Warren Buffett is famous for saying “Only when the tide goes out do you discover who’s been swimming naked.” If you invested in cybercoins, the news has not been good lately. Are you wearing your bathing suit? What to do? Is time to take your profits … or cut your losses? The international investment community… Continue reading Cryptocurrency: Stay In? Get Out? How to Decide? | Kiplinger

Stock Market Today: Dow Plummets 486 Points, Nears Bear Market | Kiplinger

Stock Market Today The selling wasn’t confined to the equities market, with crude oil, gold and Bitcoin all suffering steep losses.The stock market took another step lower Friday, as Treasury yields continued to rise to levels not seen in over a decade. Today’s drop brought the Dow below the important 30,000 mark and this close… Continue reading Stock Market Today: Dow Plummets 486 Points, Nears Bear Market | Kiplinger

Bonds are in the midst of the worst crash since 1949, and its set to unravel some of the market’s most crowded trades, Bank of America says

The worst bond market decline since 1949 is set to disrupt the stock market, according to Bank of America.The bank said soaring interest rates will unwind the most crowded trades in the stock market, including long US tech.”Bond crash in recent weeks means highs in credit spreads, lows in stocks are not yet in,” BofA… Continue reading Bonds are in the midst of the worst crash since 1949, and its set to unravel some of the market’s most crowded trades, Bank of America says

Investors may soon be able to replicate stock trades by Republican and Democratic lawmakers with the NANC and CRUZ ETFs

Two proposed exchange-traded funds would mimic stock trades made by members of Congress and their spouses. If approved, the ETFs would track trades by Democrats and Republicans, under tickers NANC and CRUZ. One poll shows 70% of likely voters in America do not want lawmakers to trade stocks while in office. Loading Something is loading.… Continue reading Investors may soon be able to replicate stock trades by Republican and Democratic lawmakers with the NANC and CRUZ ETFs

Crypto parties are still raging in the bear market. Here’s what it’s like at Mainnet, where tickets cost $2,100 and attendees network on yachts.

Crypto enthusiasts, Web3 founders, and investors convened at Messari Mainnet in New York City this week. The tone was firmly upbeat, despite bitcoin, ether, and other digital assets struggling through a bear market. Here’s a look inside the event from Insider’s Phil Rosen. Loading Something is loading. The Messari Mainnet crypto conference in New York… Continue reading Crypto parties are still raging in the bear market. Here’s what it’s like at Mainnet, where tickets cost $2,100 and attendees network on yachts.

These 50 quality cheap stocks will deliver strong returns on capital as high inflation and interest rates crush valuations, according to Goldman Sachs

High quality stocks have lagged their lower-quality peers so far this year. History suggests that investors will start to choose quality as financial conditions tighten. Goldman Sachs shared 50 quality stocks that appear to have room to rise. In theory, this year’s ugly market environment should have caused investors to flee to the safety of… Continue reading These 50 quality cheap stocks will deliver strong returns on capital as high inflation and interest rates crush valuations, according to Goldman Sachs

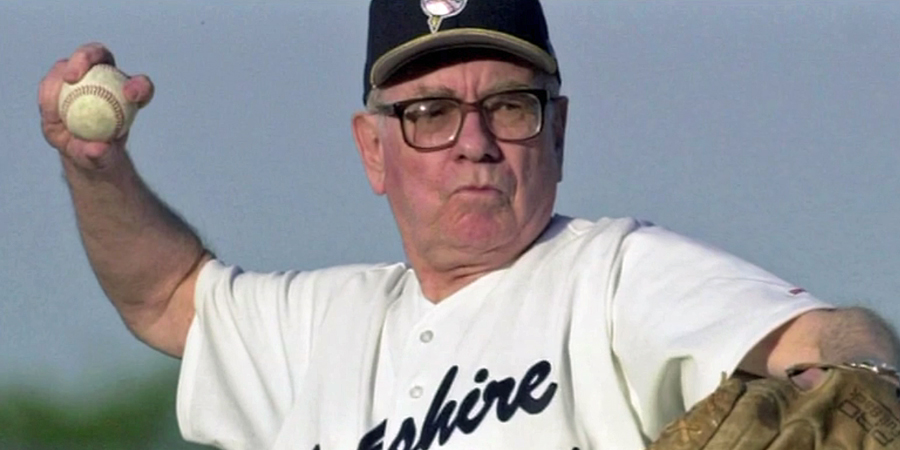

‘Moneyball’ manager Billy Beane says Warren Buffett’s investing lessons apply to baseball too – and Seth Klarman agrees

“Moneyball” star Billy Beane said Warren Buffett and Charlie Munger’s lessons apply to baseball. The ex-Oakland Athletics manager excelled at finding undervalued players and besting richer teams. Baupost CEO Seth Klarman recently described “Moneyball” as a value-investing book. Loading Something is loading. Warren Buffett and Charlie Munger preach a “value investing” philosophy centered on identifying… Continue reading ‘Moneyball’ manager Billy Beane says Warren Buffett’s investing lessons apply to baseball too – and Seth Klarman agrees

A Tax Filing Factsheet for eBay Sellers

Not All eBay Sales are subject to income taxNot every eBay sale is subject to income tax, but most are. If you use the site to get rid of household articles you’ve used in the past, you may qualify for the “occasional garage or yard sale” treatment. According to the IRS, if your online auction… Continue reading A Tax Filing Factsheet for eBay Sellers