Tips to help you stay steady and get the most out of your portfolio over the long term Investors make their biggest mistakes when prices are far off trend. Photo by Getty Images/iStockphoto files It’s human nature to go straight for the fun stuff. In investing, that means looking for the next Amazon.com Inc., riding… Continue reading Tom Bradley: A handful of things investors can actually control to generate better returns

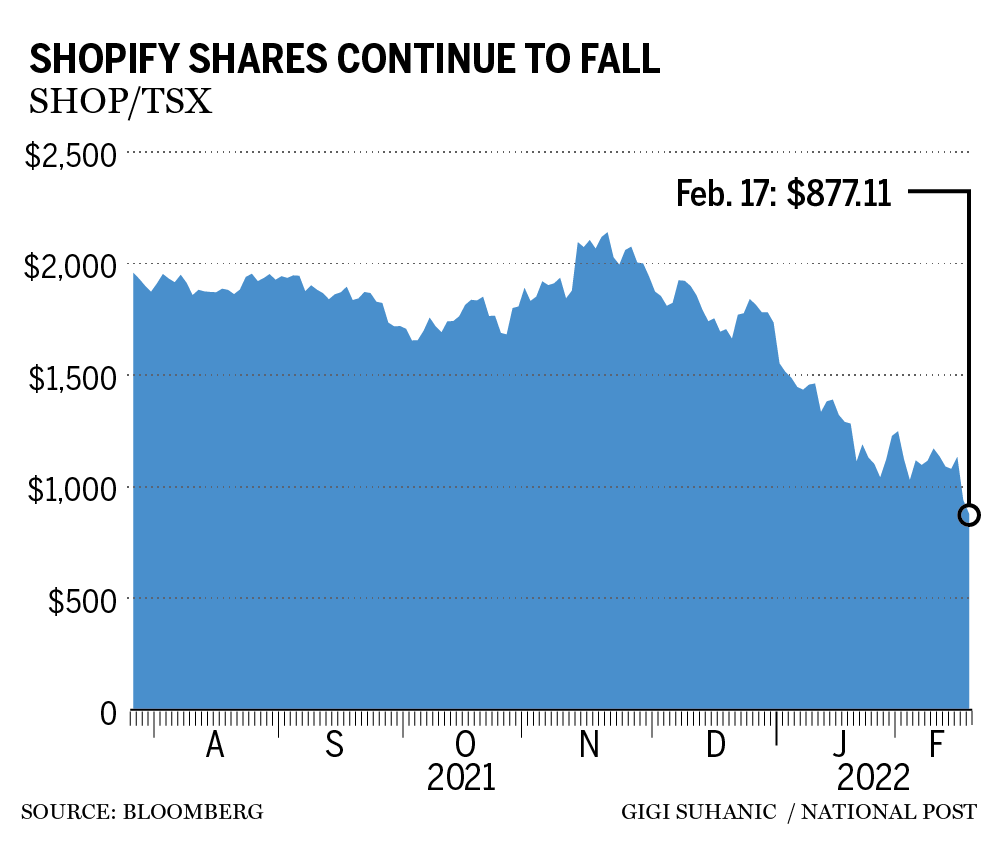

Shopify stock-price target gutted by analysts on slower growth

Over 20 analysts cut their targets after the stock plunged 17 per cent in Toronto on Wednesday, its biggest drop ever Author of the article: Bloomberg News Stefanie Marotta A monitor displays Shopify Inc.. signage on the floor of the New York Stock Exchange. Photo by Michael Nagle/Bloomberg files Canadian e-commerce company Shopify Inc. had… Continue reading Shopify stock-price target gutted by analysts on slower growth

Lightspeed pushing ahead after short-seller report hits stock

This advertisement has not loaded yet, but your article continues below. Watch: New chief executive JP Chauvet on where he plans to take Lightspeed The New York Stock Exchange welcomes Lightspeed POS Inc. on Sept. 11, 2020. Photo by Lightspeed files Article content Lightspeed’s new chief executive JP Chauvet talks with Financial Post’s Larysa Harapyn… Continue reading Lightspeed pushing ahead after short-seller report hits stock

Emerging markets: all risk and few rewards?

As inflation spirals and growth rates slow, the case for investing in emerging markets has rarely been weaker Author of the article: Financial Times Jonathan Wheatley in London A board showing the Real-U.S. dollar and several foreign currency exchange rates in Rio de Janeiro, Brazil. Photo by REUTERS/Pilar Olivares/File Photo The difference between the pace… Continue reading Emerging markets: all risk and few rewards?

Excessive risk-taking shows it’s time to raise rates and let the revolution begin

Martin Pelletier: Low interest rate policy and excessive central bank liquidity has caused some major dislocations in the market The Bank of Canada building in Ottawa. Photo by David Kawai/Bloomberg files Low interest rate policy and excessive central bank liquidity has caused some major dislocations in the market and presented a clear and present danger… Continue reading Excessive risk-taking shows it’s time to raise rates and let the revolution begin

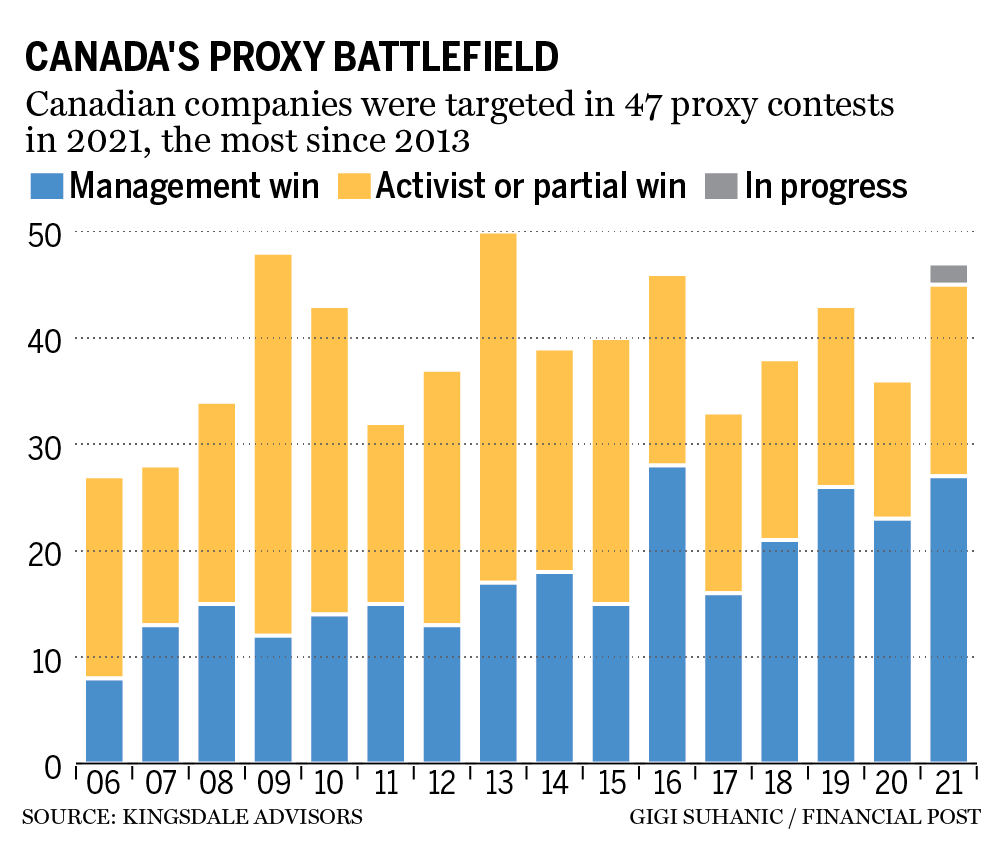

‘The pandemic was a litmus test’: Why Canadian firms are seeing an uptick in shareholder activism

Tempting targets, shareholder unrest and devastated sectors have created a climate where many activists believe companies would rather settle than fight Iamgold’s Côté Gold Project. Photo by Supplied Baker Steel Capital Managers LLP, a large resource investment fund based in London, boosted its stake in Canadian miner Iamgold Corp. by nearly 40 per cent in… Continue reading ‘The pandemic was a litmus test’: Why Canadian firms are seeing an uptick in shareholder activism

Five reasons women are better investors than men

Peter Hodson: Be prepared for some stereotyping, but studies have repeatedly shown these reasons to be true The fearless girl statue in front of the New York Stock Exchange. Photo by Johanne Eisele/AFP via Getty Images Psssst … don’t tell my wife, but it has been proven, time and time again, that women are better… Continue reading Five reasons women are better investors than men

Canada’s oil M&A flurry seen giving buyers upper hand in dealmaking

A need to transition away from fossil fuels has taken the driver’s seat in investor demands Author of the article: Reuters Shariq Khan and Rod Nickel Crescent Point Energy’s Bakken oil project in Stoughton, Saskatchewan. Photo by Handout/ Cresent Point Energy files A rally in oil prices to over seven-year highs is leading to a… Continue reading Canada’s oil M&A flurry seen giving buyers upper hand in dealmaking