Canada intends to issue $5 billion in sustainable debt to fund everything from planting trees to building carbon capture facilities Author of the article: Bloomberg News Esteban Duarte and Brian Platt Canada’s Minister of Environment and Climate Change Steven Guilbeault speaks during a press conference at the COP26 Climate Change Conference in Glasgow on Nov.… Continue reading Oil-rich Canada lays out ground rules for inaugural green bond

Staying diversified may be tough in chaotic times, but it’s worth the trouble

Tom Bradley: I’m willing to accept that diversification isn’t free anymore. But make no mistake, it’s still a bargain Despite its benefits, diversification is facing challenges. Photo by Brendan McDermid/Reuters There’s an old saying that diversification is “the only free lunch in investing,” but I’m beginning to wonder if that’s still true. Advertisement This advertisement… Continue reading Staying diversified may be tough in chaotic times, but it’s worth the trouble

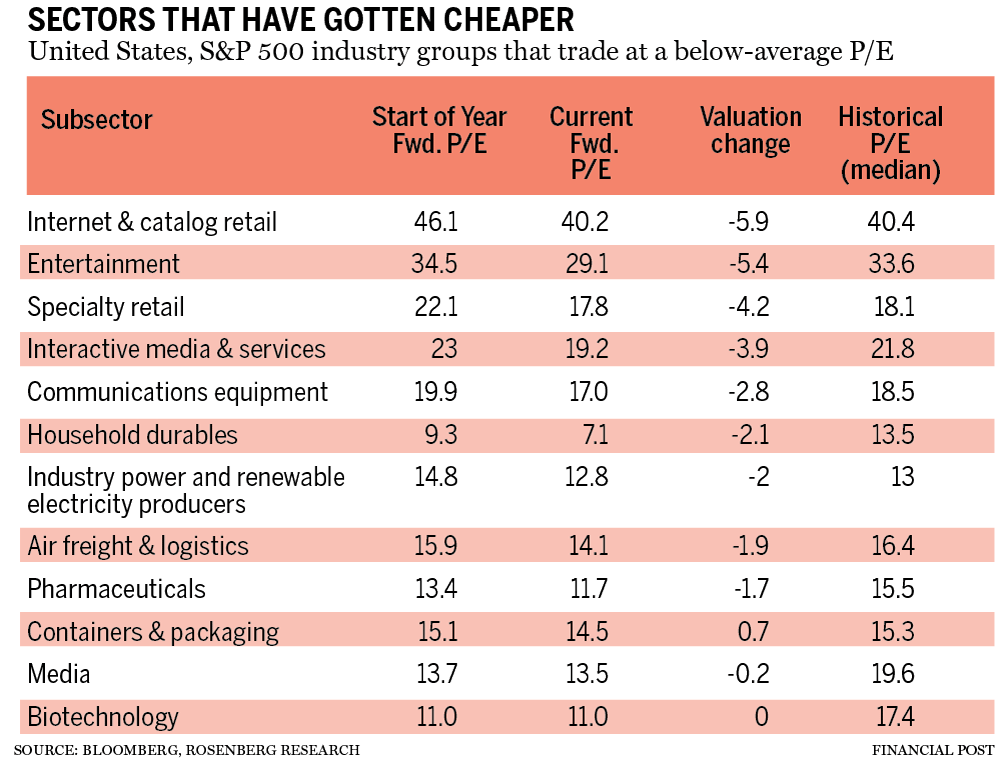

David Rosenberg: Looking for opportunities amidst the volatility

The backdrop for stocks is beginning to look more compelling Traders work on the floor of the New York Stock Exchange. Photo by Michael M. Santiago/Getty Images files By David Rosenberg and Brendan Livingstone Advertisement This advertisement has not loaded yet, but your article continues below. Heading into the year, we were bearish on United… Continue reading David Rosenberg: Looking for opportunities amidst the volatility

A tactical portfolio rebalancing can cut your risks in troubling times

Martin Pelletier: Choosing the wrong benchmark can lead to performance chasing, poor results and excessive risk taking Traders work on the floor of the New York Stock Exchange. Photo by Spencer Platt/Getty Images files “There is only one cause of unhappiness: the false beliefs you have in your head, beliefs so widespread, so commonly held,… Continue reading A tactical portfolio rebalancing can cut your risks in troubling times

Will Ontario’s plan for 1.5 million new homes change anything?

What’s in the task force’s report? The task force estimates Ontario can add 1.5 million homes to the province’s housing stock over the next ten years by following a series of 55 recommendations, which fall into five main areas: Change planning policies and zoning regulations so they allow for both greater density and a wider… Continue reading Will Ontario’s plan for 1.5 million new homes change anything?

FP Answers: What happens if I pass away before — or just after — collecting my CPP?

Despite concerns about premature death, most Canadians live longer than they think they will Publishing date: Feb 22, 2022 • 2 days ago • 4 minute read • 6 Comments If you pass away before collecting or soon after starting CPP, the money contributed remains part of the plan’s total pool of capital. Photo by Getty… Continue reading FP Answers: What happens if I pass away before — or just after — collecting my CPP?

OAS? CPP? GIS? Breaking down Canada’s alphabet soup of retirement benefits

The benefits everyone is entitled to In Canada, there are three sources of retirement income, which are often known as the three pillars. The first two pillars are government-sponsored programs. Pillar one is made up of Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), available to people of retirement age, while the second… Continue reading OAS? CPP? GIS? Breaking down Canada’s alphabet soup of retirement benefits

Why it might (sometimes) be a good idea to borrow for your RRSP

How it works for investors Borrowing money is so common that many Canadians likely do it without thinking twice about the risks. But it’s important to understand an RRSP loan before committing to one. To borrow for an RRSP, you take out a lump sum at a modest interest rate, and put it into your… Continue reading Why it might (sometimes) be a good idea to borrow for your RRSP