The latest news out of the housing market isn’t good. Mortgage rates are soaring, and sales are dropping. The one puzzler is what’s happening with prices. The 30-year fixed-mortgage rate averaged 5.81% as of June 23, hitting a near-14-year-high, according to Freddie Mac. The rate rose from 5.78% last week, when it registered its biggest… Continue reading Something Strange is Happening With Home Prices

Inflation Wallops Consumer Budgets

Inflation is roaring, with consumer prices soaring 8.6% in the 12 months through May, a 40-year high. It’s no great surprise that this surge is having an impact on consumer spending. Indeed, inflation is forcing 85% of Americans to change their buying habits, according to a Forbes Advisor survey. “Non-essential items have been hit the… Continue reading Inflation Wallops Consumer Budgets

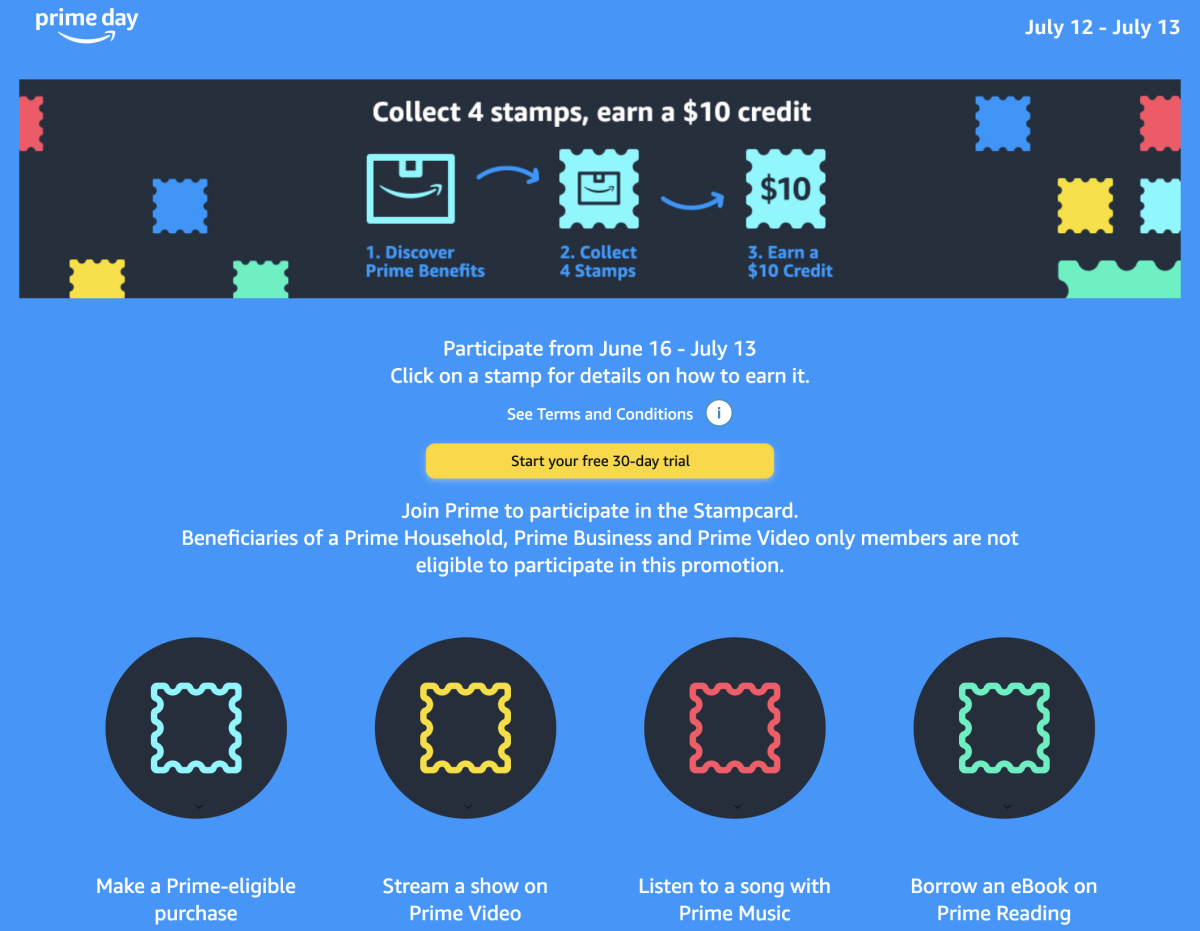

Get a $10 Credit for Using Your Amazon Prime Benefits

Whether you’re an existing Prime Member or brand new, you can get a $10 credit for using four features you get with the membership. Amazon The Arena Media Brands, LLC and respective content providers to this website may receive compensation for some links to products and services on this website. So yes, Prime Day — Amazon’s… Continue reading Get a $10 Credit for Using Your Amazon Prime Benefits

How Can it Be ‘Retirement’ if You Have to Keep Working?

In a post-Covid world, Americans have altered their lifestyles, their careers, and their futures. One byproduct of that generational realignment is the willingness, or need, to keep working in retirement. Increasingly, more Americas closing in on retirement expect to work during their “Golden Years”. According to Allianz Life Insurance Company of North America’s 2022 Retirement… Continue reading How Can it Be ‘Retirement’ if You Have to Keep Working?

A dose of much-needed optimism amid all the market negativity

Tom Bradley: I spent three days outside of my comfort zone at a tech conference and came away with a lot to think about Attendees at a tech conference. Innovators are working on things that will make the world better, writes Tom Bradley. Photo by Benoit Tessier/Reuters files I attended the Collision tech conference in… Continue reading A dose of much-needed optimism amid all the market negativity

FP Answers: I had a heart attack 5 years ago and recently retired. What are some tips for a good drawdown strategy?

Taxes will be Marko’s biggest expense in retirement Minimizing taxes will help maximize tax credits and potentially avoid OAS clawbacks. Photo by Getty Images/iStockphoto By Julie Cazzin with Allan Norman Advertisement 2 This advertisement has not loaded yet, but your article continues below. Q: I am 67 and my wife is 62. I’m newly retired… Continue reading FP Answers: I had a heart attack 5 years ago and recently retired. What are some tips for a good drawdown strategy?

‘This too shall pass:’ Why Brian Belski is still upbeat on stocks

This advertisement has not loaded yet, but your article continues below. Watch BMO Capital Markets chief strategist on how the rising tide will return to equities Brian Belski, chief investment strategist at BMO Capital Markets, says the rising tide will lift equities higher by the end of the year. Photo by Kevin Van Paassen/Bloomberg Article… Continue reading ‘This too shall pass:’ Why Brian Belski is still upbeat on stocks

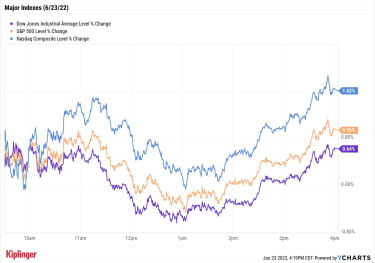

Stock Market Today: Safety-Seeking Investors Drive Stocks Higher | Kiplinger

Stock Market Today Investors piled into bonds and yield-bearing sectors such as utility stocks and consumer staples Thursday as the economy’s fate continues to be shrouded in uncertainty.Defensive stocks and the Nasdaq were in rare alignment, leading the way Thursday as much of Wall Street watched Federal Reserve Chair Jerome Powell continue his economic tightrope… Continue reading Stock Market Today: Safety-Seeking Investors Drive Stocks Higher | Kiplinger