ETFs Low-volatility funds like the Legg Mason Low Volatility High Dividend ETF have held up well during this year’s market turbulence.Low-volatility funds, which aim to offer a smoother ride, are living up to their name. Since the start of the year, U.S. stock funds with low-volatility strategies have dipped 7.7% on average, while the S&P… Continue reading Legg Mason Low Volatility High Dividend ETF (LVHD) Pays Off | Kiplinger

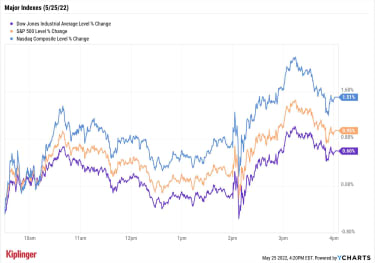

Stock Market Today: Nasdaq Jumps as Fed Minutes Fail to Flame Fears | Kiplinger

U.S. equities enjoyed a broad pop Wednesday following the release of minutes from the Federal Reserve’s most recent meeting, which showed that the central bank’s decisionmakers were willing to be both aggressive but flexible in the face of both inflationary and recessionary pressures. Much of what the Federal Open Market Committee said in the minutes… Continue reading Stock Market Today: Nasdaq Jumps as Fed Minutes Fail to Flame Fears | Kiplinger

Bond Values in a Volatile Market | Kiplinger

Investing for Income While the market’s instability may not be over just yet, the latter half of the year should be less daunting – and possibly more rewarding – for investors.Steel yourself for six more months of instability. The model: In May, the Federal Reserve hiked short-term interest rates by half a percentage point, the… Continue reading Bond Values in a Volatile Market | Kiplinger

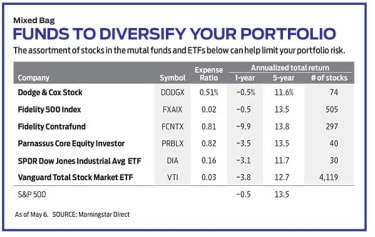

How Many Stocks Should You Have in Your Portfolio? | Kiplinger

stocks It’s been a volatile year for the market. One of the best ways for investors to smooth the ride is through a diverse selection of stocks and stock funds.With this year’s rough ride, you don’t need reminding that stocks are volatile. Their prices bounce up and down, sometimes in extreme ways. The U.S. market… Continue reading How Many Stocks Should You Have in Your Portfolio? | Kiplinger

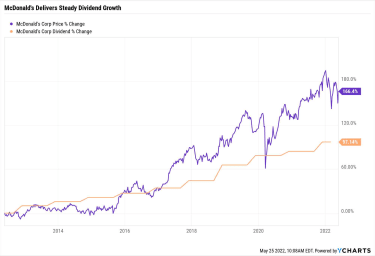

McDonald’s (MCD) Stock: Tasty, Empty Calories | Kiplinger

Investing for Income For some, ESG challenges such as climate change and animal welfare offset the durability and dividends of MCD shares.Investors very well might find riches at the end of the Golden Arches. Indeed, McDonald’s (MCD, $244.52) stock is a popular Buy call on Wall Street, and it features prominently in our own Kiplinger… Continue reading McDonald’s (MCD) Stock: Tasty, Empty Calories | Kiplinger

US stocks climb in volatile session as Fed minutes signal fast pace of rate hikes followed by a pause

US stocks ended higher Wednesday after a volatile session that saw the release of the Fed’s May meeting minutes. Policy makers want to move “expeditiously” with rate hikes to tame hot inflation. Consumer discretionary stocks led a gain on the S&P 500. Loading Something is loading. US stocks closed Wednesday’s volatile session higher after Federal… Continue reading US stocks climb in volatile session as Fed minutes signal fast pace of rate hikes followed by a pause

Gas prices have soared so high that the US is now seeing demand destruction ahead of the summer driving season

The average gallon of gas in the US hit a high of $4.59 Tuesday, about 51% higher than a year ago. Demand on a four-week rolling basis was its lowest for this time of year since 2013, excluding 2020. Costs and a demand slowdown could dash expectations for a driving season resembling pre-COVID times. Loading… Continue reading Gas prices have soared so high that the US is now seeing demand destruction ahead of the summer driving season

The average retail investor’s portfolio has lost 32% of its value in this year’s sell-off — but that hasn’t stopped them from buying the dip in stocks, research firm says

Retail investors have been sticking with buying the dips in stocks even as the value of their portfolios has suffered, Vanda Research said. The average portfolio drawdown is 32%, the sharpest decline since the firm started tracking such data eight years ago. The S&P 500 has pared some losses in recent sessions thanks to retail… Continue reading The average retail investor’s portfolio has lost 32% of its value in this year’s sell-off — but that hasn’t stopped them from buying the dip in stocks, research firm says