This advertisement has not loaded yet, but your article continues below. Watch: Starlight Capital’s Dennis Mitchell speaks about inflation, interest rates and the Bank of Canada The Bank of Canada building in Ottawa. Photo by REUTERS/Chris Wattie/File Photo Article content Dennis Mitchell, CEO and CIO at Starlight Capital, talks with Financial Post’s Larysa Harapyn about… Continue reading Why the Bank of Canada is now ‘talking tough’ on inflation

New to Canada, or the workforce? Here’s what to know about filing taxes

Your tax return doesn’t need to be stressful if you plan ahead Author of the article: JHVEPhoto/Shutterstock Are you a young Canadian who just entered the workforce, or a recent immigrant filing taxes in Canada for the first time? Don’t worry. Filing your tax return for the first time doesn’t need to be a daunting… Continue reading New to Canada, or the workforce? Here’s what to know about filing taxes

Investing in foreign property: Should you buy a home abroad and rent at home?

A lot of research will be needed to find a property that’s right for you Author of the article: MoneyWise Amy Legate-Wolfe Yarek Gora/Shutterstock A lot has changed in the last 14 years for Sam Butcher. The expat from Britain came to Canada in 2007 thinking he’d be staying here a year at most. As… Continue reading Investing in foreign property: Should you buy a home abroad and rent at home?

Commuting her pension could let this Ottawa civil servant have her cake and eat it, too. But is it worth the risk?

This dish is costly: annuities sold by profit-seeking insurance companies are not cheap, expert says Publishing date: Mar 25, 2022 • March 25, 2022 • 5 minute read • 14 Comments Lucille wants to retire next year, at age 49, and she is considering taking the commuted value of her pension. Photo by Gigi Suhanic/National… Continue reading Commuting her pension could let this Ottawa civil servant have her cake and eat it, too. But is it worth the risk?

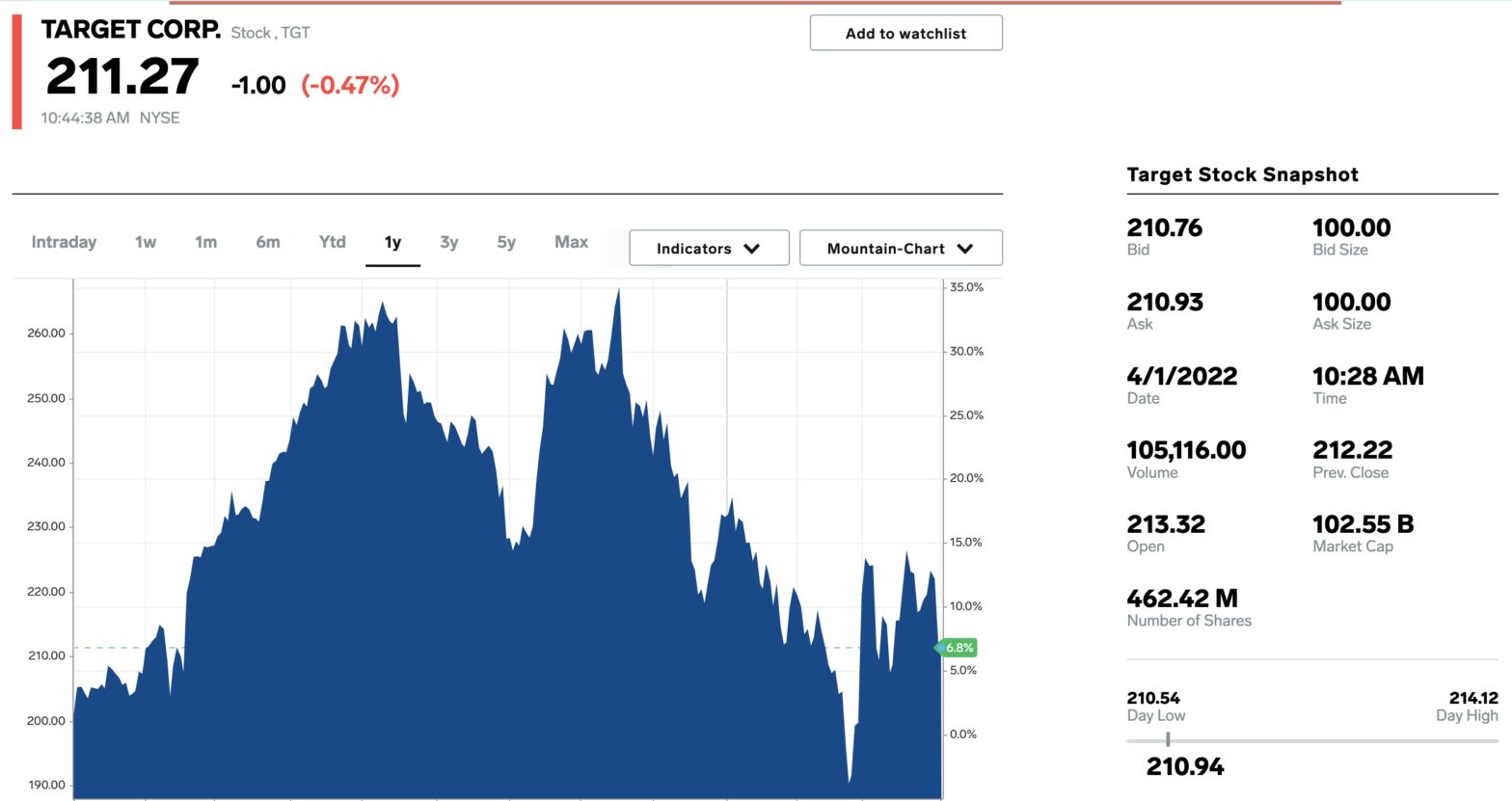

There’s a 90% probability that the stock market has already bottomed in 2022, according to Fundstrat’s Tom Lee

There’s a roughly 90% chance that the stock market has already bottomed in 2022, according to Fundstrat’s Tom Lee.Lee thinks as long as the economy avoids a recession, the S&P 500 could surge to 5,100 in 2022. “This recovery in equities to close above [the] 200-day moving average generates quite a lot of positive signal,” Lee… Continue reading There’s a 90% probability that the stock market has already bottomed in 2022, according to Fundstrat’s Tom Lee

MORGAN STANLEY: Investors should buy these 10 stocks now because they’re uniquely protected from the rising wage pressures that will erode the profits of their rivals

US Markets Loading… H M S Premium Morgan Stanley can help investors searching for stocks that will maintain margins even as wage pressure rises. Leon Neal/Getty Images This story is available exclusively to Insider subscribers. Become an Insider and start reading now. Morgan Stanley says labor markets could stay tight for years, continually pushing wages… Continue reading MORGAN STANLEY: Investors should buy these 10 stocks now because they’re uniquely protected from the rising wage pressures that will erode the profits of their rivals

Morgan Stanley says investors seem to believe the Fed can engineer a ‘soft landing’ for the economy – but here are 3 reasons for doubt

Investors seem to be confident the Federal Reserve can engineer a “soft landing”, Morgan Stanley’s Lisa Shalett said. But there are 3 reasons to doubt its rate hikes will tame inflation without sparking a recession, the CIO said. These are overvalued US stocks, the shrinking Fed balance sheet, and misplaced faith in the Fed “put”.… Continue reading Morgan Stanley says investors seem to believe the Fed can engineer a ‘soft landing’ for the economy – but here are 3 reasons for doubt

Meme stock C-suite execs like Ryan Cohen are trapped and have to play along with the psychological trick that drove this week’s comeback, an investing expert says

GameStop and AMC executives are going along with the meme stock game, risk expert Richard Smith said. “They’re trapped, and they have to play the game because that’s what they’re actually getting paid to do,” he told Insider. The meme stock comeback was partly driven by a psychological trick called the “anchoring bias”, he said.… Continue reading Meme stock C-suite execs like Ryan Cohen are trapped and have to play along with the psychological trick that drove this week’s comeback, an investing expert says