How can investors help navigate high market volatility? Prepare for bear markets before they even begin A trader works on the floor of the New York Stock Exchange. Photo by REUTERS/Brendan McDermid files Any financial adviser will likely tell you that their job is considerably easier in a bull market. The phrase “a rising tide… Continue reading If you’re reacting to volatility after it occurs, you’re already behind

Noah Solomon: Why the Fed might not save stock markets this time

Markets may be in store for additional pain Publishing date: Jul 19, 2022 • 14 hours ago • 4 minute read • 5 Comments The Federal Reserve building in Washington. Photo by REUTERS/Kevin Lamarque/File Photo One of the single largest contributors to booms and busts is the tendency of investors to suffer periodic bouts of long-term… Continue reading Noah Solomon: Why the Fed might not save stock markets this time

Half a trillion dollars wiped from once high-flying fintechs

Digital companies that boomed during lockdowns hit by fears they cannot withstand a recession Author of the article: Financial Times Nicholas Megaw and Imani Moise in New York A pedestrian walks past the PayPal logo at an office building in Berlin, Germany. Photo by REUTERS/Fabrizio Bensch/File Photo Almost half a trillion dollars has been wiped… Continue reading Half a trillion dollars wiped from once high-flying fintechs

Five reasons the investment industry may work against some investors

Being aware of these issues might save you some money and prevent panic A trader works on the floor of the New York Stock Exchange. Photo by REUTERS/Brendan McDermid files A bear market invariably causes investors to say things such as “the whole market is a scam,” or “the only people who get rich are… Continue reading Five reasons the investment industry may work against some investors

Merger arbitrage funds go hunting as corporate deals come under threat

Elon Musk’s agreement to buy Twitter is one of several deals that has thrown up opportunities for specialist funds Author of the article: Financial Times Sujeet Indap and Antoine Gara in New York Late last week, Elon Musk notified Twitter Inc. that he was terminating his US$44-billion agreement to purchase the company. Photo by REUTERS/Dado… Continue reading Merger arbitrage funds go hunting as corporate deals come under threat

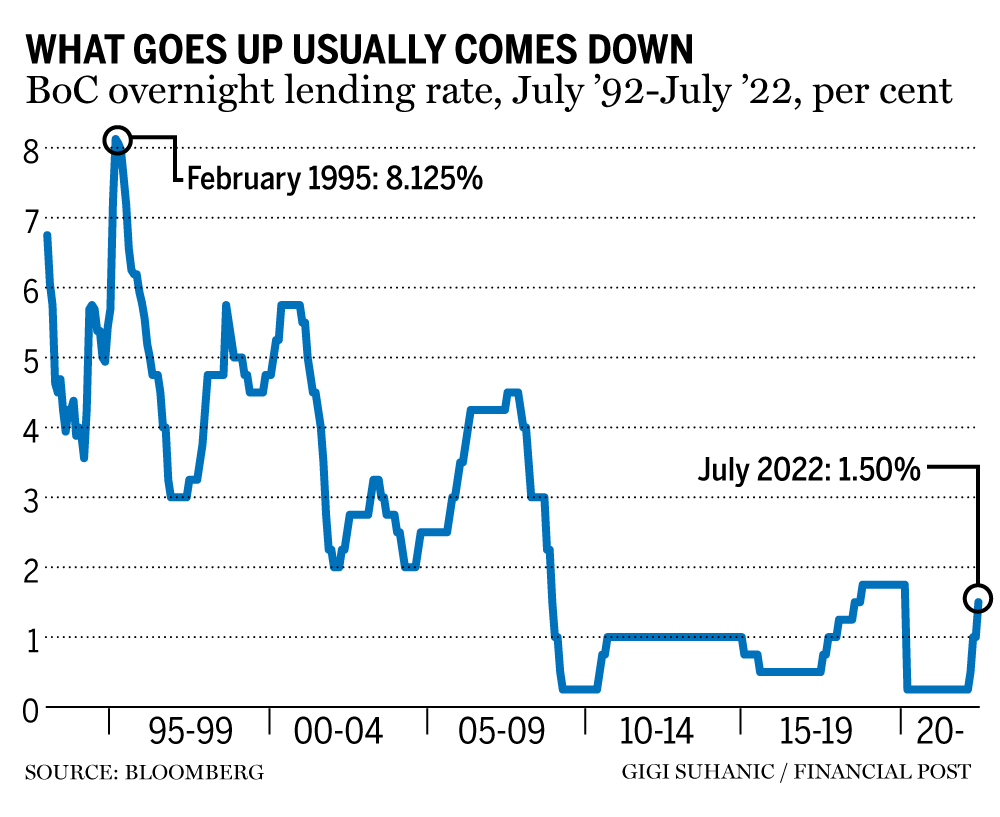

Interest rates are still rising, but investors should start preparing for when they come back down

Variable rates will likely be a benefit once again in the midterm Publishing date: Jul 12, 2022 • 1 day ago • 5 minute read • 8 Comments The Bank of Canada in Ottawa. Photo by Justin Tang/Bloomberg files The Bank of Canada over the past 30 years has had six periods of interest-rate hikes, ranging… Continue reading Interest rates are still rising, but investors should start preparing for when they come back down

Normalized interest rates are the cure, not the problem

Central bankers would be wise to continue their interest rate hikes The Federal Reserve building in Washington, D.C. Photo by REUTERS/Chris Wattie/File Photo Markets are rather fickle these days, reacting quickly and powerfully to any news. So far this year, the developments have predominantly been negative, so perhaps it isn’t surprising that we are off… Continue reading Normalized interest rates are the cure, not the problem

Twitter shares sink, with legal battle ahead as Elon Musk walks away

Shares on track to erase about US$1.4 billion in market value Author of the article: Bloomberg News Divya Balji Twitter shares have taken a hit after Elon Musk said he wouldn’t buy the company. Photo by Olivier Douliery/AFP via Getty Images Twitter Inc. shares tumbled in premarket trading after Elon Musk walked away from his… Continue reading Twitter shares sink, with legal battle ahead as Elon Musk walks away