Collapse of Shopify’s stock price appears to have little to do with anything the company did Publishing date: Jan 21, 2022 • 1 day ago • 3 minute read • 5 Comments Shopify’s headquarters in Ottawa. The e-commerce company has plunged 46 per cent from an all-time high of $2,139.82 on Nov. 19. Photo by David… Continue reading Shopify plunges in 2022 tech wreck, losing title as Canada’s biggest publicly traded company

Netflix, Peloton bring pandemic-stock era to shuddering halt as shares plunge

Netflix shares poised for biggest drop in almost a decade Author of the article: Bloomberg News Jeran Wittenstein and Nick Turner The Netflix logo is seen on top of their office building in Hollywood, California, January 20, 2022. The streaming service ended the year with 221.8 million subscribers, just below target, after booming during coronavirus… Continue reading Netflix, Peloton bring pandemic-stock era to shuddering halt as shares plunge

Oilpatch sees ‘significant’ boost in investment for second straight year

Investment in Canada’s oil and natural gas industry will rise 22 per cent this year to $32.8 billion Author of the article: Bloomberg News Robert Tuttle Investment in Canadian oil sands, the world’s third largest oil reserves, will jump by a third to $11.6 billion. Photo by REUTERS/Dado Ruvic/Illustration Investment in Canada’s oil and natural… Continue reading Oilpatch sees ‘significant’ boost in investment for second straight year

Stephen Harper — activist investor? Why the former PM’s path after politics shouldn’t surprise anyone

Now 62, Harper is looking to make his mark in perhaps the biggest way since his near-decade as Canada’s leader Publishing date: Jan 20, 2022 • 1 day ago • 9 minute read • 387 Comments Former Canadian Prime Minister Stephen Harper speaks at a conference in Washington in 2017. In contrast with many of other… Continue reading Stephen Harper — activist investor? Why the former PM’s path after politics shouldn’t surprise anyone

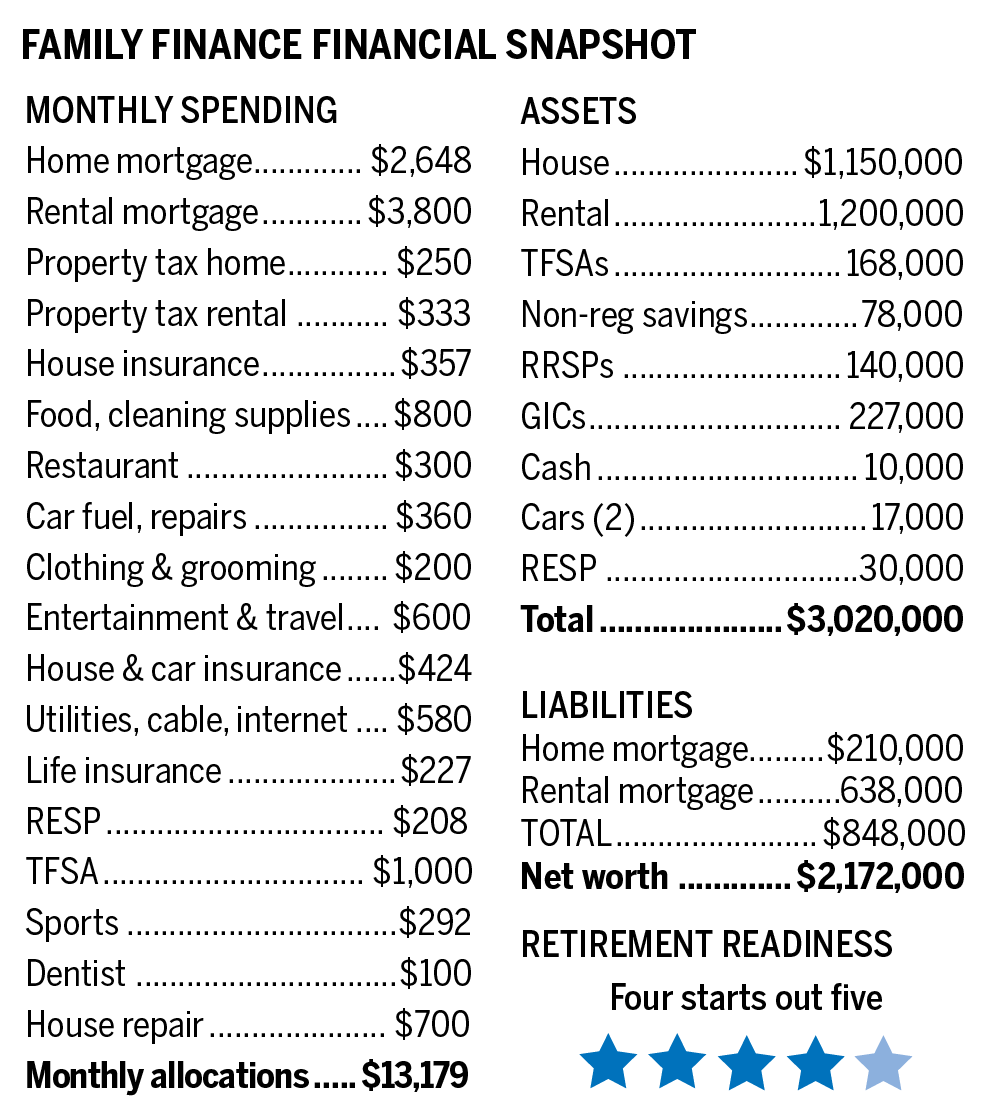

Spectre of inflation adds to early retirement risk for this young B.C. couple

Tom and Charlene will have to depend on savings to make retirement work, expert says Early retirement means that if inflation picks up, the company pension will lose purchasing power and interest rates will tend to rise. A couple we’ll call Tom and Charlene, both 40, live in B.C. with their seven-year-old son Sam. They… Continue reading Spectre of inflation adds to early retirement risk for this young B.C. couple

Three golden rules to help you avoid some common investing pitfalls

Martin Pelletier: Goals-oriented investing backed by solid financial planning a great way to remove dangers of allowing emotions to creep into your portfolio Sitting on the sidelines because of market correction fears means high levels of inflation will eat away the value of your wealth. Photo by Timothy A. Clary/AFP via Getty Images It’s tempting… Continue reading Three golden rules to help you avoid some common investing pitfalls

Cash-flow investing isn’t just a strategy for your grandparents

Cash-flow investing is increasingly attractive during times of increased market volatility Dividend-paying equities are just one of several types of cash-flow investments. Photo by Getty Images/iStockphoto files The outlook on the Omnicron variant of COVID-19 on global markets is changing by the minute, but I am reminded of a tried-and-true approach that can provide investors… Continue reading Cash-flow investing isn’t just a strategy for your grandparents

Tom Bradley: Four reasons the stock market will forever be unpredictable, erratic and prone to exaggeration

In any volatile sector, you need to have a contrarian streak, a good sense of value and plenty of patience Monitors displaying stock market information are seen through the window of the Nasdaq MarketSite in the Times Square neighbourhood of New York. Photo by Jeenah Moon/Bloomberg files Over the past few remarkable years, we’ve seen… Continue reading Tom Bradley: Four reasons the stock market will forever be unpredictable, erratic and prone to exaggeration