Retirement Daily’s Robert Powell caught up with Jeffrey Levine, CPA and tax pro from Buckingham Strategic Wealth Partners to discuss three ways to minimize the tax consequences of rebalancing. TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to… Continue reading 3 Ways to Minimize Tax Consequences of Rebalancing

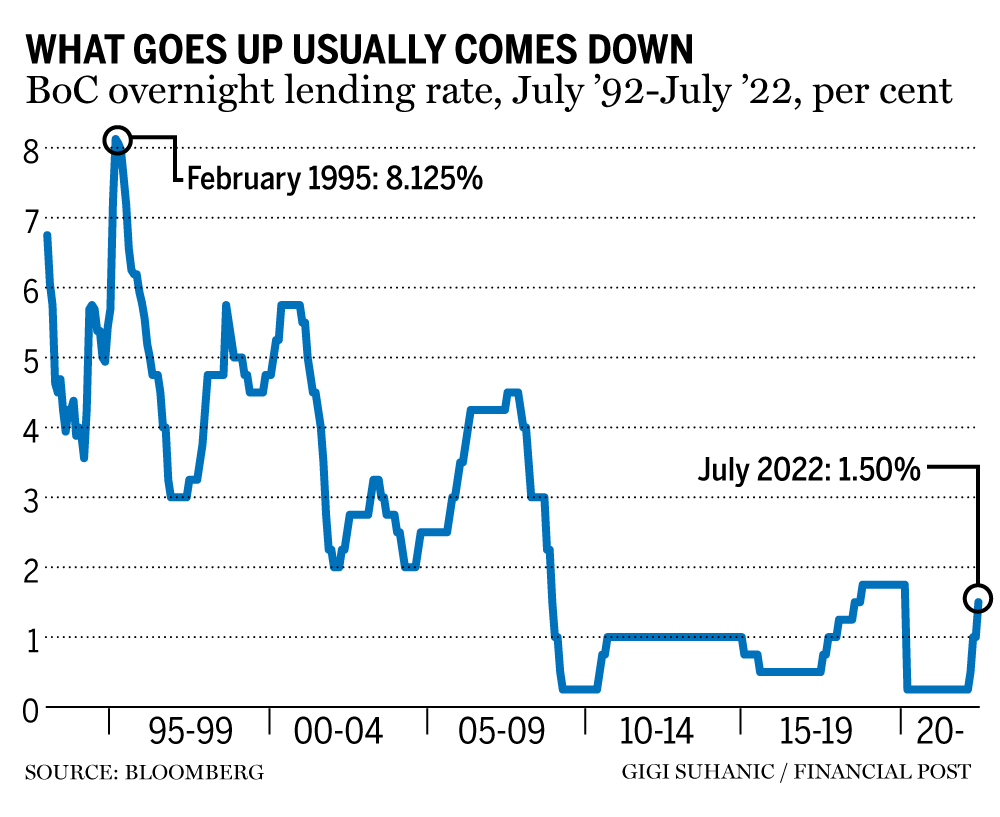

Interest rates are still rising, but investors should start preparing for when they come back down

Variable rates will likely be a benefit once again in the midterm Publishing date: Jul 12, 2022 • 1 day ago • 5 minute read • 8 Comments The Bank of Canada in Ottawa. Photo by Justin Tang/Bloomberg files The Bank of Canada over the past 30 years has had six periods of interest-rate hikes, ranging… Continue reading Interest rates are still rising, but investors should start preparing for when they come back down

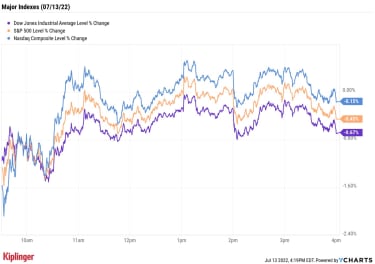

Stock Market Today: Scorching CPI Sends Stocks on Roller-Coaster Ride | Kiplinger

Another red-hot reading on inflation sparked a volatile session for stocks on Wednesday. Specifically, data released from the Labor Department this morning showed the consumer price index (CPI) jumped 1.3% month-over-month in June. On an annualized basis, consumer prices were up 9.1% – outpacing May’s 8.6% spike and marking the fastest year-over-year (YoY) rise since… Continue reading Stock Market Today: Scorching CPI Sends Stocks on Roller-Coaster Ride | Kiplinger

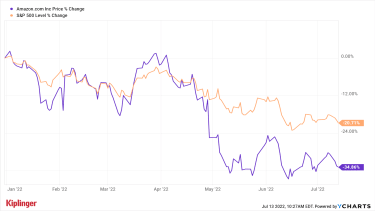

Amazon Prime Day’s Biggest Steal Might Be AMZN Stock | Kiplinger

Amazon.com’s (AMZN, $109.22) Prime Day is upon us once again. Alas, the frenzy of savings, discounts and deals on millions of items offered by the e-commerce giant is open only to Amazon Prime subscribers. Happily for investors, however, AMZN stock is as much on sale as anything to be found on the retailer’s website (which… Continue reading Amazon Prime Day’s Biggest Steal Might Be AMZN Stock | Kiplinger

With Markets Down, Is Now the Time for Young People to Invest? | Kiplinger

investing Many younger investors have never experienced stock market volatility and are wondering if they should buy now or steer clear. Answering these three questions could tell them what they need to know.“Should I invest some of the cash I’ve been sitting on?” I work with several successful young professionals who have done well in… Continue reading With Markets Down, Is Now the Time for Young People to Invest? | Kiplinger

Stock Market Today: Stocks End Lower Ahead of Major Inflation Update | Kiplinger

Broader markets bounced around Tuesday as investors waited for guidance from a pair of impending market catalysts: the latest inflation data and the start of second-quarter earnings season. As for tomorrow morning’s release of the June consumer price index (CPI), “it does seem that the market is pretty well prepared for a hot number at… Continue reading Stock Market Today: Stocks End Lower Ahead of Major Inflation Update | Kiplinger

US stocks fall as hot inflation report raises odds of steeper rate hikes while Fed survey highlights growing recession fears

Stocks closed lower following the June inflation report, which came in hotter than expected. Core CPI, which excludes food and energy prices, came in at 5.9%, above the expected 5.7%. The IMF said it will lower its global growth forecast for this month as global risks rise. Loading Something is loading. US stocks fell on… Continue reading US stocks fall as hot inflation report raises odds of steeper rate hikes while Fed survey highlights growing recession fears

Oil prices could surge above $150 if Russian supplies can’t be replaced, says Truist analyst

Jennifer Sor AN FRANCISCO – MAY 5: Gas prices are displayed at a Shell station May 5, 2008 in San Francisco, California. U.S. gas prices have shot up nearly fifteen cents in the past two weeks, bringing the national average price for a gallon of regular unleaded gasoline to $3.62. Gasoline prices have surged 55… Continue reading Oil prices could surge above $150 if Russian supplies can’t be replaced, says Truist analyst