Short seller bets against REITs that own big server warehouses on risks that customers will become rivals Author of the article: Financial Times Harriet Agnew in London Short-seller Jim Chanos has built a career out of trying to identify corporate disasters-in-the making. Photo by Patrick Fallon/Bloomberg files Short seller Jim Chanos is betting against “legacy”… Continue reading Hedge fund manager Jim Chanos’s next ‘big short’ is data centres

Shopify shares fall 6% after 10-for-1 stock split finalized

The latest in a parade of tech-stock splits as companies in the beleaguered sector try to attract investors Author of the article: Bloomberg News Stefanie Marotta The Shopify Inc. headquarters in Ottawa. Photo by David Kawai/Bloomberg files Shopify Inc. shares fell after the Canadian e-commerce giant completed a 10-for-1 split of its common stock on… Continue reading Shopify shares fall 6% after 10-for-1 stock split finalized

David Rosenberg: The stock market is signalling that a recession is coming

The only questions are how deep and how long Traders work on the floor of the New York Stock Exchange. Photo by Spencer Platt/Getty Images files By David Rosenberg and Brendan Livingstone Advertisement 2 This advertisement has not loaded yet, but your article continues below. The stock market, which led the economy out of the… Continue reading David Rosenberg: The stock market is signalling that a recession is coming

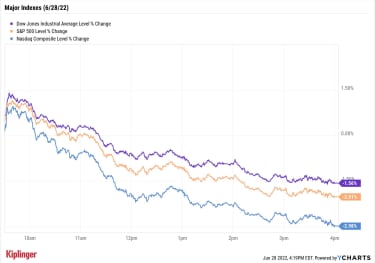

Stock Market Today: Weak Data Opens Trap Door Under Stocks | Kiplinger

Stock Market Today Slack in manufacturing data and low consumer confidence tanked early-session optimism and left the major indexes with deep losses Tuesday.Stocks started the day on solid footing as investors cheered reports that China is easing back its COVID-related restrictions by reducing the quarantine period for international travelers coming into the country to 10… Continue reading Stock Market Today: Weak Data Opens Trap Door Under Stocks | Kiplinger

Russian oil products may be increasingly headed to Saudi Arabia via Egypt

Increasing volumes of Russian oil products are appear to be landing in Saudi Arabia by way of Egypt, Bloomberg reported. While Egypt exported fuels to Saudi Arabia before Russia invaded Ukraine, Saudi Arabia is now taking 3.2 million barrels of power station fuel from Egypt this month, according to data from Vortexa cited by Bloomberg,… Continue reading Russian oil products may be increasingly headed to Saudi Arabia via Egypt

Oil is likely to hit $200 a barrel under the disastrous G7 plan to cap Russian prices, an SEB analyst says

Oil prices are likely to surge to above $200 if the G7 implements plans to cap the price of Russian crude and products, according to an analyst at Swedish bank SEB. Bjarne Schieldrop said Wednesday that the plans were a “recipe for disaster”, given the high levels of stress in the oil market, where prices… Continue reading Oil is likely to hit $200 a barrel under the disastrous G7 plan to cap Russian prices, an SEB analyst says

Legendary investor Jim Chanos is raising over $200 million for a ‘big short’ against data centers

Jim Chanos is raising more than $200 million for a fund that will bet against US-listed real estate investment trusts (REITs), the Financial Times reported this week. The famed short seller is deeply bearish on REITs that own legacy data centers, as he expects them to be disrupted by their biggest tenants: Amazon, Alphabet, and… Continue reading Legendary investor Jim Chanos is raising over $200 million for a ‘big short’ against data centers

The US will avoid stagflation and will suffer milder ‘slowflation’ instead, because inflation has already peaked: UBS

The US is likely to dodge stagflation and will suffer “slowflation” instead, which history shows is a better environment for stocks, according to UBS strategists. Stock markets have faltered in 2022 as investors grappled with inflation fears and the prospect of stalled growth, uncertain as to how deep the economic pain will be. One keen… Continue reading The US will avoid stagflation and will suffer milder ‘slowflation’ instead, because inflation has already peaked: UBS