in equities. Here’s Bank of America’s favorite REITs, by the way. The Federal Reserve continues to raise rates, most recently by 0.75 percentage point. At the same time,… Continue reading Realty Income Off for 6th Week as Yield Swells; Here’s the Chart

Home Prices Start to Slip as Mortgage Rates Soar

It looks like the tide might be gradually starting to turn for the housing market. The S&P CoreLogic Case-Shiller Home Price Index dipped 0.3% in July from June, the largest monthly decline since November 2014. To be sure, prices soared 15.8% in the 12 months through July, but that’s still a slowdown from 18.1% in… Continue reading Home Prices Start to Slip as Mortgage Rates Soar

David Rosenberg: Make no mistake, the Fed is guiding us into a credit crunch

Tightening into monetary contraction, a soaring dollar and a deeply inverted yield curve are prelude to market crash U.S. Federal Reserve chair Jerome Powell has hiked interest rates aggressively, just about the most on record in a short period. Photo by REUTERS/Kevin Lamarque There is no way the current unrest is about the consumer or… Continue reading David Rosenberg: Make no mistake, the Fed is guiding us into a credit crunch

Liz Truss tax cuts unleash $500 billion U.K. market selloff

Pound falls to record low amid chatter about emergency action by the Bank of England Author of the article: Bloomberg News Sagarika Jaisinghani The new prime minister of the U.K., Liz Truss, has implemented a series of tax cuts she promised during her campaign to take over from Boris Johnson. Photo by Getty Images The… Continue reading Liz Truss tax cuts unleash $500 billion U.K. market selloff

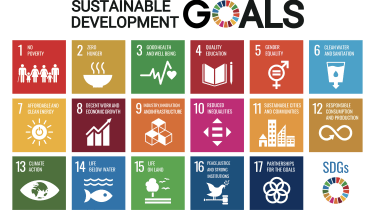

This New Sustainable ETF’s Pitch? Give Back Profits. | Kiplinger

investing Newday’s ETF partners with UNICEF and other groups.Feel like society and the environment are beginning to break down? There’s an ETF for that. Newday Impact’s Sustainable Development Goals ETF (SDGS) delivers a growth-oriented product that promotes dual impact, promising to advocate for environmental and social improvements and donating 10% of revenues to global youth… Continue reading This New Sustainable ETF’s Pitch? Give Back Profits. | Kiplinger

UK finance minister will meet with Wall Street banks after the newly unveiled mini-budget sparked panic in markets and sent the pound plummeting

The UK Chancellor of the Exchequer Kwasi Kwarteng is scheduled to meet with Wall Street execs, Wednesday. Kwarteng is conducting outreach about the UK’s newly announced mini-budget, Bloomberg reported. The pound dropped to a record low with investors spooked by the plan that includes £45 billion in tax cuts. Loading Something is loading. The UK’s… Continue reading UK finance minister will meet with Wall Street banks after the newly unveiled mini-budget sparked panic in markets and sent the pound plummeting