Rate hike pause is conditional, Macklem emphasizes Published Feb 17, 2023 • Last updated 2 days ago • 6 minute read 10 Comments Bank of Canada governor Tiff Macklem. Photo by Blair Gable/Reuters Bank of Canada governor Tiff Macklem and one of his deputy governors, Paul Beaudry, both spoke on Feb. 16 — a rare double… Continue reading Kevin Carmichael: 3 things the Bank of Canada subtly told us this week

The hottest new tax break Canadians saving for their first home should take advantage of

Jamie Golombek explains the First Home Savings Account coming in 2023 which combines the benefits of a RRSP with a TFSA Canadians saving to buy their first home home can take advantage of the new First Home Savings Account this year. Photo by Getty Images Jamie Golombek, managing director, tax & estate planning with CIBC… Continue reading The hottest new tax break Canadians saving for their first home should take advantage of

Tim Hortons parent replaces CEO, acknowledges restaurant profits have slipped amid franchisee revolt

RBI’s current chief operating officer Joshua Kobza will take over as CEO on March 1 Published Feb 14, 2023 • Last updated 2 days ago • 4 minute read 10 Comments A Tim Hortons location in Mississauga, Ont. Photo by Peter J. Thompson/National Post Tim Hortons‘ parent company replaced its chief executive and acknowledged that its… Continue reading Tim Hortons parent replaces CEO, acknowledges restaurant profits have slipped amid franchisee revolt

Why opposites attract when it comes to relationships and spending, according to ‘zen millionaire’ Ken Honda

WATCH NOW: What does your money personality say about your upbringing? Don’t miss: This cash back app pays actual cash A low credit score can cost you thousands in interest — here’s how you can prevent that 5 mistakes Canadian parents are making with their life insurance Opposites attract, but it isn’t always good In… Continue reading Why opposites attract when it comes to relationships and spending, according to ‘zen millionaire’ Ken Honda

The hottest new tax break Canadians should take advantage of this year

Jamie Golombek explains the First Home Savings Account coming in 2023 which combines the benefits of a RRSP with a TFSA Canadians saving to buy their first home home can take advantage of the new First Home Savings Account this year. Photo by Getty Images Jamie Golombek, managing director, tax & estate planning with CIBC… Continue reading The hottest new tax break Canadians should take advantage of this year

FP Answers: Can we retire on $170,000 in savings and maintain our current lifestyle?

Expert says couple may need to work longer, reduce their lifestyle expenses and more Maintaining John and Rita’s current lifestyle throughout retirement is not possible with just $170,000 of savings, expert says. Photo by SunMedia files By Julie Cazzin with Allan Norman Advertisement 2 This advertisement has not loaded yet, but your article continues below.… Continue reading FP Answers: Can we retire on $170,000 in savings and maintain our current lifestyle?

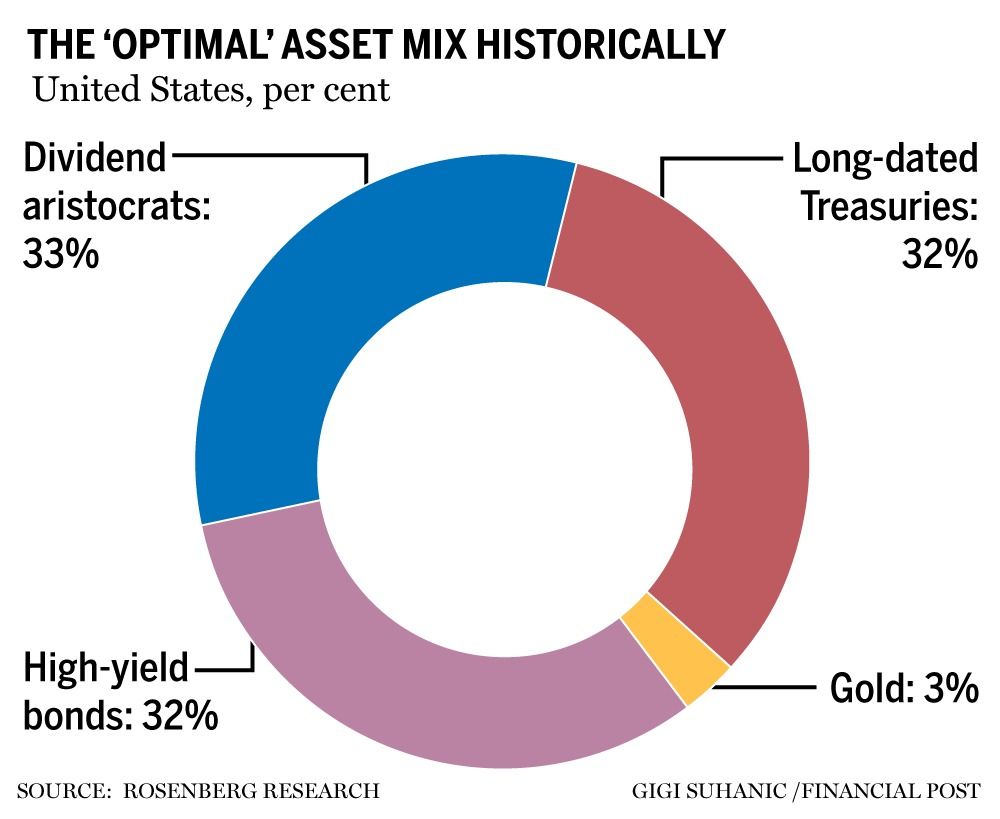

David Rosenberg: Want a portfolio to maximize risk-adjusted returns? It’s not 60/40 or 50/50

This asset mix gives you the returns of stocks with half the volatility Looking for the returns of stocks with about half the volatility? David Rosenberg and his team have some suggestions. By David Rosenberg and Brendan Livingstone Advertisement 2 This advertisement has not loaded yet, but your article continues below. REGISTER TO UNLOCK MORE… Continue reading David Rosenberg: Want a portfolio to maximize risk-adjusted returns? It’s not 60/40 or 50/50

Investors shouldn’t expect much relief from market volatility as the transition from QE to QT spells trouble for risk assets

The S&P 500 could dip as low as 3,000-3,200 during the forecast recessionary period Author of the article: Financial Times Anne Walsh Published Feb 15, 2023 • 4 minute read Join the conversation Traders work the floor of the New York Stock Exchange. Photo by Michael M. Santiago/Getty Images files By Anne Walsh Advertisement 2… Continue reading Investors shouldn’t expect much relief from market volatility as the transition from QE to QT spells trouble for risk assets