Stock market rules laid out by a Wall Street legend are ringing true decades later amid the ongoing sell-off. Bob Farrell of Merill Lynch wrote these investing rules in 1998 when tech stocks dominated the market. These are his 10 stock market rules to remember as investors grapple with rising inflation and higher interest rates.… Continue reading A Wall Street legend’s 10 market rules are still relevant decades later as stocks buckle under soaring inflation and higher interest rates, Bank of America says

Tesla could get an ESG boost from the SEC’s greenwashing crackdown but funds will still have plenty of wiggle room

The SEC is trying to rein in so-called greenwashing that mislead investors about a fund’s holdings. The regulator recently offered new proposals that would tighten rules on how funds are named and boost disclosure requirements. But the proposals still leave companies with ample room to define ESG goals for themselves, a lawyer says. Loading Something… Continue reading Tesla could get an ESG boost from the SEC’s greenwashing crackdown but funds will still have plenty of wiggle room

The stock market’s plunge is ending, and investors should buy these 15 stocks that will outperform in the rally that follows, Evercore ISI says.

After falling almost 20% in the last few months, stocks have surged over the last week. Evercore strategist Julian Emanuel says there are some signs the rally will keep going. He says that if a bear market is avoided, hard-hit but highly profitable stocks will outperform. Nobody wants to be premature and say the stock… Continue reading The stock market’s plunge is ending, and investors should buy these 15 stocks that will outperform in the rally that follows, Evercore ISI says.

‘Big Short’ investor Michael Burry predicts a consumer recession — and warns companies face more woe

Michael Burry predicted a consumer recession and more pressure on company profits. People are saving less, borrowing more, and have spent what they saved during the pandemic, he said. “The Big Short” investor expects those trends to weigh on consumer spending and corporate results. Loading Something is loading. Americans are saving less, borrowing more, and… Continue reading ‘Big Short’ investor Michael Burry predicts a consumer recession — and warns companies face more woe

Investors may be hoping for a ‘Fed pause’ to save them from higher interest rates, but that would be a big policy mistake, Mohamed El-Erian says

The Fed making “stop-go” moves in raising interest rates would be a major policy error, economist Mohamed El-Erian told Bloomberg. The notion of a “Fed pause” has gained footing among equity investors in recent weeks. The best investors can hope for is a “soft-ish” landing for the US economy, he said. Loading Something is loading.… Continue reading Investors may be hoping for a ‘Fed pause’ to save them from higher interest rates, but that would be a big policy mistake, Mohamed El-Erian says

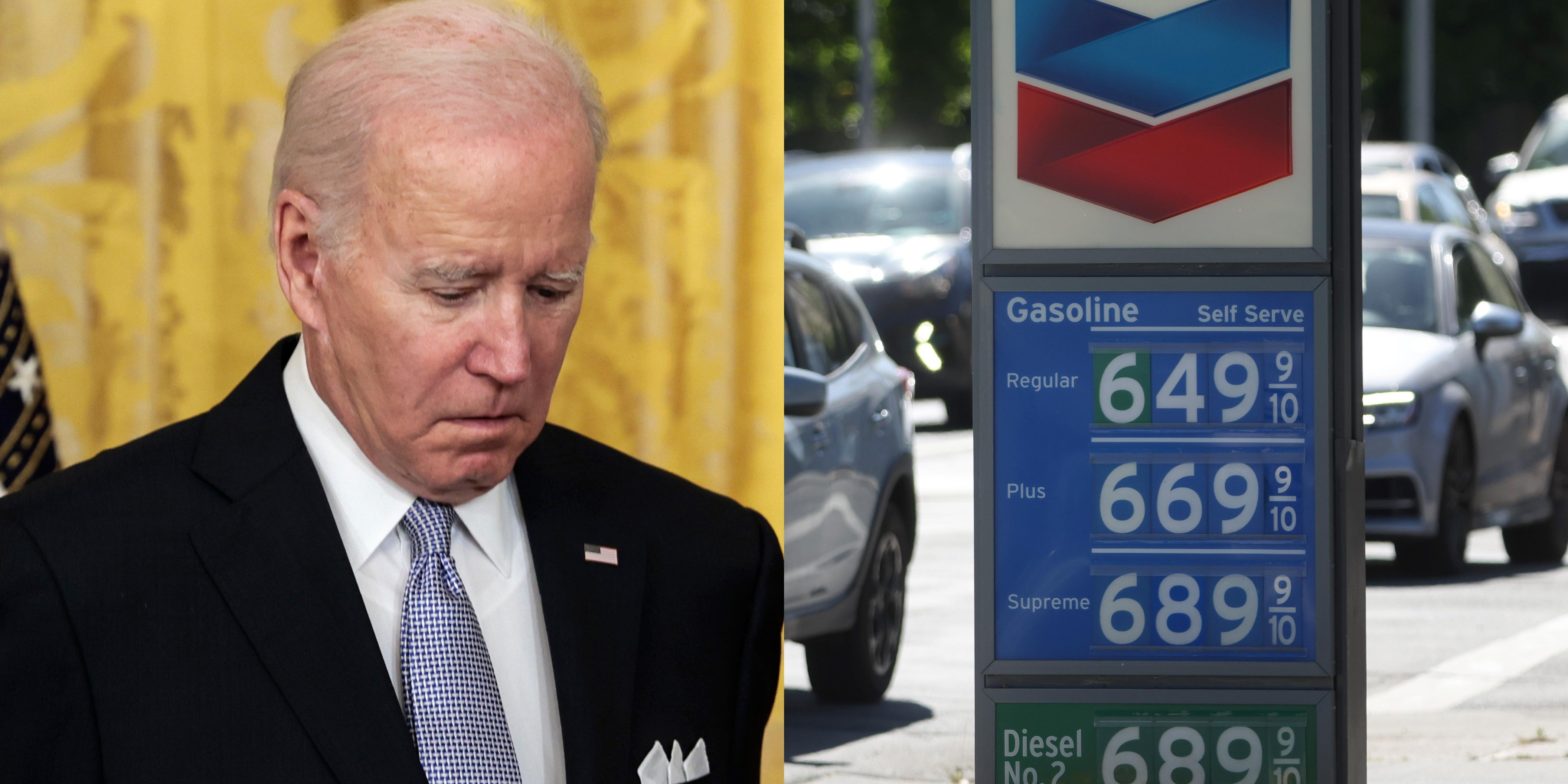

Gas prices have hit record highs but don’t expect Biden to lower them: ‘They already used their biggest bullet’

President Biden is scrambling to lower gas prices ahead of the midterm elections, but he has few tools to do so. US gas prices have hit records, and the strategic petroleum release won’t be able to bring them down. “There are very few tools the US administration has because the biggest driver for gasoline prices… Continue reading Gas prices have hit record highs but don’t expect Biden to lower them: ‘They already used their biggest bullet’

Jeremy Grantham, Michael Burry, and other market gurus expect stocks to plunge further. Here’s a roundup of their latest comments.

Theron Mohamed Jeremy Grantham. Alison Yin/AP Images for DivestInvest Jeremy Grantham, Michael Burry, and other market gurus expects stocks to fall further. Grantham and Burry both forecast the S&P 500 will drop by at least another 50%. David Rosenberg expects a 19% fall in the benchmark index from its current level. Loading Something is loading.… Continue reading Jeremy Grantham, Michael Burry, and other market gurus expect stocks to plunge further. Here’s a roundup of their latest comments.

A 29-year-old who built up a net worth of more than $1 million and quit his day job shares the savings and investing strategies he used

Tyler Wright increased his day job income from $30,000 a year to $250,000 in six years. He saved and invested most of his money, up to 80%, in the stock market and real estate. At 29, he’s worth over $1 million, owns three properties, and quit his job to run his own business. Tyler Wright’s… Continue reading A 29-year-old who built up a net worth of more than $1 million and quit his day job shares the savings and investing strategies he used